E-mini pre-open market analysis

E-mini daily chart

E-mini bears sold off for 5 days, which is relatively a lot, compared to other pullbacks since the pandemic low. However, next week’s FOMC announcement will be important since that increases the chance of the E-mini starting to go sideways.

The next magnet below is the bottom of the bull channel, which is just a few points below Friday’s low.

September or October should be the high of the year and the start of 15% to 20% correction. There is a 40% chance it has already begun.

There have been many selloffs comparable to this one since the pandemic low. The bulls bought each one, and they will probably buy this one as well. It has been strong enough so that the bulls will probably need a micro double bottom this week before they can get back to a new high. We could see sharp acceleration up to above 4600 before the correction begins, possibly after the Sept. 22 FOMC meeting. If so, that would probably be a blow-off top.

And the next 15% move should be down instead of up.

E-mini 5-minute chart and what to expect today

E-mini was up 30 points in the overnight Globex session. Friday was a sell climax day. About 50% of the selling was likely caused by the gamma effect and option selling firms, and only 50% is from institutions selling stock. The day after a sell climax day has only a 25% chance of being another big bear day. There is a 75% chance of at least a couple hours of sideways to up trading that begins by the end of the 2nd hour.

Magnets above are the 10:15 pm PT lower high (which was the start of the late sell climax), and the 60-minute EMA, the 20-day EMA. They are all between 4470 and 4490, which is where the E-mini will likely open today.

With Friday being a very big day and today opening in the middle of Friday’s range, there is an increased chance of today being an inside day. It will probably mostly overlap Friday’s range, which means it should have a difficult time getting much above Friday’s high or below Friday’s low.

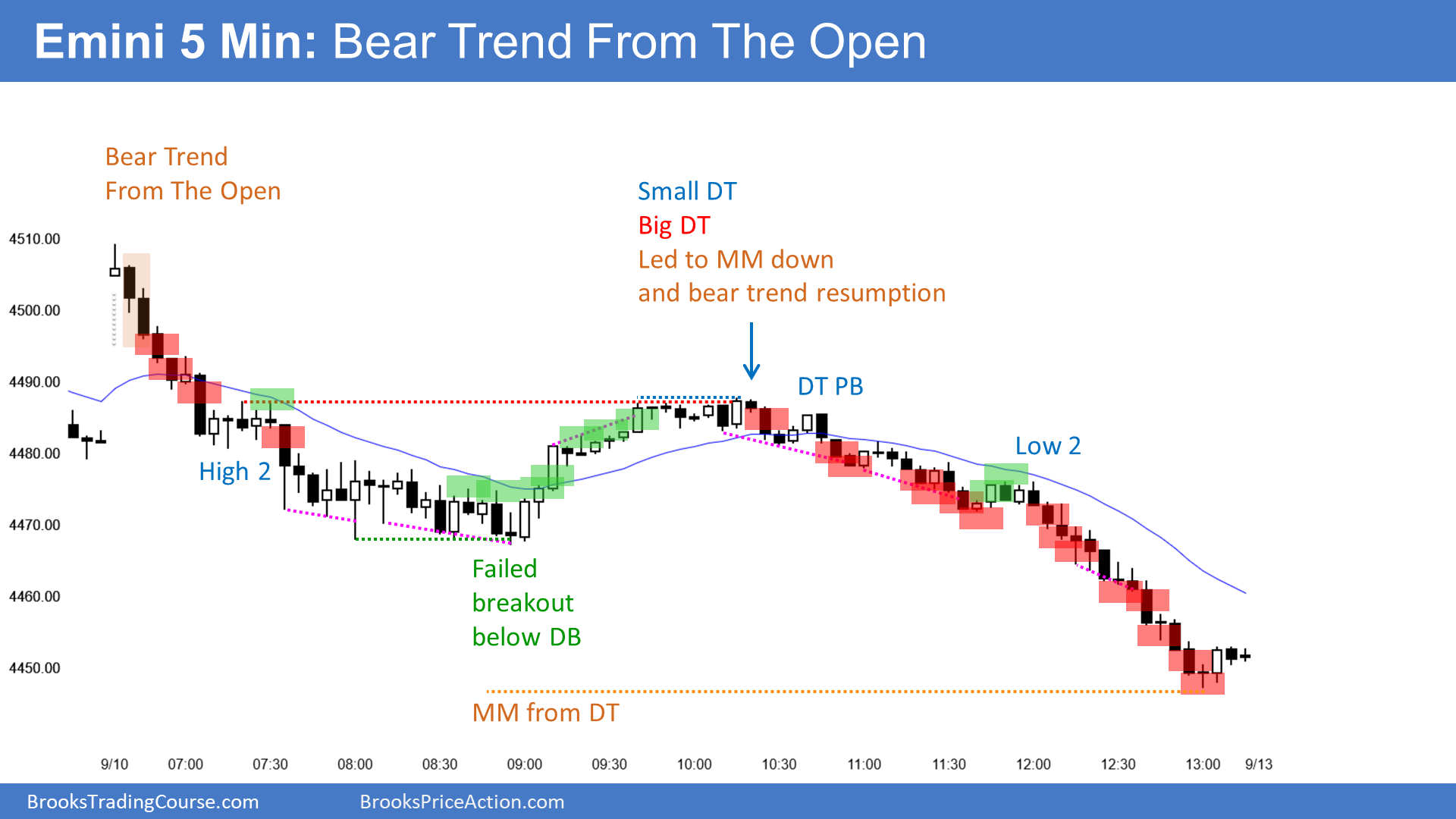

Friday’s E-mini setups

Here are several reasonable stop entry setups from Friday. I show each buy entry with a green rectangle and each sell entry with a red rectangle. Buyers of both the Brooks Trading Course and Encyclopedia of Chart Patterns have access to a much more detailed explanation of the swing trades for each day (see Online Course/BTC Daily Setups). My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter. These therefore are swing entries. It is important to understand that most swing setups do not lead to swing trades. As soon as traders are disappointed, many exit. Those who exit prefer to get out with a small profit (scalp), but often have to exit with a small loss. If the risk is too big for your account, you should wait for trades with less risk or trade an alternative market like the Micro E-mini.