The first official third-quarter report on US GDP is more than two months away, but the preliminary nowcasts point to a softer-but-still-solid gain, based on several estimates compiled by The Capital Spectator. The question is whether escalating trade-war tension and Turkey’s financial crisis that’s roiling emerging markets will take a bit out of the rosy projections for the US?

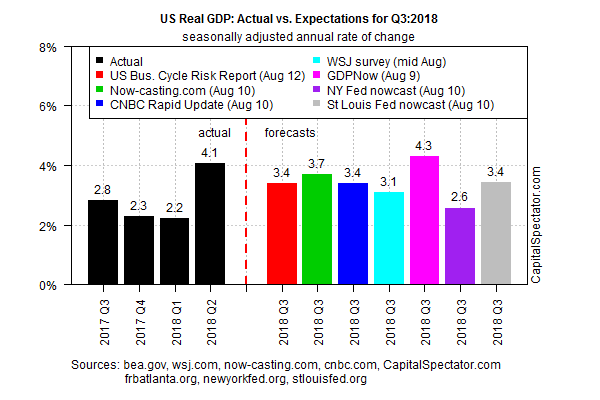

For the moment, several widely followed estimates for GDP nowcasting are painting an upbeat profile for the current quarter. The median projection is 3.4% for Q3, based on the numbers presented in the chart below. Although that’s down from Q2’s strong 4.1% gain, a real 3.4% increase in economic output (at a seasonally adjusted annual rate) is a robust advance that will keep the nine-year-old expansion bubbling.

At the high end of current estimates is the Atlanta Fed’s GDPNow model, which is looking for a slight acceleration in growth to 4.3% in Q3 (as of Aug. 9). By contrast, the low number in our sample at the moment is the New York Fed’s 2.6% estimate (Aug. 10).

Relative to those extremes, economists overall are looking for a relatively middling 3.1% gain, based on yesterday’s monthly release of The Wall Street Journal’s economic survey.

It’s still early for Q3 data, of course, and so the current estimates should be taken with a grain of salt. A lot can happen over the remaining two months of the current quarter. Indeed, a lot has happened already, including Turkey’s largely self-inflicted financial crisis that’s reverberating across global markets.

Although Turkey’s economy is tiny fraction of global economic activity, its recent convulsions are resonating near and far. Katie Nixon, chief investment officer for wealth management at Northern Trust, explains why this risk can’t be dismissed, via a recent research note, CNBC reports.

How can a country where the entire market cap of Turkish equities traded on the Istanbul Stock exchange is less than the market cap of Netflix (NASDAQ:NFLX) wreak such havoc? It is all about the direct and indirect impacts. There are certain emerging market countries with relatively weak currencies and a heavy reliance on external (predominately dollar based) financing. The fear is that what happens in Turkey won’t stay in Turkey.

The US stock market is certainly paying attention. Headlines citing Turkey’s turmoil, which has cut the country’s currency, the lira, to record lows in recent days, are widely cited as a factor in the S&P 500’s slide in the past two trading sessions.

The big risk is that Turkey’s problems – high debt, rising inflation, a falling currency, and an authoritarian president who appears intent on limiting the country’s government and central bank from responding with economically rationale policies – spill across borders and take a toll on sentiment.

“This has the potential to be a real crisis,” Gary Kleiman, an emerging-market investment consultant tells The New York Times. “Banks are overstretched, and soon you are going to see an increase in nonperforming loans. It is going to spread.”

Perhaps, but from a US perspective Turkey’s ills look relatively contained. Nonetheless, all eyes are focused on how this key emerging-markets nation fares in the days and weeks ahead and whether its macro troubles infect (or don’t) the global economy.

“The broad conclusion from history is that the US can generally ignore what happens in emerging markets, unless it involves China,” says Michael Gapen, chief US economist at Barclays Plc and a former section head at the Fed Board in Washington, via Bloomberg.

True, but the wrinkle is that the US has been raising trade tariffs on China, which has responded in kind, prompting concern that growth in both countries could suffer if the policy restrictions persist.

The current rosy outlook for the US economy in Q3, in short, may be vulnerable to downgrades in the weeks ahead. The latest GDP estimates for the current quarter are already looking for a slowdown in the macro trend. The burning question is whether geopolitical risk will further pare economic activity in Q3?