Here are the latest developments in global markets:

- FOREX: The US dollar index is 0.1% higher on Monday, extending the gains it posted on Friday in the aftermath of the US employment report for April. The US unemployment rate touched a 17-year low, likely enhancing speculation that an ever-tightening labor market is set to push wages higher in the coming months.

- STOCKS: Wall Street closed higher on Friday, paring some early losses posted after the US employment report to rally into the close. The Nasdaq Composite climbed by 1.71%. Meanwhile, the Dow Jones and the S&P 500 gained 1.39% and 1.29% respectively, with both of these indices surging after they found support near their 200-day moving averages. The gains were partly fueled by Apple (+3.92%), which closed at a record high following news that Warren Buffet’s Berkshire Hathaway increased its stake in the company even further. As for today, futures tracking the Dow Jones, S&P, and Nasdaq 100 Futures are all flashing green, pointing to a higher open. In Asia, Japan was mixed with the Nikkei 225 falling by 0.25% but the Topix rising 0.09%, while in Hong Kong, the Hang Seng was down by 0.16%. In Europe, futures tracking all the major indices were in the green, with the only exception being France’s CAC 40.

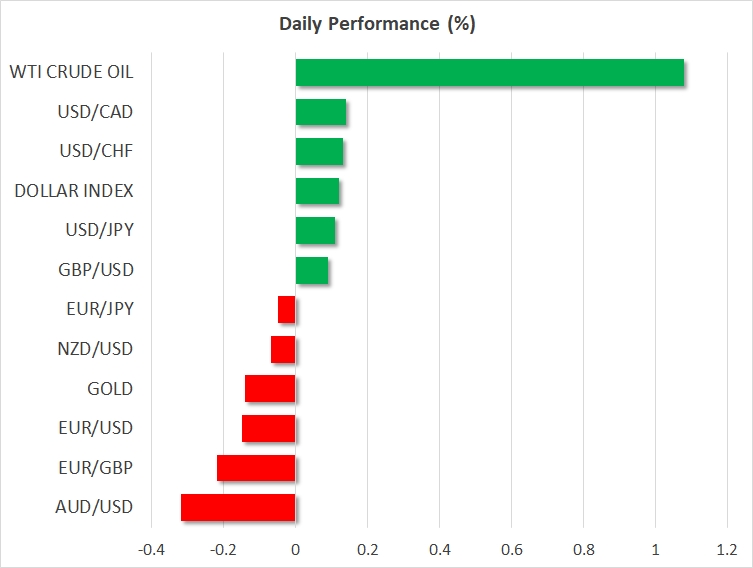

- COMMODITIES: Oil prices surged on Friday and are also higher this week. Crude Oil WTI and Brent are up by 1.1% and 1.0% respectively on Monday, both benchmarks touching fresh highs last seen in 2014. Energy markets largely overlooked another rise in the Baker Hughes oil rig count on Friday, which increased by 9 rigs, and instead focused on the prospect of fresh sanctions on Iran. This story is likely to get a lot more attention this week, as the self-imposed US deadline on making a decision about Iran is May 12. Worries around Venezuelan oil production falling even further likely aided the rally. In precious metals, gold is nearly 0.2% lower today, currently trading near the $1,313/ounce mark. The dollar-denominated metal has been on the decline for three consecutive weeks now, as the rebound in the dollar is weighing on demand.

Major movers: Dollar goes into a spin, but closes higher after jobs data

The US employment report released on Friday was mixed, sending the dollar into a spin, though the currency managed to finish the day higher overall. Nonfarm payrolls and wage growth were disappointing, both coming in lower than their respective forecasts. NFP came at 164k in April, missing the consensus for 192k, while average hourly earnings clocked in at 2.6% year-on-year, below the forecast of 2.7%. Last month’s print was revised lower to 2.6%. As a result, the knee-jerk reaction in the dollar at the release was negative.

The dip was short-lived though, with the greenback managing to recover all its losses and trade even higher in the following hours, as markets digested the data and focused on the other aspect of the report; the unemployment rate. It fell to 3.9% from 4.1% previously, beating the forecast for a smaller decline to 4.0%. This was the lowest rate recorded in nearly two decades. Although part of the decline may be owed to a similar fall in the labor force participation rate, this still managed to ignite speculation for a more hawkish Fed down the road. The unemployment rate is now notably below full employment levels, which implies that wage growth may be set to pick up speed in the coming months, leading to a more aggressive Fed. Both euro/dollar and sterling/dollar touched fresh four-month lows in the aftermath.

On the trade front, the US-China talks in Beijing that concluded on Friday appear to have yielded no material results, with the two sides simply agreeing to continue negotiating.

In the energy market, oil prices hit their highest levels since November 2014 amid speculation that this week will bring fresh sanctions against Iran, thereby removing a significant chunk of oil supply from the market. The US is set to decide by Saturday, though any comments from the US administration on the subject could move oil prices even before then.

In emerging markets, the Turkish lira posted a new all-time low against the US dollar on Friday, as a combination of high inflation and a large current account deficit continued to apply downward pressure on the currency. In Argentina, the central bank raised interest rates to 40%, in an attempt to stem further declines in the peso and reign in inflation.

Day ahead: Light calendar with eurozone’s Sentix index and US consumer credit data on the agenda; trade issues could take center stage

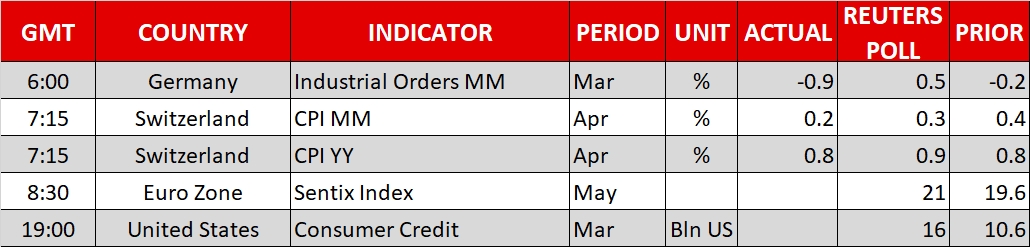

Monday is a light day in terms of economic releases, with the calendar featuring the Sentix index, which gauges investor confidence in the eurozone, and consumer credit data out of the US.

At 0830 GMT, the Sentix index will be made public. Eurozone investor morale in May is anticipated to edge higher after declining in the three preceding months. Worries about easing expansion in international markets and global trade tensions – most notably between the US and China – were seen as factors leading to the measure’s decline earlier in the year.

The US will be on the receiving end of consumer credit data at 1900 GMT. Credit is projected to have risen by $16.0 billion in March. This compares to February’s $10.6bn.

In equities, this will be another busy week in term of corporate earnings, with Walt Disney (Tuesday) and Nvidia (Thursday) being two of the companies releasing results as the week unfolds. Equity market sentiment could be driven by developments on global trade though, as NAFTA talks are resuming today in Washington. Meanwhile, discussions between the US and China last week seem to have produced little progress and any updates on this front will be closely watched as well – beyond stock markets, trade developments also have the capacity to affect other markets, such as currency and fixed income ones.

Regional Fed Presidents Raphael Bostic (1225 GMT - voting FOMC member in 2018), Tom Barkin (1800 GMT - voter), Patrick Harker (1800 GMT – non-voter), Robert Kaplan and Charles Evans (both non-voters and both at the same venue at 1930 GMT) will be making appearances today.

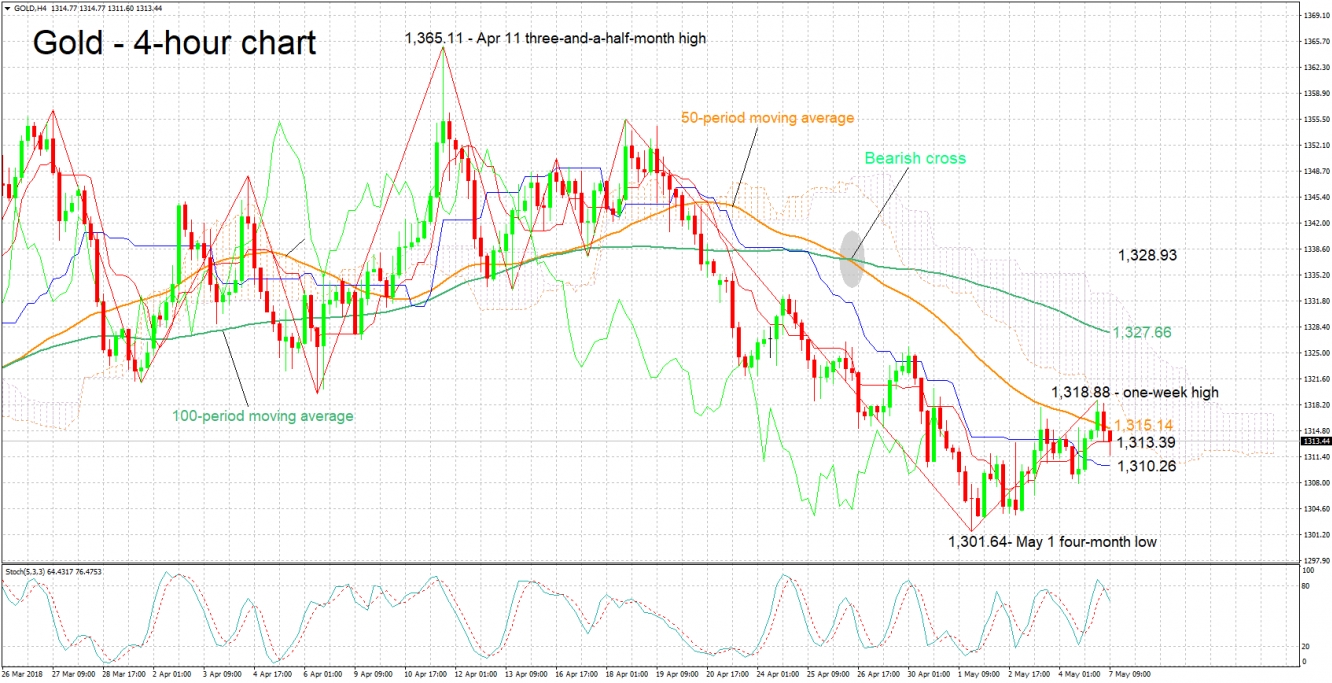

Technical Analysis: Gold retreats after hitting 1-week high; bearish signal by stochastics in very short-term

Gold posted a one-week high of 1,318.88 earlier on Monday before retreating a bit. The Tenkan- and Kijun-sen lines are positively aligned in support of a bullish short-term picture. Notice, though, that the two have flatlined; bullish momentum may be easing. Moreover, the stochastics are giving a bearish signal in the very short-term: the %K line has crossed below the slow %D one.

Rising global trade tensions might support the safe-haven perceived asset. Resistance to advances could come around the current level of the 50-day moving average at 1,315.14 and further above from the area around the Ichimoku cloud bottom at 1,319.65 (this also encapsulates today’s one-week high of 1,318.88).

Receding trade worries on the other hand might divert funds out of gold and into riskier assets. The yellow metal could be finding support around the current level of the Tenkan-sen at 1,313.39 at the moment, with steeper declines turning the attention to the Kijun-sen at 1,310.26. Further below, the focus would increasingly start to shift to the four-month low of 1,301.64 from May 1.

A rising US currency could also exert pressure on the dollar-denominated metal, and vice versa.