By Kathy Lien, Managing Director of FX Strategy for BK Asset Management.

To the disappointment of investors looking for renewed hawkishness from the Federal Reserve, the central bank failed to deliver causing USD/JPY to tumble from a high of 112.65 to a low of 112.80. Ten-year Treasury yields also turned briefly negative after rising as much as 5bp. Although the greenback and yields recovered part of their losses ending the day in positive territory after the monetary policy announcement, they have yet to recapture their pre-announcement highs. The Federal Reserve recognized the improvements in consumer and business sentiment and noted that job gains remained solid while unemployment stayed low. They also said household spending continued to rise but they felt that inflation remained low and business investment was soft. They didn’t appear to be particularly worried about inflation as the gauges “remained low” and as such, only “gradual tightening is warranted.” At the last meeting, U.S. policymakers penciled in 3 rate hikes this year but according to Fed Fund futures, the market is only looking for 2 rounds of tightening. With that in mind, the odds for a March hike increased slightly after the announcement from 31 to 32 percent. The lack of unambiguous optimism hurt the dollar but with ADP reporting a sharp increase in payroll growth and ISM reporting a pickup in manufacturing activity, investors are still holding out hope that Friday’s jobs report will be good. Which means that losses in USD/JPY should be limited to 112 with gains capped below 114 as the market will also be taking Trump’s recent comments into account and we know he wants to see the dollar lower.

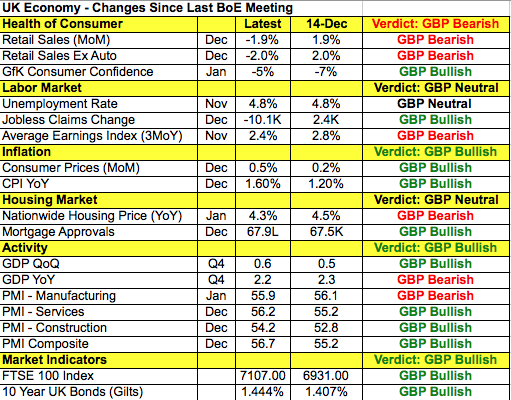

Thursday's focus will be on the British pound for a number of reasons. There is a Bank of England monetary policy announcement on the calendar along with the Quarterly Inflation Report and a speech from Governor Carney. Additionally, Prime Minister May will be publishing a white paper containing her Brexit plan. We are not sure exactly what time her the paper will be released but the monetary-policy announcement and Quarterly report could be more positive than negative for sterling as the central bank is widely expected to increase its inflation forecast. Growth and inflation have been stronger than expected but the challenge for Carney is assessing how this could change in light of the government’s Brexit plan. The last time the BoE met, Carney said rates could go up or down in the months ahead. Brexit is quickly becoming reality as members of Parliament passed a bill Wednesday backing the trigger of Article 50. In May’s report on Thursday, she could outline a timeline for Britain’s exit from the European Union. Taking a look at the table below, there has been more improvements than deterioration in the U.K. economy since their last meeting but the slowdown in manufacturing activity, retail sales and average hourly earnings is concerning. Its going to be a very volatile day for GBP/USD and the levels to watch will be 1.2775 on the upside and 1.2475 on the downside. If either of these levels give, we could see a much stronger move in the currency.

Unlike sterling, euro traded lower against the U.S. dollar, confirming the rejection of the 1.08 resistance level. Part of the weakness can be attributed to mixed data as the German manufacturing PMI index printed slightly lower then expected, coming in at 56.4 vs. 56.5 forecast. The Eurozone Manufacturing PMI index, on the other hand, printed higher with a reading of 55.2 vs. 55.1 expected. EUR/GBP selling also managed to keep the euro under pressure with the currency cross moving lower by nearly to 1% for the day, hovering around the 0.85 level. For now, the euro is still taking its cue from the greenback and pound as no market-moving data is expected to be released on Thursday.

All three of the commodity currencies lost value against the greenback Wednesday but the slide in AUD and CAD was nominal. The New Zealand dollar was the biggest loser as the currency continued to feel the sting of Tuesday’s employment report. The Australian dollar was hit by the decline in gold prices and weaker-than-expected data. The AiG Manufacturing PMI came in at 51.2, far lower than last month’s 55.4 reading. China's Manufacturing PMI ticked slightly higher with a reading of 51.3 vs. 51.2 expected but the impact on AUD was nominal. The Canadian dollar held onto its recent gains despite cautionary comments from Bank of Canada Governor Carney. The BoC head talked about excess capacity, weaker-than-expected exports, low inflation and Trump uncertainty. Oil prices increased despite continued supply worries and took in gains of about 1%. The DOE reported that oil inventories rose to about 6.4m barrels for last week, an increase of over 3m barrels. Australia was set to report trade and housing data.