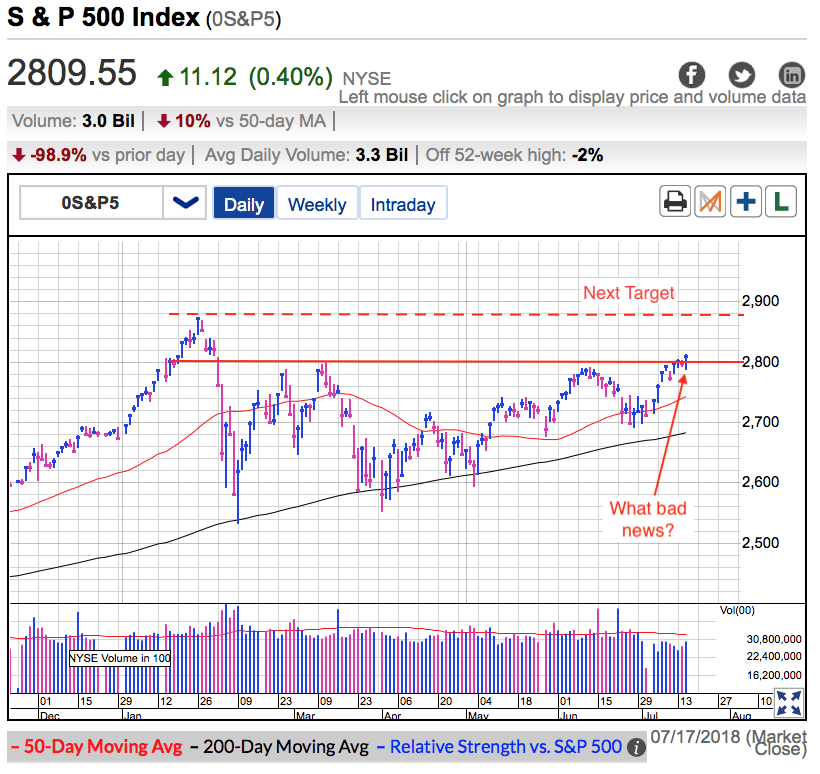

The S&P500 ended Tuesday with nice gains, easily erasing opening losses. Monday evening Netflix (NASDAQ:NFLX) reported disappointing subscriber growth and that sent a chill through the entire tech sector. But Tuesday’s weak open was as bad as it got and prices rebounded decisively through the day. This strength resulted in the highest close since February 1st and leaves us within 2% of all-time highs. Not bad given all the headline uncertainty swirling around the market.

Bears are left dumbstruck by this market’s resilience and no doubt they are crying foul. But it didn’t have to be this way if they had been paying attention. We trade the market, not the headlines. If a person kept this in mind, they would have embraced this strength, not challenged it.

I’ve been telling readers for months this is a strong market. This is what I wrote back in early May when the market threatened to crash under 2,600 support:

As I’ve been saying since February, we are in a trading range. That means buying weakness and selling strength. Stick with what is working until something changes. Did something change today? Nope. That means today’s weakness was a buying opportunity, not a chance to bailout “before things get worse”. Maybe we slip a little further, but that’s not a big deal. Remember, risk is a function of height. The lower prices go, the less risky it is to buy. If this market wanted to crash, it would have happened months ago. There have been more than enough excuses to send prices tumbling. Instead, every time we slip to the lows, supply dries up and prices rebound. This is a resilient market, not a weak one. And the only people losing money are the ones overreacting to these gyrations. They lose money buying when they feel confident (high) and sell when they are fearful (low). If we want to make money, do the opposite of most people. That means buying fear and selling confidence.

The market is up nearly 8% since I wrote that. I don’t have a crystal ball, but I’ve been doing this long enough to know what to pay attention to. While fearful owners were panic selling, I was buying their discounts and it has worked out really well. And nothing has changed.

If this market ignored bad news in May and June, why would that change in July? Given yesterday’s resilient price-action, clearly it hasn’t.

But that was then and this is now. What people want to know is what comes next. If it isn’t obvious yet, this market wants to go higher and it isn’t going to let headlines get in its way. Either we jump aboard and enjoy the ride, or we get out of the way. But we most definitely don’t fight it.

If this market was fragile and vulnerable, we would have crashed months ago. Bears can talk all they want about complacency, but they forget periods of complacency often last months and even years before ending in a top. Confident owners don’t sell and the resulting tight supply propping up prices. Headlines don’t matter when no one sells them and that is the exactly what is happening here. Right or wrong, it doesn’t matter, I trade the market and this market wants to go up.

That said, the easy gains are behind us. Long gone are the days of buying the dip and racking up quick profits. Instead this market is approaching old highs and we should expect the rate of gains to slow.

Confident owners don’t want to sell, but we need new money willing to chase prices higher and that is getting harder to come by. We are still in the slower summer months and we shouldn’t expect the real buying to start until big money returns from their summer cottages this fall. Things still look good for this market, but expect gains to slow. And remember, slow includes lots of back and forth along the way. The easy money was made weeks ago.

Now it takes more conviction to hold through the inevitable gyrations like we saw Tuesday morning. But the rewards will be there for those that have the patience and conviction.

The market is acting well and that means we stick with what has been working. Longer-term, keep holding our favorite buy-and-hold stocks. Short-term, we are stuck in no-man’s land and a lot depends on a trader’s plan.

Shorter-viewed swing-traders can start taking profits and waiting for the next trade. Those with a little more patience can continue waiting for higher prices. Over the next few weeks I expect this market will challenge all-time highs near 2,880. But rather than cheer that strength, I will be collecting my profits.