Enbridge Inc. (NYSE:ENB) reported strong fourth-quarter 2017 results, courtesy of higher liquid delivery volumes from the Canadian Mainline and Wood Buffalo Extension Pipeline. Higher natural gas processing volumes, lower expenses and contributions from new projects led to the encouraging numbers.

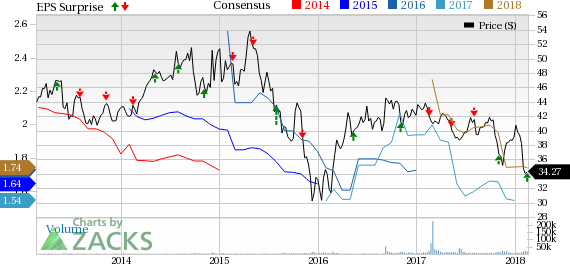

Earnings per share were 48 cents, which beat the Zacks Consensus Estimate and the year-ago quarter’s figure, both of which were 42 cents.

Total revenues in the quarter rose 45% year over year to $10,149 million. The top line also surpassed the Zacks Consensus Estimate of $9,385 million.

In 2017, the leading energy infrastructure company registered earnings of $1.96, which beat the Zacks Consensus Estimate of $1.65 but declined from $2.28 a year ago.

In 2017, total revenues were $36,057 million, which lagged the Zacks Consensus Estimate of $36,230.0 million.

Segment Analysis

Liquids Pipelines: Adjusted operating income in this segment was C$1,482 million, up 9.4% from C$1,355 million in the year-ago quarter. Higher delivery of liquids from the Canadian Mainline and Wood Buffalo Extension Pipeline led to the improvement.

Gas Pipelines and Processing: The segment reported earnings of C$1,020 million, skyrocketing from C$166 million recorded in fourth-quarter 2016. Higher contributions from expansion projects commissioned in 2016 and 2017 along with Spectra assets drove the upside.

Gas Distribution: This business unit reported profit of C$450 million, up more than 89% from C$238 million recorded in the October-December 2016 quarter. The upside was mainly due to the acquisition of the Union Gas, which benefited from higher contributions from the Dawn-Parkway expansion projects, improved storage optimization and increases in delivery rates.

Green Power and Transmission: This segment delivered earnings of C$109 million, which increased from C$91 million recorded in the prior-year quarter.

Energy Services: This segment reported loss of C$21 million, wider than a loss of C$4 million in fourth-quarter 2016.

Q4 Price Performance

Enbridge’s shares have lost 6.5% during the quarter compared with the industry’s 3% decline.

Outlook

The company expects to initiate online secured growth projects worth $22 billion through 2020. Enbridge increased the dividend by 10% for 2018 and expects annual dividend per share at a CAGR of 10% through 2020. Considering the stable and improving business, Enbridge expects 2018 DCF between $4.15 and $4.45 per share.

Zacks Rank & Key Picks

Enbridge has a Zacks Rank #3 (Hold).

A few better-ranked players in the same sector are EOG Resources (NYSE:EOG) , Pioneer Natural Resources Company (NYSE:PXD) and Devon Energy (NYSE:DVN) . All these stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Houston, TX-based EOG Resources is a major independent oil and gas exploration and production company. The company delivered an average positive earnings surprise of 40.94% in the preceding four quarters.

Headquartered at Irving, TX, Pioneer Natural Resources Company is an independent oil and gas exploration and production company. The company delivered an average positive earnings surprise of 66.92% in the preceding four quarters.

Devon Energy, based in Oklahoma City, is an independent energy company engaged primarily in the exploration, development and production of oil and natural gas. The company delivered a positive earnings surprise of 13.77% in the preceding quarter.

Breaking News: Cryptocurrencies Now Bigger than Visa

The total market cap of all cryptos recently surpassed $700 billion – more than a 3,800% increase in the previous 12 months. They’re now bigger than Morgan Stanley (NYSE:MS), Goldman Sachs (NYSE:GS) and even Visa! The new asset class may expand even more rapidly in 2018 as new investors continue pouring in and Wall Street becomes increasingly involved.

Zacks has just named 4 companies that enable investors to take advantage of the explosive growth of cryptocurrencies via the stock market.

Click here to access these stocks >>

Enbridge Inc (ENB): Free Stock Analysis Report

Devon Energy Corporation (DVN): Free Stock Analysis Report

Pioneer Natural Resources Company (PXD): Free Stock Analysis Report

EOG Resources, Inc. (EOG): Free Stock Analysis Report

Original post

Zacks Investment Research