It’s difficult to dispute the success of the first ETF offering from DoubleLine, which has managed to acquire more than $2.3 billion in assets during its short 14-month tenure. The SPDR DoubleLine Total Return Tactical ETF (NYSE:TOTL) is a hybrid strategy that is sourced from two prominent fixed-income mutual funds that are run by Jeffrey Gundlach.

I have long been a fan of Gundlach’s approach and have owned his flagship DoubleLine Total Return Bond Fund (DBLTX) for myself and clients for some time now. I have also recommended the TOTL strategy for those who are seeking a core fixed-income fund with a lower average duration than the Barclays) U.S. Aggregate Bond Index (NYSE:AGG).

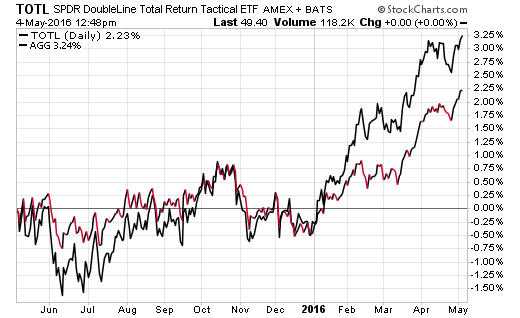

Looking at a chart of TOTL versus its benchmark over the last year, the active fund has aggressively lagged the passive index. This has primarily been a result of the strength in Treasuries and investment grade corporates in addition to differences in duration exposure.

TOTL isn’t designed to kill the benchmark in a falling interest rate environment that favors longer duration. It’s designed to offer a more competitive yield with moderated interest rate risk. That’s its true value for those who are seeking a differentiated approach to their fixed-income allocation. Note that TOTL currently sports a 30-day SEC yield of 2.90% versus 1.90% for the iShares Core U.S. Aggregate Bond ETF (AGG).

Recently, Gundlach and State Street released two new actively managed ETFs that are also aimed at setting themselves apart from the pack. These include the SPDR DoubleLine Short Duration Total Return Tactical ETF (BATS:STOT) and SPDR DoubleLine Emerging Markets Fixed Income ETF (BATS:EMTL).

STOT is aimed at an even more conservative mix of bonds with a similar multi-sector approach as TOTL. The fund sports a modified adjusted duration of 2.40 years compared to TOTL’s 3.73 years. Think less price volatility and also a concomitant step down in yield.

The new fund hasn’t paid a dividend yet, so we don’t know exactly what the difference in yield will be. However, suffice it to say that this type of fund will be deemed more of a place holder for those who want to focus on capital preservation with a small income stream.

Bear in mind, you will have to pay a 0.45% expense ratio to access the STOT conservative strategy. That sounds on the high side for a short duration bond fund, but may still be acceptable for those who are stepping out of an even more expensive mutual fund alternative. There are also several other active low duration competitors in the ETF space by the likes of PIMCO, Guggenheim, Fidelity, and others.

The more interesting fund from my perspective is EMTL. Prior to the launch of this ETF, there were only four other actively managed bond funds in the emerging market category. That makes for a very enticing opportunity to exercise their expertise in country screening, security selection, risk management, and duration positioning. The EMTL portfolio will be managed by Luz Padilla, who runs the emerging market strategies for the open ended DoubleLine mutual funds as well.

One of the advantages of the looser active management restrictions in EMTL is that the fund manager can select both corporate and sovereign debt in the portfolio. Most passively managed indexes and even some of their active counterparts are relegated to one or the other. The comingling of these two emerging market bond classes can potentially unlock greater value and allow for superior differentiation from its peers.

At the outset, EMTL has heavy exposure to bonds in Latin America via Mexico, Peru, Colombia, and Chile. It currently sports a modified adjusted duration of 5.34 years and will likely offer a competitive yield to other funds in this category. This type of fund may offer investors a way to add a tactical emerging market bond allocation in tandem with core fixed-income or other strategic yield enhancing plays.

Furthermore, this fund only sports a modestly higher expense ratio than traditional options as well. EMTL carries a net expense ratio of 0.65% versus 0.50% in the PowerShares Emerging Market Sovereign Debt Portfolio (NYSE:PCY) and 0.40% in the iShares JP Morgan Emerging Market Bond Fund (NYSE:EMB).

The Bottom Line

It will be interesting to watch how both these new offerings evolve over time and whether the active management underpinnings add value for shareholders over a passive benchmark. DoubleLine has been known to make some bold calls with their global bond exposure and these funds will likely stand out from the pack in their overall positioning.

Disclosure: FMD Capital Management, its executives, and/or its clients may hold positions in the ETFs, mutual funds or any investment asset mentioned in this article. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities.