Despite some modest improvement in risk appetite, the US dollar continued to gain against all the other major currencies yesterday and today in Asia. In our view, this may have been due to haven inflows and suggests that participants' worries over inflation, the US debt ceiling, and China's Evergrande (OTC:EGRNY) are still on the table.

Meanwhile, concerns about soaring natural gas prices and nearly a week of petrol shortages weighed on the pound.

USD Marches North, Despite A Modest Rebound In Some Indices

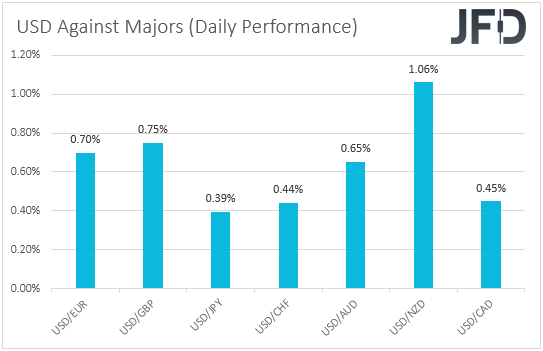

The US dollar kept marching north against all the other major currencies on Wednesday and during the Asian session Thursday. It rose the most versus NZD, GBP, EUR, and AUD, in that order, while it eked out minuscule gains against CHF and JPY.

The strengthening of the US dollar, the weakening of the risk-linked Kiwi, pound, and Aussie, as well as the fact that the safe-havens yen and franc lost the least ground, all suggest that market participants remained concerned.

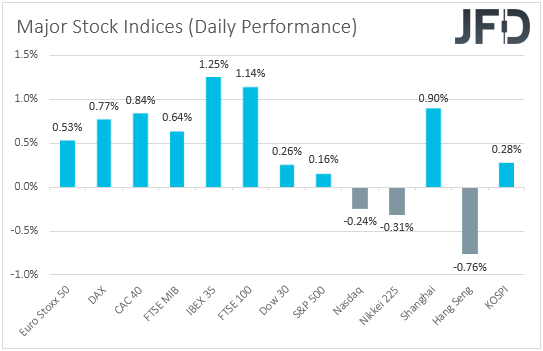

However, looking at the performance in the equity world, we see that major EU indices rebounded. Although appetite softened again during the US session, only the NASDAQ closed in the red.

Today in Asia, China’s Shanghai Composite, and South Korea’s KOSPI gained, but Japan’s Nikkei 225 and Hong Kong’s Hang Seng slid.

Despite the rebound in some equity indices yesterday, the strengthening of the US dollar and the other safe-haven currencies suggests that market participants have not suddenly forgotten what forced them to abandon equities on Tuesday.

As we noted yesterday, we would treat any near-term recovery as a short-covering corrective bounce. We see decent chances for equities to resume their declines, here's why.

First, Fed Chair Powell, European Central Bank (ECB) President Lagarde, and Bank of England (BoE) Governor Andrew Bailey shared that inflation remains and could remain elevated for longer than they have estimated. However, they maintained the view that the surge in prices could still prove to be transitory.

Their comments added to speculation for earlier than previously expected tightening by the Fed and the BoE. We cannot say the same about the ECB because this Bank made it clear that it can tolerate overshooting inflation and refused to discuss tapering.

The ECB slowed its Pandemic Emergency Purchase Programme (PEPP) purchases at its latest gathering but hinted that it could compensate through other schemes when the program ends. In our view, the ECB would prefer to move late rather than too early.

Meanwhile, the deadlock between Democrats and Republicans persists, increasing the risk of a government default and a shutdown. Senate Democrats have tried to pass a bill that funds the government and prevents a catastrophic default by raising the nation's debt ceiling.

However, Republicans opposed the proposal. The government hits the ceiling on Oct. 18, and lawmakers are due to vote on a potential resolution to fund operations through early December today before funding expires.

A potential breakthrough could provide temporary relief, but it would be far from a permanent solution. Thus, the risk of a possible government shutdown remains well on the table.

Lastly, China's Evergrande failed to make payments yesterday, increasing concerns over a default, which could have a spillover effect on the nation's financial system and the rest of the world. As we noted recently, Evergrande has 30 days past the scheduled date to settle the payments of a specific bond. Otherwise, the bond defaults.

Back to the currencies, the pound was the second loser in line, behind the New Zealand dollar, despite increasing expectations that the BoE could raise its benchmark interest rate in the months to come. The pound has been the best performing one at some point earlier this year, boosted by high expectations over an economic rebound due to the country's vaccination program.

However, it came under intense selling pressure the last couple of days, hitting its lowest since end-2020 against USD on Wednesday, due to concerns about soaring natural gas prices and nearly a week of petrol shortages. People have been panic-buying fuel, as oil firms warned that they don't have enough truck drivers to carry petrol and diesel from refineries to filling stations.

What's more, the correlation between sterling and risk sentiment has increased lately, which leaves the currency vulnerable when investors reduce their risk exposure.

S&P 500: Technical Outlook

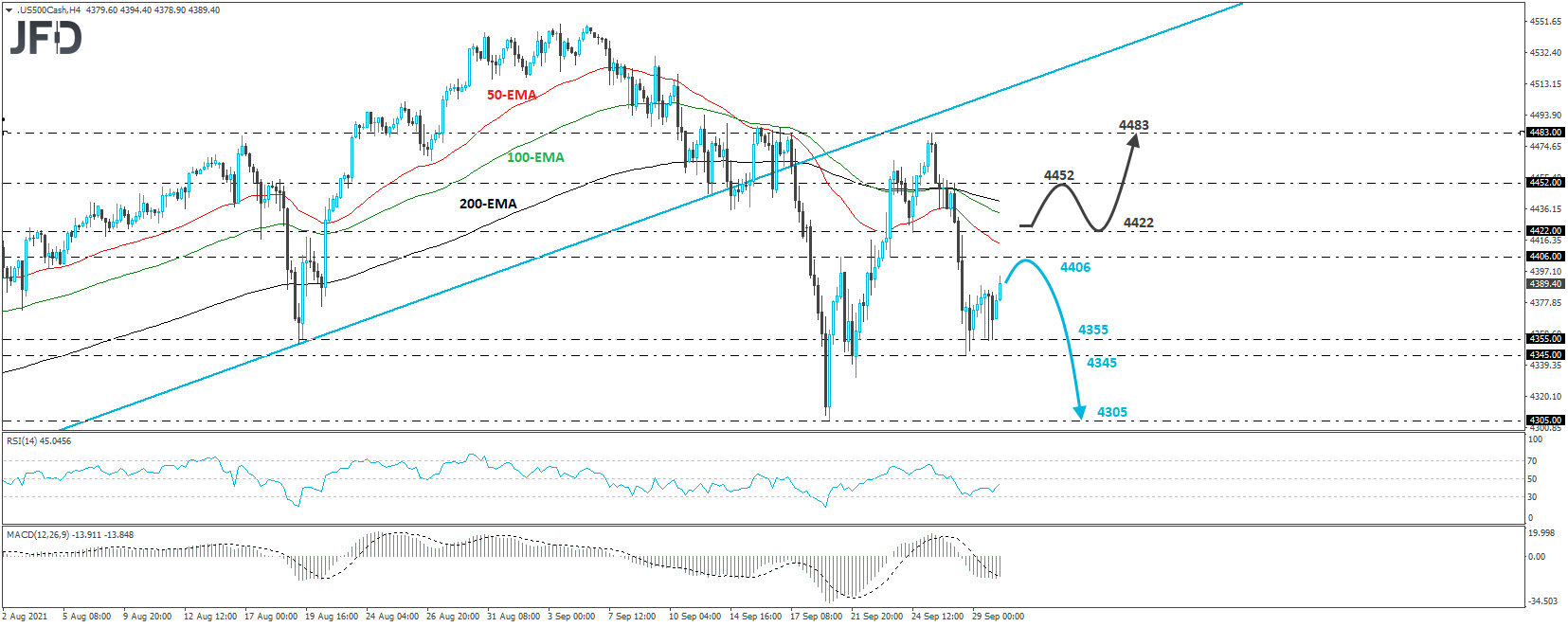

The S&P 500 traded slightly higher after hitting support near the 4355 area, slightly above Tuesday's low of 4345. Overall, the index remains below the last upside support line taken from the low of Mar. 4, and even if the price climbs a bit higher, we still see decent chances for the bears to regain control again at some point soon.

The slide may come after a test near the 4406 level, and could result in another test near the 4355 or 4345 territories. If the bears are willing to drive the battle lower this time around, we could see them aiming for the low of Sept. 20, at about 4305.

To start examining a more robust recovery, we would like to see a move above the inside swing low of Sept. 24, at 4422. This may encourage advances towards Tuesday's high of 4452, the break of which could allow extensions towards Monday's peak, at 4483.

AUD/USD – Technical Outlook

AUD/USD fell sharply yesterday, breaking below the critical support (now turned into resistance) territory of 0.7220, which had been acting as a floor for the pair since Aug. 24. In our view, the dip below that barrier reinforced a short-term downtrend that's been in place since the beginning of September.

After the break, AUD/USD hit support at 0.7168 and rebounded. Now it looks ready to challenge the 0.7220 zone as a resistance, from where the bears may jump back into the action and push the rate down again. A dip below 0.7166 would confirm another lower low and may pave the way towards the low of Aug. 20, at 0.7105.

On the upside, a break above 0.7265 may invite some bulls into the game, but we will not call for a bullish outlook yet, as the rate would still be trading below the longer-term downside line drawn from the high of May 10.

We could see a corrective recovery towards the 0.7310 zone, which provided resistance on Sept. 23, 24, and 28. A break higher could aim for the 0.7346 level, marked by the high of Sept. 16.

As For Today's Events

During the European session, Germany releases its preliminary inflation data for September. The CPI and HICP YOY rates are expected to rise further, to +4.2% and +3.8%, from +3.9% to +3.4%, respectively.

This may raise speculation that Eurozone's headline rate, due out tomorrow, may rise as well. From the UK and the US, we have the final GDP prints for the second quarter.

The UK numbers are already out, and they are slightly higher than their initial estimates, while later in the day, the US forecasts confirm their second estimates.

Tomorrow, Asian time, Japan's Tankan survey for the third quarter is due to be released, with the large manufacturers index expected to have ticked down to 13 from 14. Still, the large non-manufacturers index is forecast to have risen to 3 from 1. The nation's employment report for August is also coming out.

As for the speakers, we have four Fed members on our agenda and those are New York President John Williams, Atlanta President Raphael Bostic, Philadelphia President Patrick Harker, and Chicago President Charles Evans.