Emini rally hesitating at April high during Israel embassy crisis

I will update again at the end of the day

Pre-Open market analysis

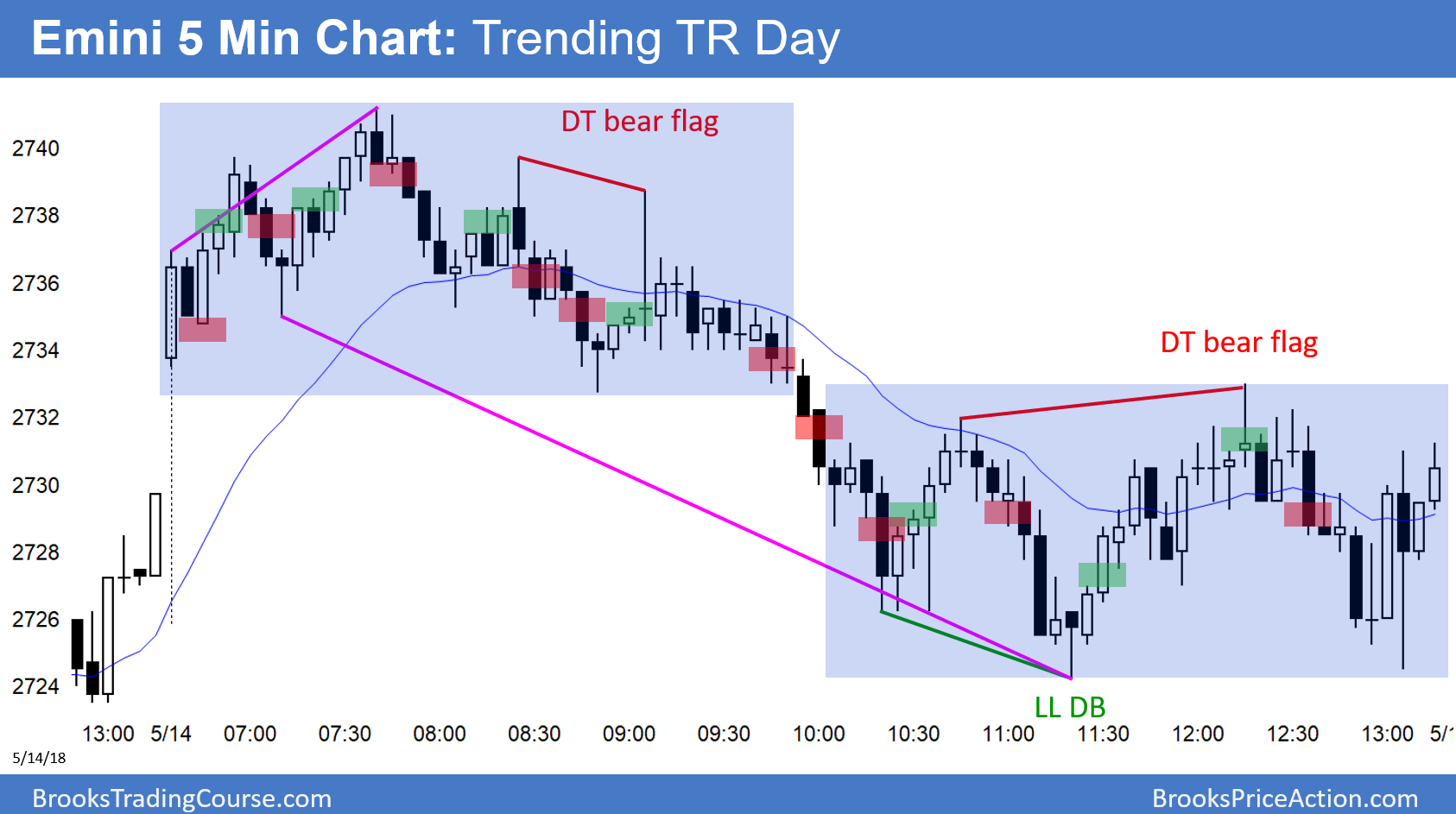

The Emini daily chart had an 8 bar rally with shrinking bull bodies for 4 days. The odds were that yesterday would not be a bull trend day. It was a trading range day.

The bears see yesterday as a sell signal bar on the daily chart for a failed breakout above the April high. The bears today will probably get a break below yesterday’s low to trigger a minor reversal down. While a 1 – 3 day pullback is likely, a reversal into a bear trend is is not. The bears need several big bear days to retake control.

Despite the strong rally, the bears still have a 40% chance of a break below the 4 month range until the bulls get a much stronger reversal up. This is because the daily chart is in a trading range. Trading ranges constantly form strong legs up and down. But, most breakout attempts fail. Until there is a breakout, there is no breakout. The momentum up over the past 2 weeks favors the bulls. However, they cannot have more than a 60% chance of a bull trend while the Emini is still in a trading range.

Overnight Emini Globex trading

The Emini is down 16 points in the Globex session. It will likely trade below yesterday’s low and therefore trigger a sell signal on the daily chart. Since the daily chart is in a trading range, the size or duration of the selloff will disappoint the bulls. An obvious way to do that is for the selloff to fall back below the April 18 high of 2718.00. That is the breakout point.

However, after an 8 day strong rally, the selling will probably last only 1 – 3 days before the bulls will buy again. If the selloff is strong, then a trading range for a few days will be likely. If the selling is weak, the bulls will probably get back above yesterday’s high this week.

But, the rally has been climactic. There is therefore an increased chance of a big bear trend day today. In addition, the bull climax at the resistance of the April high will probably lead to a few days of sideways trading.

Yesterday’s setups

Here are several reasonable stop entry setups from yesterday. I sometimes also show limit order entries and entries on the close of bars.