Global stock markets fumbled for support in Tuesday's slump, with the S&P 500 strengthening by 1.5%. Positive vibes continue to spread through the markets on Wednesday morning, sending European indices higher.

However, looking at FX market dynamics, there is a growing sense that the backbone of the bull market has broken already. 'Buy the deep' tendency remains in place for now, but the systematic rise in the dollar indicates that yesterday's lull is just a small respite as part of a wider unwinding of risk positions.

The Dollar Index has now topped 93, broken through the resistance of the converging range and is now close to this year's peak area of four months ago. This pattern suggests a technical breakdown, but for it to be confirmed, we must wait for an increase above the March highs at 93.4.

The major currency pairs are dominated by dollar buying, which, together with falling US debt yields, indicates a broader pull towards defensive assets.

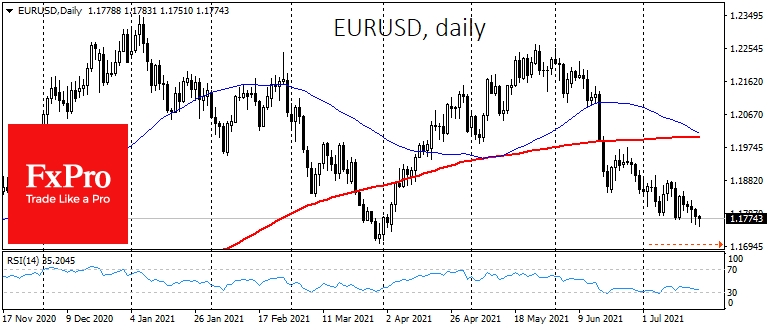

Thus, in the EUR/USD pair, methodical selling on intraday rallies is visible, and a general downtrend has already formed at the beginning of June. Worse still, a "death cross" looming over with the 50 SMA is moving below the 200 SMA. This cross will happen in the coming days, which tends to intensify the selloff sharply.

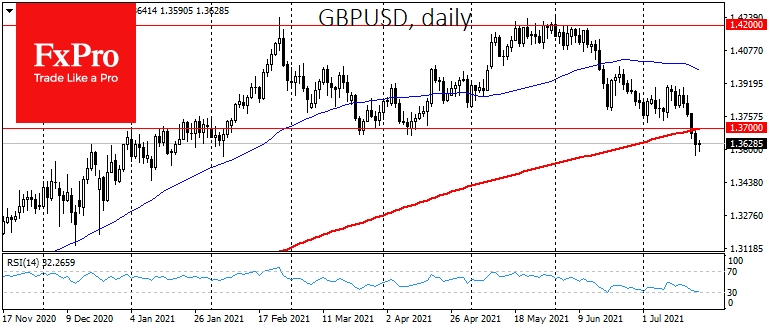

This morning, the GBP/USD was below 1.3600, falling under the support at 1.3700 and its 200-day moving average earlier in the week. Cable often directly correlates with the stock market, so the pair's current dynamics speak in favour of renewed selloff soon.

The AUD/USD is also at the mercy of the bears, having rolled back to 0.7300, the lows since last November.

The Chinese renminbi stands out from this trend, gaining strength against the dollar for a second day. The USD/CNH selling has intensified on the approach to the 200-day average.

As we have seen many times, the stock market can go up for a while on inertia but very often joins the dynamics of the debt and currency markets.

Gold developed a decline after it failed over the 200 SMA. Silver ended a long period of consolidation by sharply falling $25. The speculators in the precious metals market seem to be maintaining a bearish mood, which could very quickly transfer to gold as well.

The FxPro Analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Dollar Breaks The Bull Markets

Published 07/21/2021, 07:06 AM

Updated 03/21/2024, 07:45 AM

Dollar Breaks The Bull Markets

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.