Here are the latest developments in global markets:

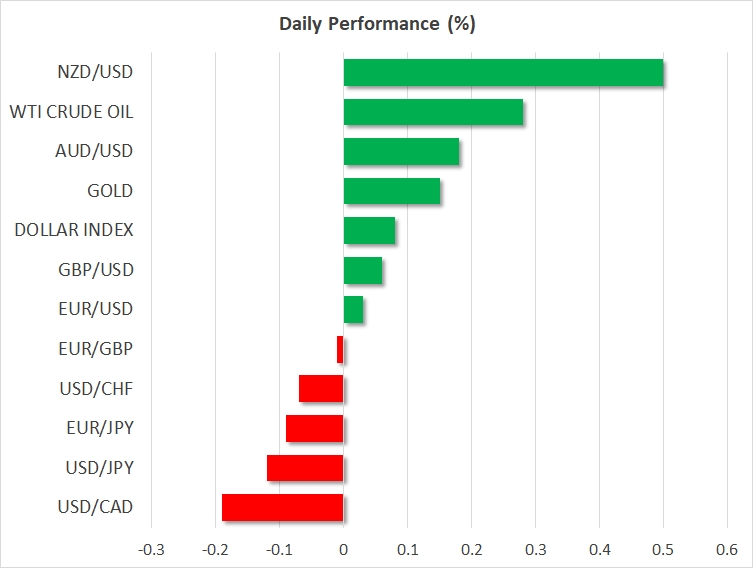

- FOREX: The dollar was not much changed after hitting an eight-day low against a basket of currencies yesterday on uncertainty over the passage of tax reforms. Kiwi/dollar advanced after New Zealand’s finance minister expressed no concerns about a rising currency.

- STOCKS: The Nikkei 225 lost 0.6% and the Hang Seng was down by 1.1%, with Asian markets mostly on the decline. Euro Stoxx 50 futures were 0.25% lower at 0723 GMT, with futures on the Dow being up by 0.25% and S&P 500 as well as NASDAQ 100 contracts both trading higher by 0.2%.

- COMMODITIES: WTI and Brent crude were both up by 0.3%, at $57.21 and $63.50 a barrel respectively. Gold traded higher by 0.2% at $1,255.83 per ounce, further distancing itself from $1,235.92, its lowest since late July hit earlier in the week.

Major movers: Dollar near week’s low; kiwi gains as finance minister avoids talking down the currency

Two Republican senators seeking changes to the proposed tax legislation had investors casting doubts about its eventual passage and pushed the dollar lower during yesterday’s US session. The dollar index was at 93.56, slightly up on the day but still near the week’s lows. Dollar/yen was losing ground after finishing the three previous trading days lower. The pair was down by 0.1% at 112.20.

Euro/dollar traded at 1.1785, little changed after recording losses the previous day on the back of perceived dovishness by the ECB. Pound/dollar was up by 0.1% at 1.3441. After the completion of its meeting on monetary policy yesterday, the Bank of England maintained its position that interest rates were likely to increase only gradually despite inflation moving well above the bank’s target of 2%.

The New Zealand dollar was a major gainer after the country’s finance minister said he was comfortable with the trend in the currency, abstaining from talking down the currency. Kiwi/dollar was up by 0.5% at 0.7022 and not far below a two-month high recorded earlier in the day. The aussie maintained positive momentum following yesterday’s employment figures which came in above expectations. Aussie/dollar was up by 0.2% at 0.7684, hovering around one-month high levels.

Day ahead: EU summit to unlock Brexit talks; US & Canada manufacturing data awaited

Friday would be a relatively quiet day in terms of economic releases, with the US and Canada being the ones to submit reports giving clues on industrial trends.

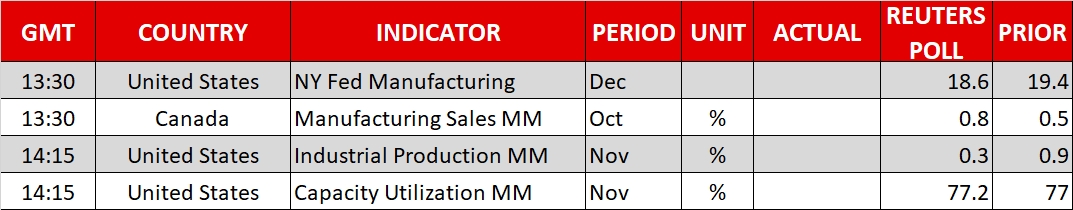

The New York Fed will publish readings on New York’s manufacturing conditions for the month of December at 1330 GMT. Forecasts suggest the index would decline by 0.8 points to 18.60.

At 1415 GMT, growth in industrial production reported by the Fed is forecasted to slow down to 0.3% m/m in November after reaching a six-month high of 0.9% in the previous month.

In Canada, manufacturing sales will be available at 1330 GMT with analysts projecting the measure to increase by 0.3 percentage points to 0.8% m/m in October.

In energy markets, investors will keep a close eye on the US oil rig counts issued by the Baker Hughes company at 1800 GMT. Potential increases in active drilling rigs are likely to add pressure to oil prices.

However, the focus will turn to the EU summit in Brussels as the EU heads of state conclude their two-day meeting today. EU leaders, who recently welcomed UK PM May’s Brexit proposals, are expected to officially announce that sufficient progress has been made in negotiations and move talks to the next stage of the future relationship which would include discussions on trade ties. Note that on Thursday, May agreed to give priority to talks on the transition period rather than on trade deals, with trade negotiations starting only in March. It is also worthy to note that May will not accompany her EU counterparts at Friday’s meeting.

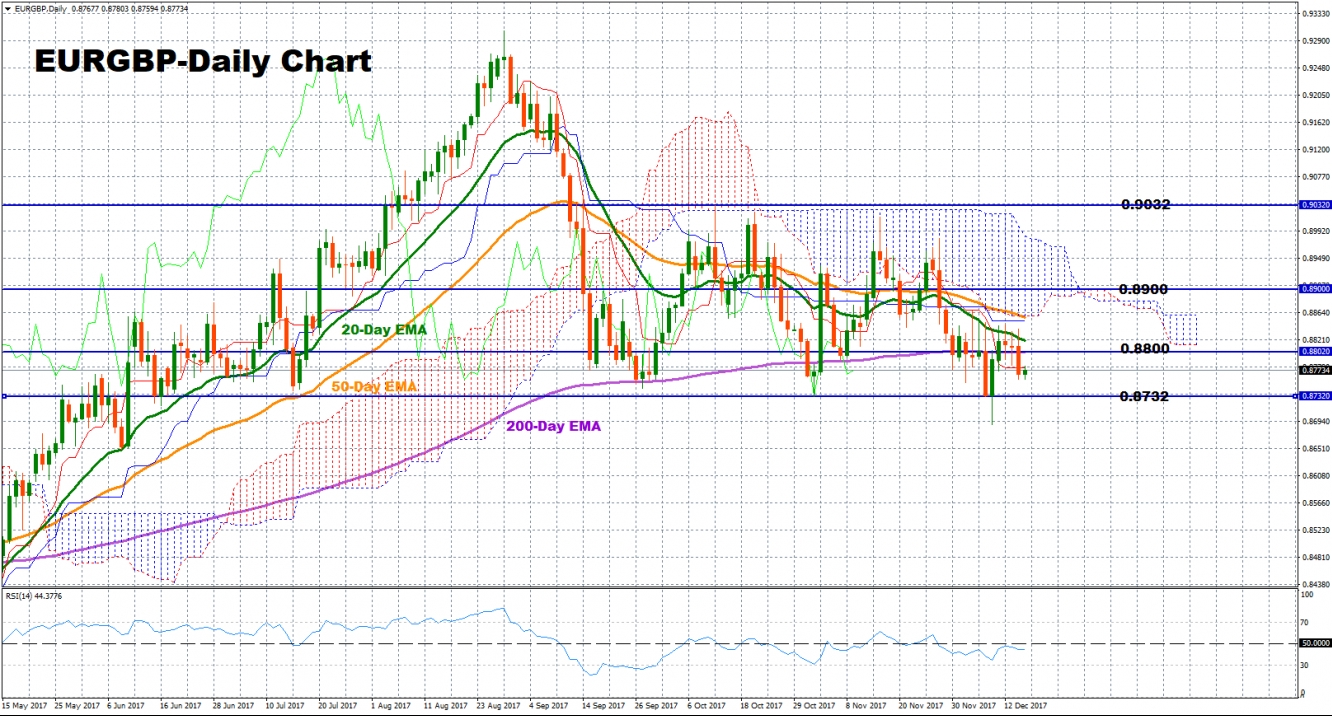

Technical Analysis: EUR/GBP trapped in a range; risk tilted to the downside

EUR/GBP holds a neutral bias in the short-term as evidenced by the RSI moving sideways in recent days. The risk, however, is titled to the downside as the pair fluctuates below the exponential moving average lines.

The pair has been mostly moving within a range between 0.8732 and 0.9032 in recent months. A confirmation of Brexit talks moving to the next stage could push prices down to meet the bottom of the range at 0.8732, while steeper decreases could also drive the market towards the three-month low of 0.8688.

In case of a move to the upside, the pair would target resistance at 0.8802 (200-day EMA). Breaking above this level, the focus would shift to the 0.89 key level and the upper bound of the range at 0.9032.