We expect Dillard’s, Inc. (NYSE:DDS) to beat expectations, when it reports fourth-quarter fiscal 2017 results on Feb 20. In the last quarter, this leading departmental store retailer delivered a positive earnings surprise of 115.8%.

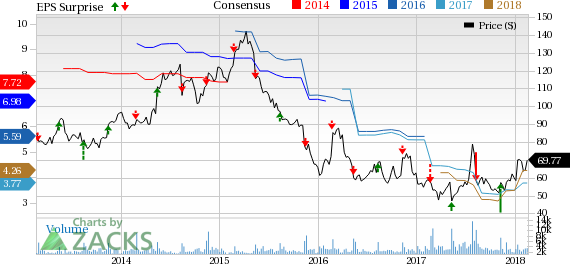

However, a look at the company’s earnings trend shows that Dillard’s has lagged the Zacks Consensus Estimate in six of the last 10 quarters. Consequently, the company has recorded an average negative surprise of 68.6% in the last four quarters. Let’s see how things are shaping up ahead of the upcoming release.

Which Way Are Estimates Treading?

In order to get a clear picture of what analysts are thinking about the company right before earnings release, let’s have a look at the earnings estimate revisions. The Zacks Consensus Estimate of $1.73 per share for the fiscal fourth quarter has witnessed an uptrend in the last 30 days. However, the estimate reflects a decline of about 6.5% from $1.85 per share earned in the year-ago quarter.

Analysts polled by Zacks also expect revenues of $2.04 billion, up 2.9% from the prior-year quarter’s figure.

Factors at Play

Dillard’s appears to be in good shape on the back of its strategic initiatives that aided performance in the last reported quarter. We are encouraged by its constant efforts to capitalize on growth opportunities in its brick-and-mortar stores and e-commerce business. The company continues to gain from its niche market position, offering a broad array of merchandise in its stores, featuring products from both national and exclusive brands.

Moreover, the company’s strategy of offering fashion-forward and trendy products acts as a catalyst for attracting more customers. Dillard’s focus on increasing productivity and enhancing domestic operations are likely to strengthen customer base. Its constant shareholder-friendly moves are also noteworthy.

The benefits from these factors are well reflected in the company’s share price that rose 19.5% in the past year, outperforming the industry’s growth of 5.5%.

However, increased markdowns to manage inventories have been denting the company’s margins for a while now. Additionally, Dillard’s has been plagued by the challenging trends in the apparel retail segment, arising out of the changing preference of customers from offline to online.

What the Zacks Model Unveils

Our proven model shows that Dillard’s is likely to beat earnings estimates this quarter. A stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. Earnings ESP of +15.83% and the company’s Zacks Rank #1 make us reasonably confident of an earnings beat. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Other Stocks With Favorable Combination

Here are some other companies that you may want to consider as our model shows that these have the right combination of elements to post an earnings beat:

Ross Stores Inc. (NASDAQ:ROST) has an Earnings ESP of +1.37% and a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Macy’s, Inc. (NYSE:M) has an Earnings ESP of +0.92% and a Zacks Rank #2.

TJX Companies Inc. (NYSE:TJX) has an Earnings ESP of +2.12% and a Zacks Rank #2.

Breaking News: Cryptocurrencies Now Bigger than Visa

The total market cap of all cryptos recently surpassed $700 billion – more than a 3,800% increase in the previous 12 months. They’re now bigger than Morgan Stanley (NYSE:MS), Goldman Sachs (NYSE:GS) and even Visa! The new asset class may expand even more rapidly in 2018 as new investors continue pouring in and Wall Street becomes increasingly involved.

Zacks has just named 4 companies that enable investors to take advantage of the explosive growth of cryptocurrencies via the stock market.

Click here to access these stocks>>

Ross Stores, Inc. (ROST): Free Stock Analysis Report

TJX Companies, Inc. (The) (TJX): Free Stock Analysis Report

Macy's Inc (M): Free Stock Analysis Report

Dillard's, Inc. (DDS): Free Stock Analysis Report

Original post

Zacks Investment Research