· Inflation fears subside overall – Biden infrastructure bill downsized?

· Stocks hover near record highs, oil traders bet against Iran talks

Investors shake off inflation blues

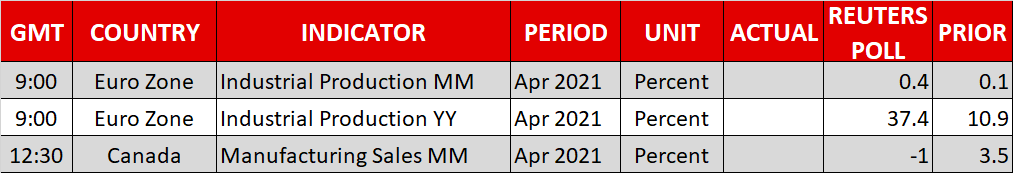

Global markets seem to have concluded that this inflation episode will indeed fade soon. Despite US inflation printing 5% in annual terms last week, Treasury yields actually traded lower and various inflation expectation measures remain under pressure. The verdict is that inflation is here, but it won't last long.

One could argue a short squeeze is what dragged Treasury yields lower, as the bond market was heavily positioned for higher yields, but that doesn't explain why inflation expectations are also moving lower. It might be the latest signals around Biden's infrastructure package, which seems destined to shrink as political negotiations chip away at its size.

With the market coming around to the Fed's own view that inflation will be short-lived, the FOMC meeting on Wednesday is unlikely to deliver any real fireworks. It's still too early for a discussion about an exit strategy from cheap money policies, as the US labor market remains far away from its pre-pandemic glories.

While a taper discussion will probably have to wait until later in the summer, there's still some scope for the Fed to strike a more cheerful tone, through upgraded economic forecasts or more officials penciling in a rate hike for 2023. This may have been what lifted the reserve currency on Friday, as traders covered some short-dollar bets.

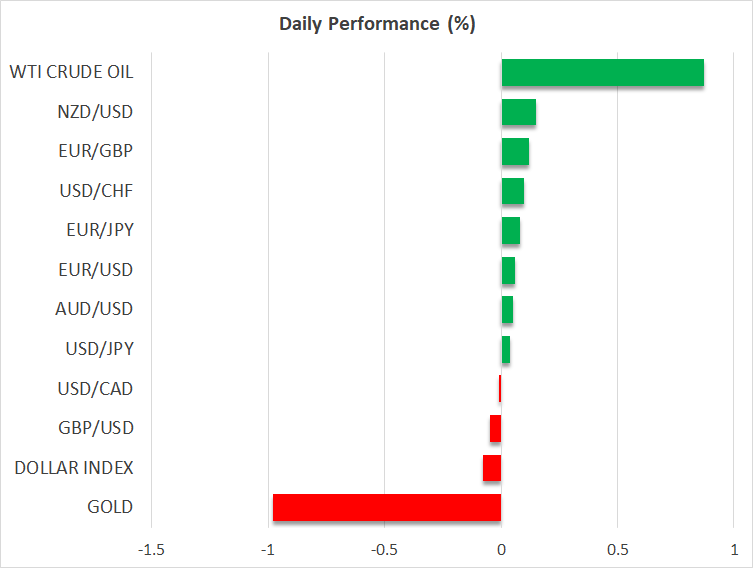

Gold struggles, crude oil takes off

What is good for the dollar is usually bad for gold, which has lost around 2% in the past two trading sessions and is now testing its recent lows near $1855/ounce. The positive fundamental setup for gold seems intact over the summer, with inflationary pressures likely to remain intense and the Fed patient, but the longer-term picture isn't very bright. The last time the Fed tapered around 2013 was a very difficult period for gold.

In energy markets, crude oil prices continue to power higher despite signs that diplomats are making progress in the US-Iran nuclear talks, which could end up bringing millions of barrels in lost supply back online. The US even lifted some sanctions on an Iranian individual lately, most likely as a sign of good faith.

Headlines aside, markets are betting that the deal probably won't happen – at least not immediately. Iran will hold presidential elections on Friday and the proximity to that event may complicate matters. Ultimately, even a surprise deal probably wouldn't be enough to derail the entire uptrend, although it could make for a deep correction.

Pound inches down after reopening delay

Over in the UK, the economy's complete reopening has been pushed back by four weeks. While most of the population has already been vaccinated, the new Indian covid variant is still spreading quickly, leading the government to delay the reopening of nightclubs and other venues.

The pound absorbed the news with only a scratch as this delay impacts a small part of the economy. The other risk to watch is politics, where Brussels is threatening London with tariffs over Northern Ireland. That said, sterling has absorbed Brexit news numerous times without much damage and the overall outlook remains favorable, with the Bank of England slowly moving away from cheap money.

Finally, equity markets continue to party. The tech sector and growth stocks have staged a massive comeback lately, drawing strength from the decline in real yields. Whether the rally persists this week will depend mostly on the Fed's tone, especially on the famous 'dot plot' of rate projections.