The dollar posted lower against the yen in early trade on Thursday as the U.S. yields declined overnight to hit two-week lows, but the dollar remained steady against the euro and the pound.

The greenback dropped 0.2 percent and stood at 117.070 yen, which sharply declined from a high of 117.815 overnight.

Meanwhile, the treasury yields dropped amid a weaker-than-expected pending home sales, along with a strong debt auction.

The euro slightly changed at $1.0420 after posting losses of 0.4 percent in an earlier session, which hit as low as $1.0372.

"The dollar looks like it has run its course against the yen for now. But against the euro, the dollar still has room to gain as the pair is now trying to catch up to the widening between U.S. and German yields," analyst Masafumi Yamamoto said.

The U.S. 10-Year Treasury spread, including the German bond yields settled as the widest on record stretching back to 1990.

The spread is currently increasing on the divergence between European and U.S. central bank policy, including perspectives for growth and inflation.

Subsequently, the dollar already stood at nearly 14-year low of $1.0352 during the weekly trade and analysts are expecting the currency to reach parity with the dollar next year.

The pound holds steady at $1.2229, which hit a two-month low of $1.2201 in overnight trade amid growing uncertainties over Britain’s Brexit negotiations.

The dollar index declined by about 0.15 percent at 103.150, but still in reach of a 14-year high of 103.650 amid session last week.

The index has found support on heightened expectations that Donald Trump’s incoming administration will strengthen U.S. growth through fiscal stimulus, which will likely supported by a tight monetary policy and higher yields.

The Australian dollar rose 0.15 percent and stood at $0.7188.

Dollar Slips on Lower U.S. Yields

The dollar slipped against the yen on Thursday’s session after the U.S yields declined to two-week lows, along with the risk appetite that favoured the safe-haven yen.

The dollar posted losses of 0.4 percent at 116.800 yen, which came down from a session high of 117.815 in overnight trade.

Current Stance of USD/JPY

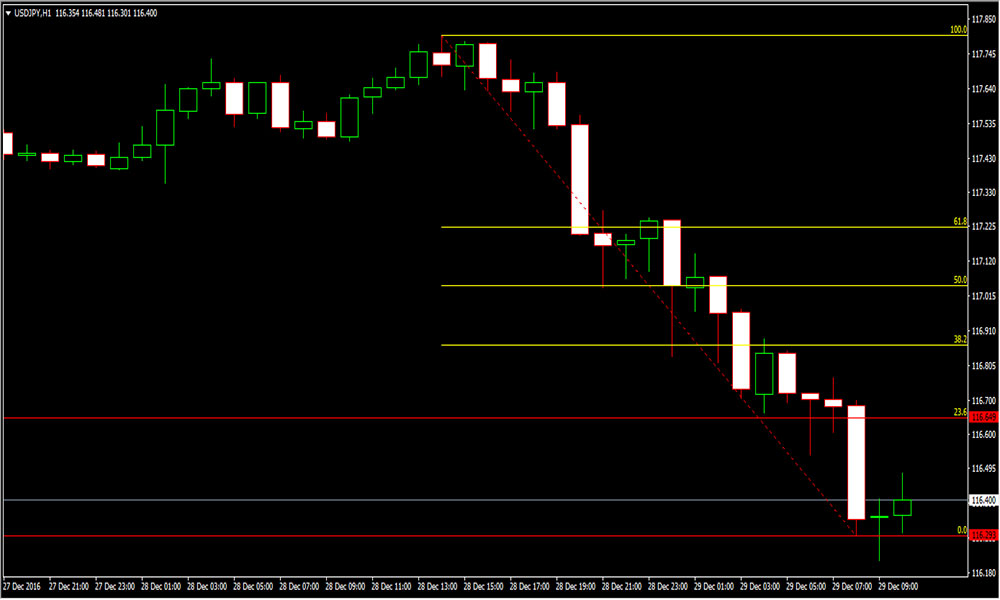

The chart below illustrates USD/JPY price movement amid the incoming administration of Donald Trump, which is expected to boost U.S. growth through fiscal stimulus.

Given a bearish tone of the pair, market participants have begun selling riskier currencies as Trump’s administration is expected to give a huge impact on both currencies.

Further, the pair is currently showing a disappointing result after a heavy trading volume almost break through below its support level.

Conclusion

As the illustrative chart above shows a bearish tone on the pair, market participants are recommended to still wait on the sidelines as there aren’t any supporting candle as of writing.