OPEC failed the markets, but a Kuwaiti oil worker strike came through

It was only a matter of time before the overly bearish supply fundamentals in crude oil were overshadowed by a supply disruption at the hands of Mid-East turmoil. What some believed on Sunday night was the beginning of another precipitous crude oil decline, quickly turned into a sharp energy rally on news of a Kuwaiti oil worker strike. Adding fuel to the fire was a report released this morning by the U.S. Energy Information Administration suggesting distillate stocks (heating oil/diesel/gasoline) experienced small declines. Remember, commodity markets don't need an actual change in fundamentals to turn things around, they just need the perception that it is possible. In other words, crunching supply and demand data isn't going to change momentum.

The direction of crude oil matters to financial futures traders because it is was a big weight on equities earlier in the year. Higher energy prices eases concerns of contagious debt defaults in junk bonds, and could eventually put layed off shale oil workers back on the job.

Treasuries are struggling, but support looms and potential weakness in the ES could provide support

Tomorrow's ECB meeting was cause for concern for many traders. We believe much of today's bond and note selling can be attributed to anticipation of further stimulus by the ECB. The currency market behaved with the similar mindset, forcing the euro lower against the dollar.

We will likely know the fate of the currency market tomorrow, and that could also determine the direction of Treasuries. A lower dollar should be bullish for bonds, but a stronger dollar will be bearish.

Treasury Futures Market Analysis

**Bond Futures Market Consensus:** Stocks are overstretched on the upside, and Treasuries are on support. It is now or never for a reversal.

**Technical Support:** ZB : 163'04, 162;23, 160'27, 156'25, and 153'26 ZN: 129'25, 129'15, 128'22, and 128'00

**Technical Resistance:** ZB : 167'14, 168'08, and 169'14 ZN: 131'10, 131'29, and 132'20

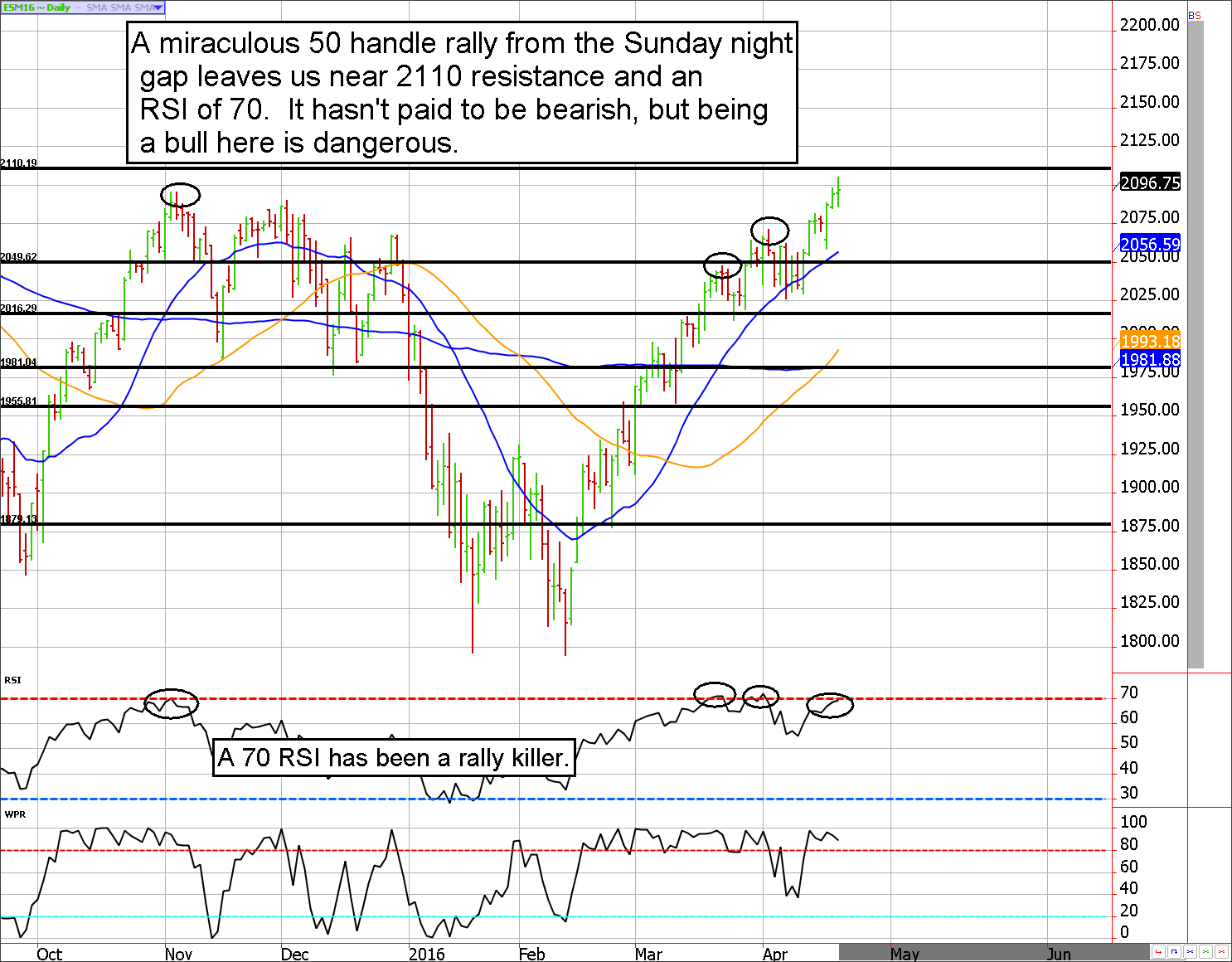

It is hard to believe the ES has traveled 50 handle from Sunday night's open!

It certainly hasn’t paid to be a bear, but being overly bullish "up here" is dangerous. The Relative Strength Index (RSI) on a daily chart of the S&P 500 is hovering near 70, which has been like kryptonite for rallies. Also, 2110 to 2115 should be heavy resistance. At minimum, it should trigger some sort of pullback to digest the recent gains. Active futures traders know, the e-mini S&P 500 has traveled 50 handles from the Sunday night gap lower following a busted OPEC meeting, that’s probably “too far too fast” for this market. The bulls probably should be protecting profits, and if you are a bear it might be worth adding on near 2110 to 2115.

Good luck!

Stock Index Futures Market Ideas

**e-mini S&P Futures Market Consensus:** 2110 to 2115 is the "do or die" level in the ES. Bulls should be protecting profits, bears should be looking to get aggressive.

**Technical Support:** 2049, 2016, 1981, 1960, 1879

**Technical Resistance:** 2110, 2016, 2135

e-mini S&P Futures Day Trading Ideas

**These are counter-trend entry ideas, the more distant the level the more reliable but the less likely to get filled**

ES Day Trade Sell Levels: 2110, and 2116

ES Day Trade Buy Levels: 2082, 2064, and 2053

In other commodity futures and options markets....

November 24 - Roll long December corn into March to avoid delivery.

January 14 - Sell March 10-year note 129.50 calls for about 19 ticks, or $300.

February 3 - Buy back the March 10-year note 129.50 call, and replace it with a 2 short April 132 calls and 1 short 128 put. This spreads the risk out on both sides of the market, and slows things down.

February 9 - Buy back the short ZN 128 put, replace it with 2 (double the quantity) of the 129 puts. This brings in more premium, and offers a better hedge to the upside risk.

February 11 - Roll ZN strangles higher to the 133.50/130.50 strikes to try to keep up with the rally and volatility.

February 17 - Buy back April ZN 133.50 calls to lock in a gain.

February 18 - Sell April ZN 131.50 calls for about 28 ticks to hedge the short 130.50 puts remaining from the original strangle.

March 2 - Buy back April ZN 131.50 calls near 8 ticks to lock in a gain.

March 3 - Sell April 130 calls for about 29 ticks to bring in more premium and hedge our short put position.

March 8 - Sell a May ZN 131 call for about 29 ticks. This brings our trade to only slightly bullish.

March 10 - Buy back the May ZN 131 call and all of the April 130 calls. This locks in profits on the call side of the trade, we'll hold the puts in hopes of a bounce.

March 14 - Sell May ZN 129 calls for about 40 ticks, to bring in more premium and hedge our downside risk.

March 17 - Buy back all April puts and May calls, then sell a fresh strangle using the May 130/128.50 strikes. This gets us into a more reasonable position which stands to profit from premium erosion (the previous trade was largely intrinsic value at the point of exit).

March 29 - Buy back May ZN puts to lock in a profit.

March 30 - Sell June ZN 128.50 puts to get back into strangles. This leaves the trade short May 130 calls, and June 128.50 puts...a short strangle with a slightly bearish stance.

March 30 - Sell June ES 2150 call near 10.00/11.00.

April 7 - Buy back ZN 128.50 puts near 9 to lock in a gain.

April 13 - Sell ZN 129.50 puts to bring in more premium and get back into strangles.

**There is substantial risk of loss in trading futures and options.** These recommendations are a solicitation for entering into derivatives transactions. All known news and events have already been factored into the price of the underlying derivatives discussed. From time to time persons affiliated with Zaner, or its associated companies, may have positions in recommended and other derivatives. Past performance is not indicative of future results. The information and data in this report were obtained from sources considered reliable. Their accuracy or completeness is not guaranteed. Any decision to purchase or sell as a result of the opinions expressed in this report will be the full responsibility of the person authorizing such transaction. Seasonal tendencies are a composite of some of the more consistent commodity futures seasonals that have occurred over the past 15 or more years. There are usually underlying, fundamental circumstances that occur annually that tend to cause the futures markets to react in similar directional manner during a certain calendar year. While seasonal trends may potentially impact supply and demand in certain commodities, seasonal aspects of supply and demand have been factored into futures & options market pricing. Even if a seasonal tendency occurs in the future, it may not result in a profitable transaction as fees and the timing of the entry and liquidation may impact on the results. No representation is being made that any account has in the past, or will in the future, achieve profits using these recommendations. No representation is being made that price patterns will recur in the future.