There are 2 things that traders are watching most closely. The first is the 50-day moving average (MA). The E-mini is now above 50-day MA.

Next is the trading range that began with the Sept. 20 low.

I have been saying for several weeks that the E-mini would probably form a trading range between the 50-day MA and the 100-day MA.

Also, I said the trading range would likely have a double top around the 50-day MA and a double bottom around the 100-day.

There is a double bottom at the 100-day MA.

If the E-mini stalls here for a few days and then turns down, there would be a double top at the 50-day MA.

As long as the E-mini is in the trading range, it is in Breakout Mode. That means there is a 50% chance of a successful bull breakout and a 50% chance of a successful bear breakout.

When last Thursday, Oct. 7, turned down from just below the 50-day MA, I said that traders would not consider that to be an adequate test. They wanted the rally to get above the average before turning down.

For the past week, I said that the E-mini would rally to at least a little above the 50-day MA within a couple weeks. It closed above it yesterday, and yesterday closed on its high. The E-mini should trade at least a little higher today.

Traders do not yet know if yesterday’s rally was a buy vacuum test of resistance or a resumption of the 18-month bull trend.

The bulls want a close far above the 50-day MA within the next week. It would then become support.

The bears want a reversal down and a close far below the 50-day MA.

Since yesterday went above the moving average, traders would see a strong reversal down at some point next week as a sign that the 50-day MA has become reliable resistance. It would increase the chance of lower prices.

If the rally reaches the all-time high and then turns down, there would be a bigger double top.

As for the trading range, the bulls want a measured move up above that Oct.7 high, which is the neckline of the Sept. 20/Oct. 4 double bottom. That would result in a new all-time high.

While yesterday’s rally was strong, the bulls need follow-through buying over the next week. That would make a test of the all-time high likely.

E-mini weekly and monthly charts

On the weekly chart, this week went above last week’s high. But there is a 6-bar bear micro channel. That is a weak buy setup. There probably will be a lower high or a double top with the all-time high within a month and then a second leg sideways to down, like last year at this time.

Although the E-mini broke below the weekly bull channel in September, the Small Pullback Bull Trend is still intact. It will end once there is a pullback that is at least 50% bigger than the biggest prior pullback in the trend. That pullback was in September and October last year.

Unless next week is a big bull bar on the weekly chart, there will still be a 50% chance that Sept. 2 will be the start of that pullback.

On the monthly chart, September was a big outside down bar. It was the third time that there was a bear bar in the rally from the pandemic crash.

Look at all prior buy climaxes over the past decade. Most of the time, once there was a bear bar, there was another bear bar within a month or two. That should therefore happen this time.

Therefore, if there is a new high, it probably will only last a bar or two (a month or two). Traders should expect a second bear bar on the monthly chart before the end of the year.

October so far is a bull bar closing near its high. If the month remains like this, it will be a High 1 buy signal bar for November. November then would probably trade above the October high.

September was an outside down bar. Traders should understand that the month after an outside down bar rarely is an outside up bar. That would create an OO (outside-outside) Breakout Mode Pattern. While unlikely, October could rally strongly to above the September high before the end of the month.

There is still a 50% chance that either November or December will be a second bear bar.

E-mini 5-minute chart and what to expect today

E-mini is up 18 points in the overnight Globex session. It will gap above yesterday’s high.

Yesterday was a buy climax day, even though the E-mini was in a trading range around the 50-day MA for the final 4 hours.

The day after a buy climax day has a 75% chance of being sideways to down for at least 2 hours, beginning by the end of the second hour.

Even with a couple hours of sideways to down trading, the bulls will try to create a follow-through bull trend day today. The rally would probably be a weaker type of trend, like a bull channel or a trending trading range day.

There might be a pullback down to the 50-day MA, but today will probably not be a big bear day after yesterday’s surprisingly strong rally to the start of a resistance zone.

Today is Friday so weekly support and resistance can be important, especially in the final hour. Last week’s high is a magnet below, and it is near the daily magnet of the 50-day MA. There are no other nearby major weekly targets.

Yesterday’s E-mini setups

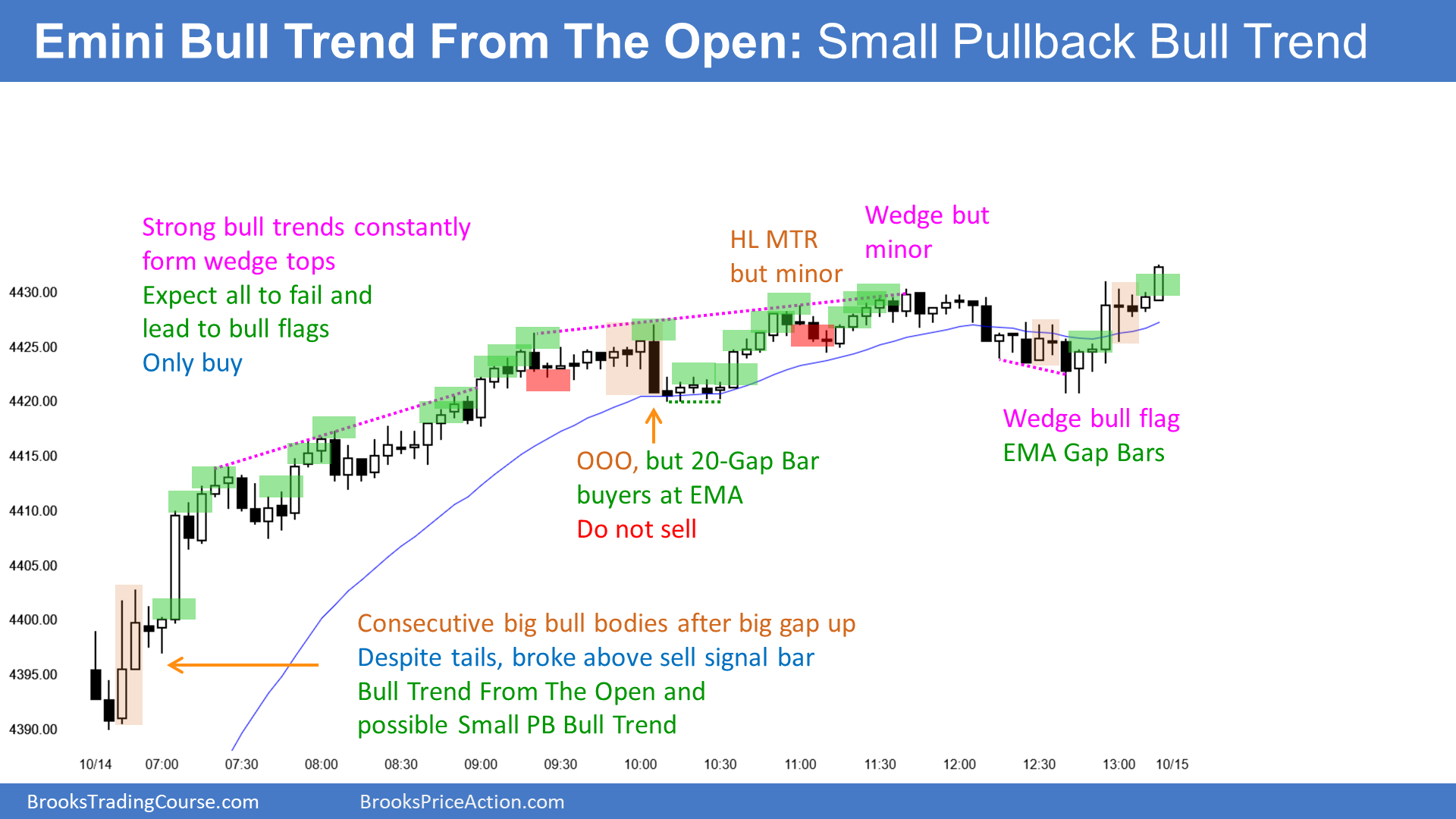

Here are several reasonable stop entry setups from yesterday. I show each buy entry with a green rectangle and each sell entry with a red rectangle. Buyers of both the Brooks Trading Course and Encyclopedia of Chart Patterns have access to a much more detailed explanation of the swing trades for each day (see Online Course/BTC Daily Setups).

My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter. These therefore are swing entries.

It is important to understand that most swing setups do not lead to swing trades. As soon as traders are disappointed, many exit. Those who exit prefer to get out with a small profit (scalp), but often have to exit with a small loss.

If the risk is too big for your account, you should wait for trades with less risk or trade an alternative market like the Micro E-mini.