Easy money policies by the Fed and excessive fiscal spending have placed the economy and, thus, markets in a position of weakness. Inflation is raging and the Fed is trying to reign it in as the economy is showing signs of slowing. The net result is that markets are likely to be more volatile and the risk of prolonged market declines elevated. Passive investment strategies that worked well over the past bull market run are likely to underperform going forward.

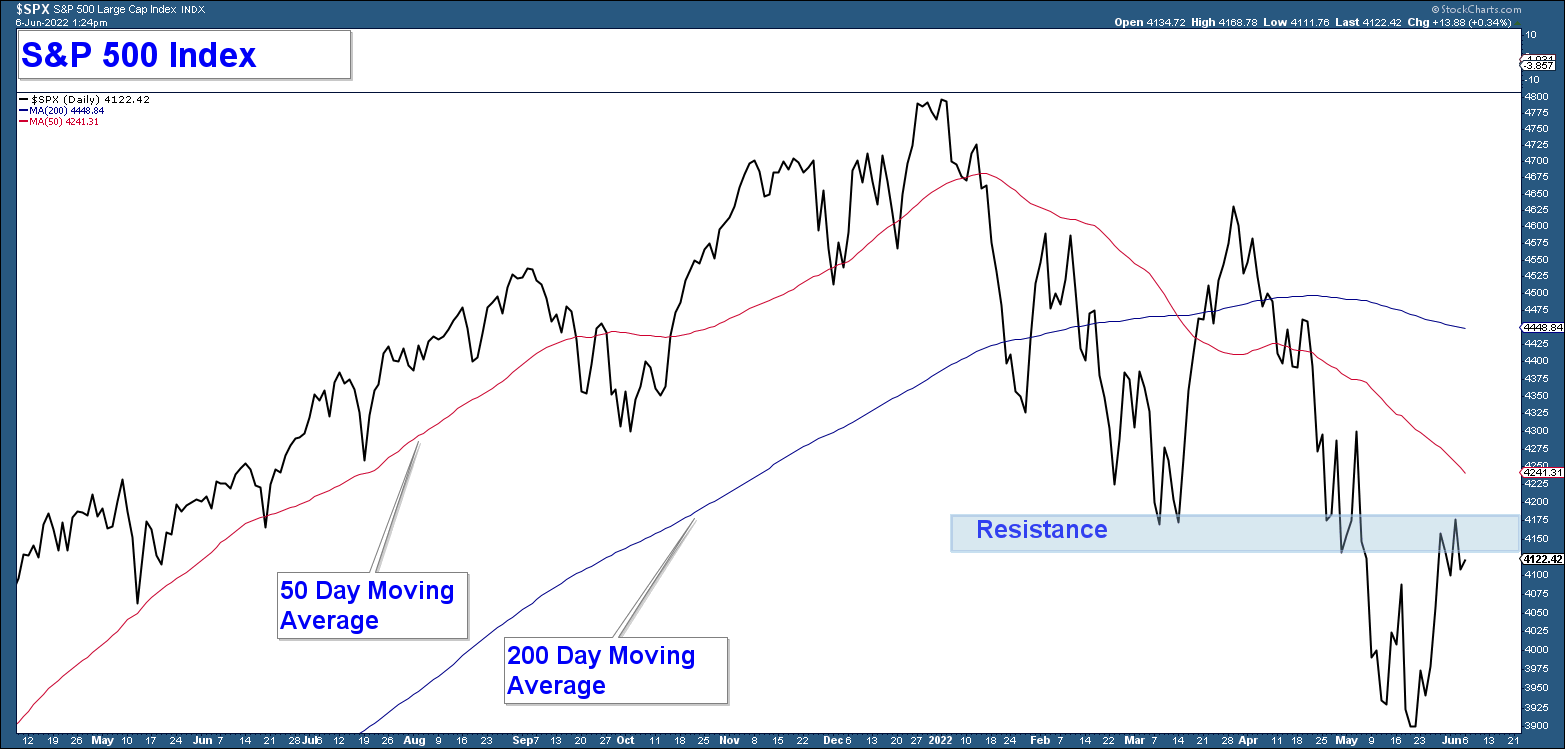

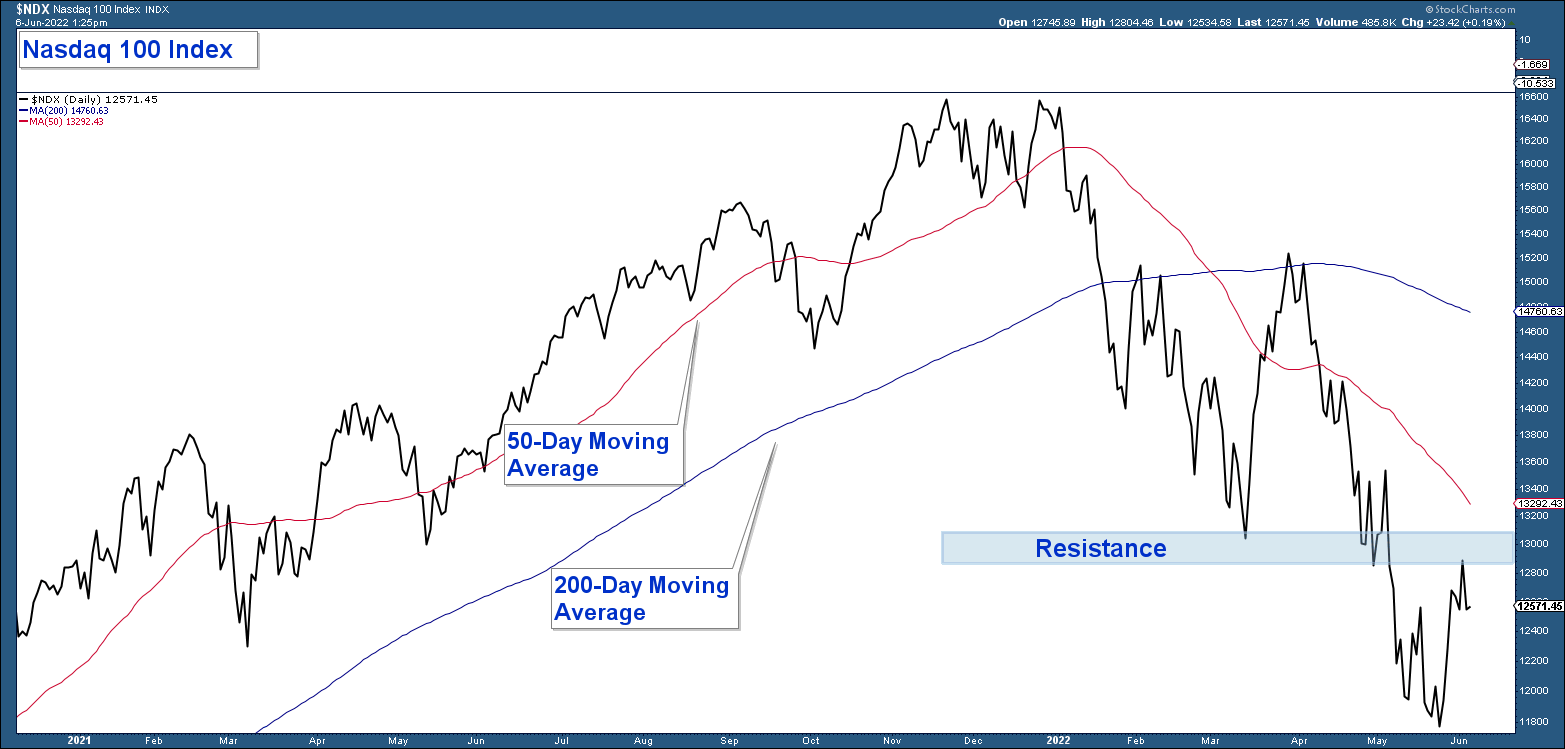

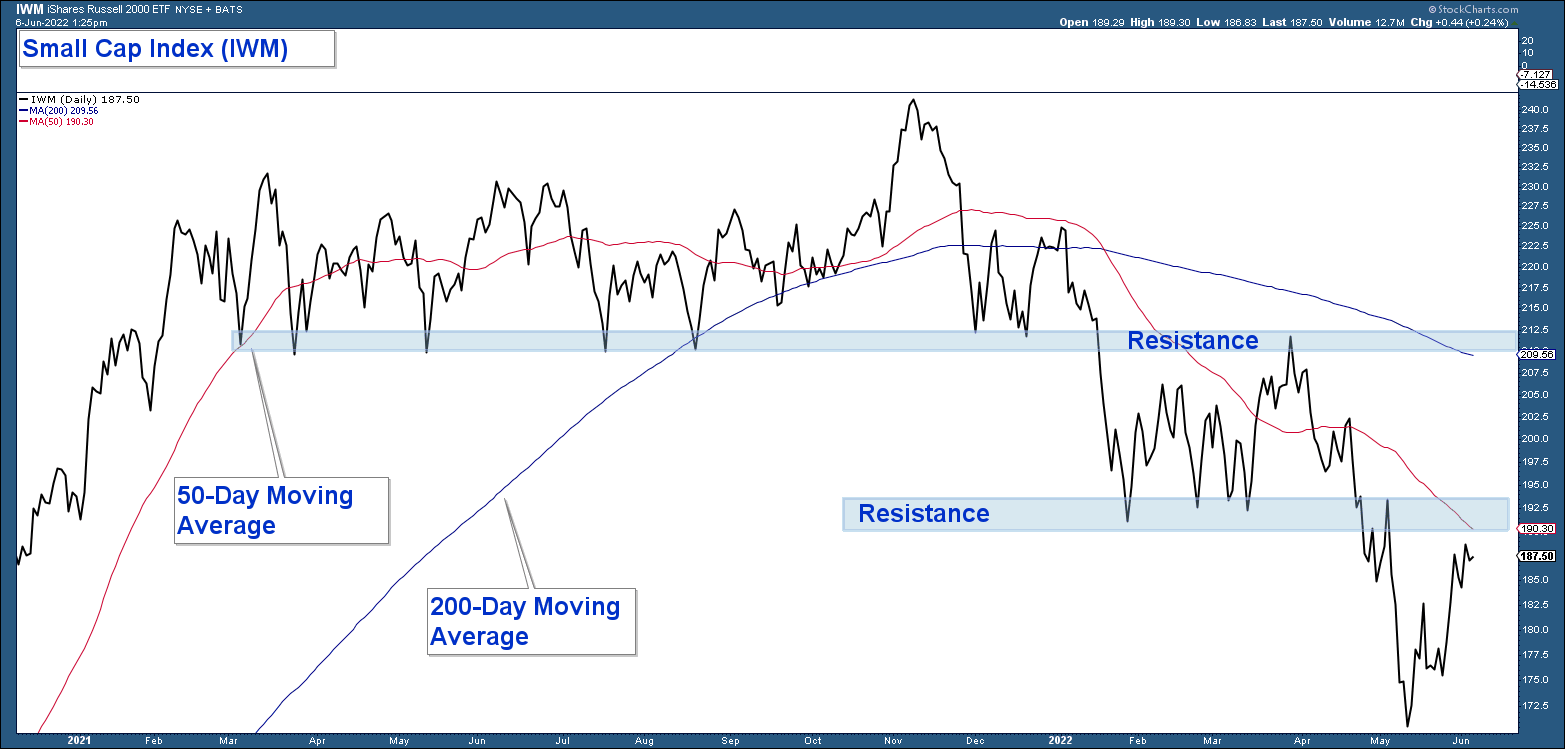

Below are daily charts for the S&P 500, Nasdaq 100 and iShares Russell 2000 ETF (NYSE:IWM). The pattern of all three are similar in that they are experiencing a short-term advance within a longer-term downtrend.

The question is, of course, does this bounce signal the end of the downtrend? For those investors hoping the market has bottomed because they are fearful of further losses. Don’t get your hopes up.

Here are my takeaways from the charts:

- All three are in downtrends, price is below both their 50- and 200-day moving averages, and those averages are trending down.

- The bounce that began last month has taken all three indexes right up to resistance.

At this point, I don’t see any technical data that suggests this advance is anything other than an oversold bounce. However, if those indexes can advance strongly above resistance and risk-on assets start to outperform, I would have to reevaluate that thesis.

In summary, the market still looks bearish.