Will A Fourth Hike In 2018 Be Included In New Projections?

US futures are trading relatively flat ahead of the open on Wednesday, as we await the latest interest rate decision from the Federal Reserve.

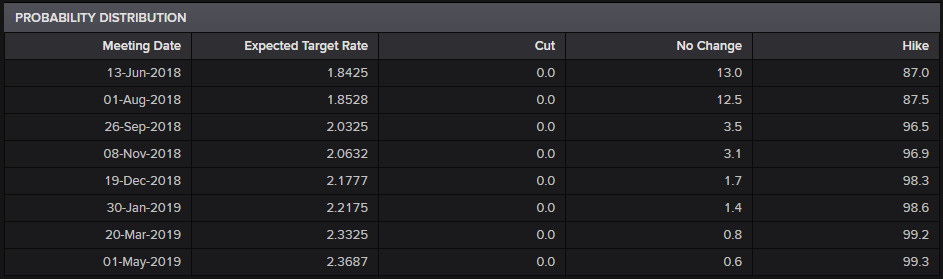

Markets have almost fully priced in a rate hike today which, assuming the central bank does as expected, should draw attention instead to the new economic projections. The central bank has previously indicated that three rate hikes this year is likely but with the inflation picking up, the economy performing well and tax reforms having added an additional stimulus this year, a fourth could be on the cards.

It will therefore be very interesting to see whether this is being factored into the economic projections yet or if policy makers still intend to take their time raising rates. There have already been suggestions that they will be willing to tolerate above target inflation but if prices are rising faster than anticipated – CPI inflation rose 2.8% in May, core CPI 2.2% – we should get an idea of just how much they will accept.

Should the Fed signal a fourth hike this year, it could trigger some near term strength for the dollar with markets only currently pricing a fourth hike at less than 40%. It could also lead to a further flattening of the yield curve which has caused some traders concern as it has been associated with recession warnings, although I remain skeptical that this is the case.

GBP Lower As Inflation Data Does BoE No Favours

The morning saw the release of inflation data from the UK, which was in line with expectations but will likely continue to cause a headache for the Bank of England, particularly in light of yesterday jobs data that showed wages growing slower than expected. The central bank was intent on raising interest rates back in May but held off after a difficult first quarter for the country.

GBP/USD

With the data no longer looking quite so robust, we could see further back-peddling from the BoE, especially as we’re now entering a crucial period in the Brexit negotiations. Theresa May is facing another potentially difficult day in parliament today as she tries to defeat another batch of Brexit bill amendments passed down by the House of Lords. May narrowly avoided an embarrassing defeat on Tuesday after offering concessions on the final deal.