It was a rather pedestrian FOMC Statement day on Wednesday. There is GDP data incoming, and the widely Fed-followed Core PCE Price Index data comes out on Friday.

What can we take away from the FOMC Statement and press conference?

Rates unchanged. No rush to raise interest rates. Inflation should persist.

No surprises here.

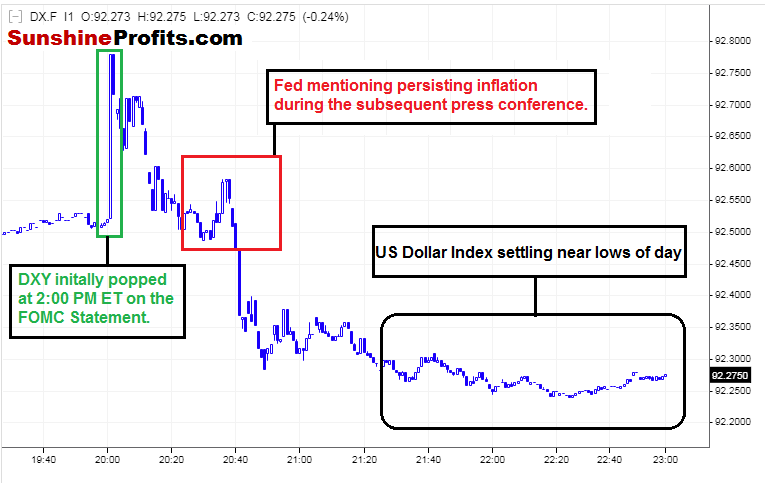

However, there was some notable price action in the US Dollar Index during Wednesday’s session. The US Dollar Index initially rose on the FOMC statement at 2:00 PM. During the press conference, the USD fell as Fed Chair Jerome Powell mentioned that inflation should persist for several months. It is noteworthy price action and can be a forward-looking indicator for the direction of other asset prices.

First, let’s take a look at the daily chart of the DXY:

Figure 1 - US Dollar Index November 1, 2020 - July 28, 2021, Daily Candles Source stockcharts.com

As we know, the US Dollar has been in a longer-term downtrend. The repeating pattern has been lower daily highs. Short the dollar was a heavily crowded trade recently that we examined and discussed. After reaching oversold conditions, a quick bounce occurred. However, with no rush to raise interest rates and Fed open market operations continuing, the DXY could try the downside once again. This downward move could impact the prices of commodities even further to the upside. There is a key Fibonacci level that was not quite reached in the index on its last downside attempt (near $88.41).

Figure 2 - US Dollar Index July 28, 2021 - July 28, 2021, 1-minute Candles Source stooq.com

I find value in this type of analysis; when you can take a daily/longer-term trend/outlook and then take an intraday peek on a day such as a Fed day. I would have guessed that the market would be factoring in further inflation already. However, based on the DXY behavior intraday, it appears that the US Dollar may want to get set to go and retest the recent low near $89.50.

GDP Data, Core PCE

On Thursday morning, we are getting GDP (q/q), and on Friday morning we will get the Core PCE data. GDP can be a market mover, and the Fed does like to monitor the PCE data for inflation signals.

As the US Dollar may weaken some, a place to park some cash could be in the Invesco DB US Index Bearish ETF (UDN). I wouldn’t expect any home runs here; the ETF is unleveraged, but a 2 - 3% pop could be in the cards here if the DXY wants to test its recent lows.

Figure 3 - Invesco DB US Dollar Index Bearish Fund - September 4, 2020 - July 28, 2021, Daily Candles Source stockcharts.com

UDN is doing its job rather well and is inversely tracking the US Dollar Index at an efficient rate. Other traders could use the DXY product on ICE if their accounts are enabled for it. ICE passes through the monthly fee for its products to retail traders (somewhere in the neighborhood of $110 per month) to trade these products and receive quotes.

So, using UDN can give traders some pure exposure to a dollar decline. We will be eyeballing the $21.48 - $21.64 levels as potential TP targets for now. Levels and sentiment can change quickly, so stay tuned!