The US Dollar Index is often a topic of debate within financial circles. Every minor move tracked to determine how it will impact other markets and the economy. It gets to be too much some times. On a broader scale the US Dollar Index trades in a very narrow range most of the time. If we viewed this like a stock at a similar price, like Walmart (NYSE:WMT), no one would even talk about it.It has just run sideways since May.

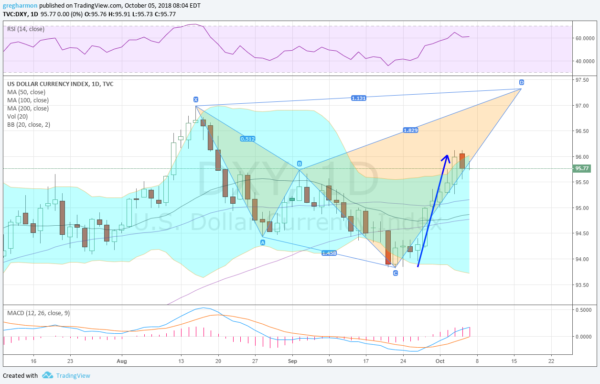

But it is not Walmart, it is the Reserve Currency for the world (ex- crypto fanatics and Peter Schiff). So minor moves might be the start of a major change in asset flows. And when we look at it today the Index is making some interesting short term moves. Take a look at the chart below.

Four things stand out when reviewing this chart. The first is the bearish Shark harmonic pattern building. This targets a move to the 97.30 area before a potential reversal. The second is the recent move up into consolidation. A Measured Move out of this flag gives a target to about 97.50 should the move be to the upside.

Third, the Bollinger Bands were tight and are now opening to the upside as the Index pushed higher. This allows a continued Move up. Finally the momentum indicators are in bullish ranges and improving. All of this points to an easier path to the upside for the US Dollar Index in the near term.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.