- After Powell, investors listen to more Fed members

- But implied path on interest rates stays unchanged

- Jobless claims and next week’s CPI data are the dollar’s next tests

- Wall Street indices close in the red

Fed bets stay untouched after parade of Fed speakers

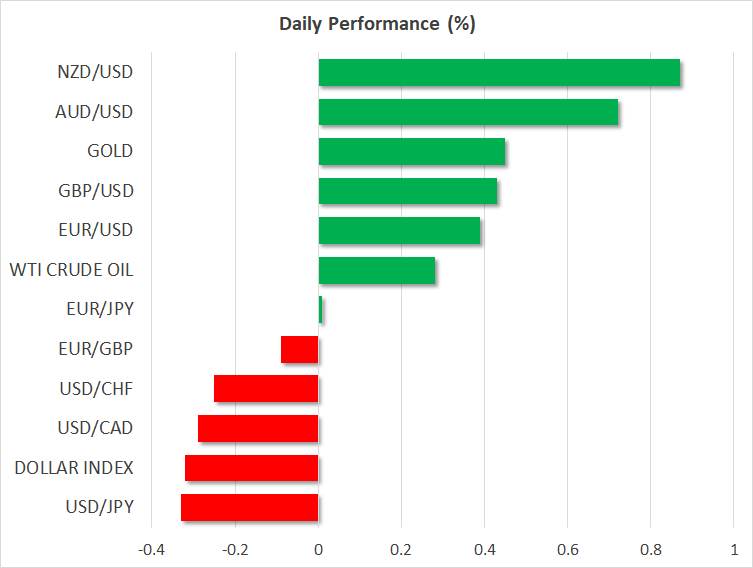

The US dollar stabilized against most of the other major currencies yesterday, pausing the Powell-related slide. However, that was only for a while as today the US currency is back under pressure.

Although there were no major data releases on yesterday’s agenda, a number of Fed speakers expressed their view on interest rates, allowing the US dollar to find some footing, at least temporarily.

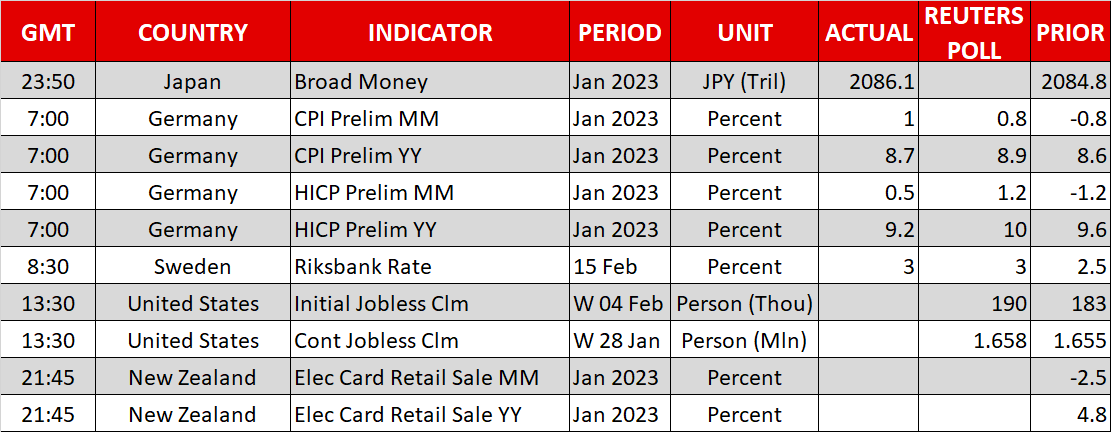

New York Fed President John Williams said that moving interest rates to the 5.00-5.25% range seems very reasonable in order to get the supply and demand imbalances down, and that it remains key for monetary policy to stay at restrictive levels “for a few years”. Meanwhile, Fed Governor Christopher Waller said that while wage growth has slowed, the decline is “not enough”, which reinforces the need for tight monetary policy for longer. The most hawkish remarks came from Minneapolis Fed President Neel Kashkari, who reiterated his view that the fed funds rate needs to go as high as 5.4% or even further if the data suggests so.

Those comments stopped the dollar’s decline, but what forbade a decent rebound may have been a speech by Fed Governor Lisa Cook. Cook said that last month’s strong job gains combined with moderating wage growth increased hopes for a “soft landing”, and that a return of inflation to 2% can be accomplished without a large increase in unemployment. Reading between the lines, this could mean that she believes the job can be done with policy not necessarily being as restrictive as her colleagues suggest.

Therefore, the aggregate outcome was for investors to keep their rate bets untouched. They are still pricing in a terminal rate of 5.13%, in line with the Fed’s own projection, but they see around 35bps worth of rate cuts by the end of the year.

Traders lock gaze on US jobless claims, await next week’s CPI data

Their attention may now fall on the jobless claims data for last week, scheduled to be released later today, as they seek evidence on whether the labor market remained strong at the beginning of this month. A downside surprise may revive speculation that Fed officials could keep interest rates elevated for longer and thereby add some more fuel to the greenback’s engines.

Having said all that though, even if jobless claims encourage some dollar buying today, calling for a long-lasting recovery seems premature. Next week’s agenda includes the US CPI numbers, where another notable slowdown could trigger the resumption of the greenback’s prevailing downtrend. With ECB members Joachim Nagel and Isabel Schnabel appearing in their hawkish suits yesterday and signaling that more bold action is needed, euro/dollar may soon rebound back above 1.0800, allowing traders to put the 1.1175 territory back on their radars.

Wall Street slides as Alphabet (NASDAQ:GOOGL)'s chatbot gives wrong answer

Passing the torch to the equity market, all three of Wall Street’s main indices dropped yesterday, despite Treasury yields sliding. This suggests that relatively hawkish remarks by some Fed officials were not the only reason investors reduced their risk exposure.

Indeed, the biggest drag on the S&P 500 and the Nasdaq was Google’s parent Alphabet, whose shares tumbled 7.7% after its new AI chatbot Bard gave an incorrect answer during a promotional video, adding to concerns that the firm is losing ground against rival Microsoft (NASDAQ:MSFT).

However, with talks about a “soft landing” in the US intensifying after data added credence to that view, and with market participants maintaining bets of a Fed pivot at some point this year, stock indices may continue trading higher for a while longer. A clear break of the S&P 500 above the key resistance zone of 4,155 could see scope for advances towards the high of August 16 at around 4,325.