El Salvador would partially fund the $1.6 billion buyback using special drawing rights from the IMF.

El Salvador President Nayib Bukele has announced plans to repurchase the nation’s dollar-denominated bonds due in 2023 and 2025 to reduce default fears. Ironically, the country aims to partly fund the buyback using special drawing rights from the International Monetary Fund (IMF), which has long hit out at the country for making Bitcoin legal tender.

El Salvador to Buy Back $1.6B in Debt

On Tuesday, President Bukele sent two bills to the local congress to secure funds needed to buy back all sovereign debt bonds maturing in 2023 and 2025. The repurchase would cost El Salvador around $1.6 billion and could help reduce fears of default in the Central American country.

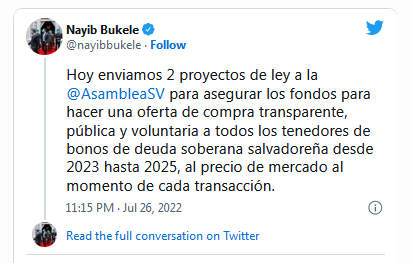

President Bukele announced the plan in a recent tweet, detailing that he has sent two bills to the national assembly “to ensure that we have the available funds to make a transparent, public, and voluntary purchase offer to all the holders of Salvadoran sovereign debt bonds.”

He claimed that the country has enough “liquidity not only to pay all of its commitments when they are due but also purchase all of its debt (till 2025) in advance.” Bukele added that the bonds would be repurchased at market prices, and the process would begin in about six weeks.

In January next year, El Salvador will have to pay $800 million on its traditional dollar bonds. However, this year, the country has failed to demonstrate healthy public finances. El Salvador arguably wanted to collect some funding using its Bitcoin bond, which failed to attract any investment.

The country has also directly invested more than $100 million in Bitcoin, which has lost over half its value over the past couple of months. According to credit rating agency Moody’s, the country’s unrealized Bitcoin loss stands at $57 million.

El Salvador’s bet on Bitcoin has also affected its relationship with the IMF. Earlier this year, the IMF asked the country to drop Bitcoin as legal tender to receive the requested $1.3 billion loan. This led to the country stalling talks with the IMF, further exacerbating investors’ confidence in El Salvador’s ability to honor upcoming payments.

El Salvador to Partially Fund Buyback Using Special Drawing Rights from IMF

Alejandro Zelaya, the country’s finance minister, has reportedly told a press conference that they aim to fund the repurchase using special drawing rights from the IMF and a $200 million loan from the Central American Bank for Economic Integration, a Central American multilateral lender. Zelaya said:

“We are ensuring the availability of funds to offer our bondholders an early purchase option for the debt, which will be public and will respect market regulations. It is a sign of the liquidity of our finances.”

El Salvador’s bonds have been trading at deep discounts as of late. As reported, Morgan Stanley (NYSE:MS) analysts even claimed it is a good time to purchase battered bonds from El Salvador, predicting that the 2027 notes could bounce back to 44 cents on the dollar by year-end.

The country’s bonds also registered double-digit gains following the buyback news. According to indicative prices compiled by Bloomberg, El Salvador’s dollar bonds set to mature in 2023 increased nearly 10 cents after the announcement to 86 cents, while the 2025 notes jumped 16 cents to be quoted at 52 cents.