“I’ve got you in my sights.” The USDX heard that a lot over the last two weeks. While it was bullish for gold, the dollar might take revenge soon.

With Fed Chairman Jerome Powell doubling down on his dovish dialogue on Aug. 27 and the Delta variant depressing U.S. nonfarm payrolls on Sept. 3, the stars aligned for a profound decline in the USD Index. However, while the greenback came under fire from all angles, it demonstrated immense resiliency in the face of adversity. Moreover, the bullish determination helped reinforce our expectation for another move higher over the medium term.

To explain, the USD Index suffered a breakdown below the neckline of its inverse (bullish) head-and-shoulders pattern on Sept. 3 (following the release of the payrolls). However, once cooler heads prevailed, the dollar basket recouped the key level during futures trading on Sept. 5/6/7. As a result, U.S. dollar sentiment still remains quite elevated, and at the moment of writing these words, the USD Index is trading back (not much, but still) above the neck level of the pattern (dashed, thick line) that’s based on the closing prices.

Please see below:

No Pain, No Gain

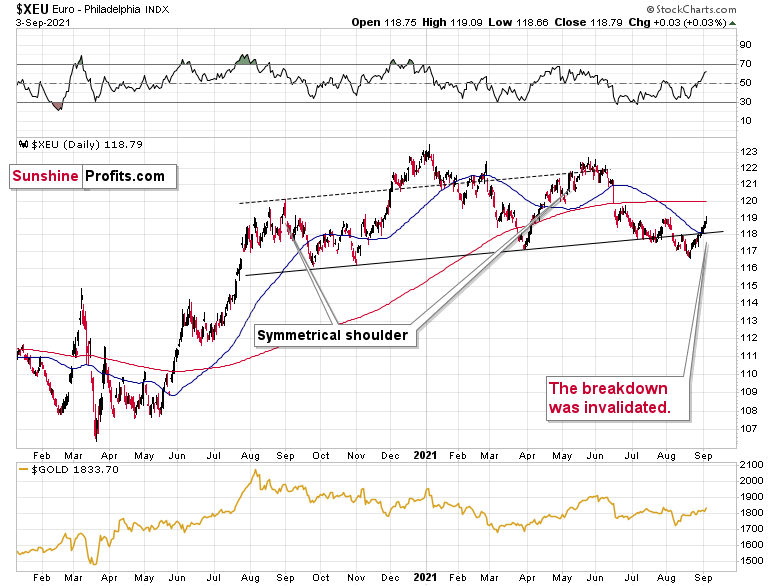

Furthermore, the USD Index’s pain is the Euro Index’s gain, the latter invalidated the breakdown below the neckline of its bearish head-and-shoulders pattern. For context, the EUR/USD accounts for nearly 58% of the movement of the USD Index. And while the uprising is bad news for the greenback, could the Euro Index actually prolong gold, silver and mining stocks’ party?

Well, for one, if I was trading the EUR/USD pair, I would be concerned about any short position that I might possibly have in this currency pair, and I could even close it based on this invalidation alone.

However, I’m not concerned about our short position in the junior miners at all because of the invalidation in the Euro Index. Why? Because of the situation in the USD Index and – most importantly – because of the way the mining stocks refuse to react to the USDX’s weakness right now. Thus, while the situation is worth monitoring, it’s unlikely to move the needle over the medium term.

Please see below:

What A Scorching Heat!

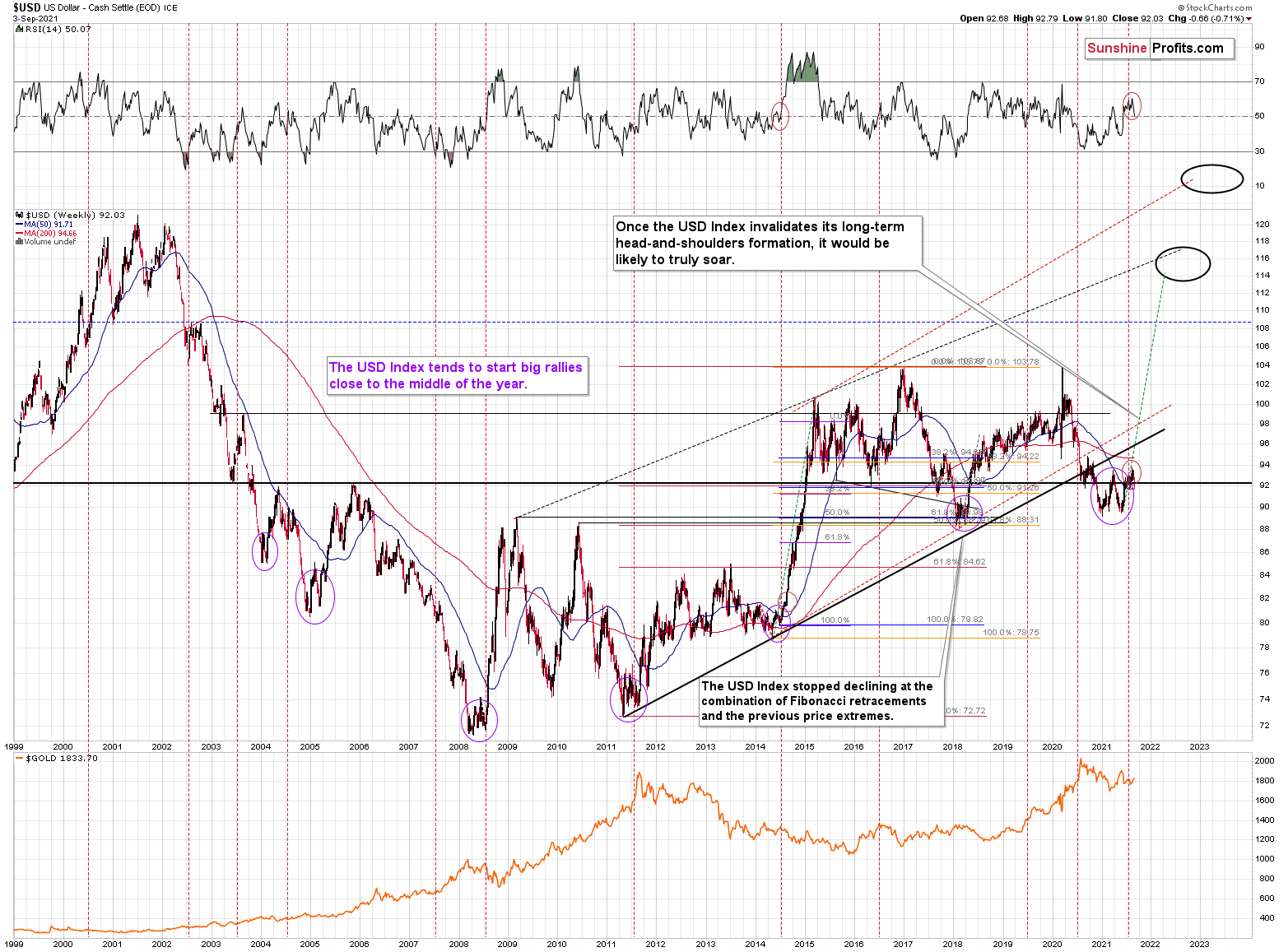

Adding to our confidence, the USD Index often sizzles in the summer sun, and major USDX rallies often start during the middle of the year. Summertime spikes have been mainstays on the USD Index’s historical record and in 2004, 2005, 2008, 2011, 2014 and 2018 a retest of the lows (or close to them) occurred before the USD Index began its upward flights (which is exactly what’s happened this time around).

Furthermore, profound rallies (marked by the red vertical dashed lines below) followed in 2008, 2011 and 2014. With the current situation mirroring the latter, a small consolidation on the long-term chart is exactly what occurred before the USD Index surged in 2014. Likewise, the USD Index recently bottomed near its 50-week moving average; an identical development occurred in 2014. More importantly, though, with bottoms in the precious metals market often occurring when gold trades in unison with the USD Index (after ceasing to respond to the USD’s rallies with declines), we’re still far away from that milestone in terms of both price and duration.

Moreover, as the journey unfolds, the bullish signals from 2014 have resurfaced once again. For example, the USD Index’s RSI is hovering near a similar level (marked with red ellipses), and back then, a corrective downswing also occurred at the previous highs. More importantly, though, the short-term weakness was followed by a profound rally in 2014, and many technical and fundamental indicators signal that another reenactment could be forthcoming.

Please see below:

Just as the USD Index took a breather before its massive rally in 2014, it seems that we saw the same recently. This means that predicting higher gold prices (or the ones of silver) here is likely not a good idea.

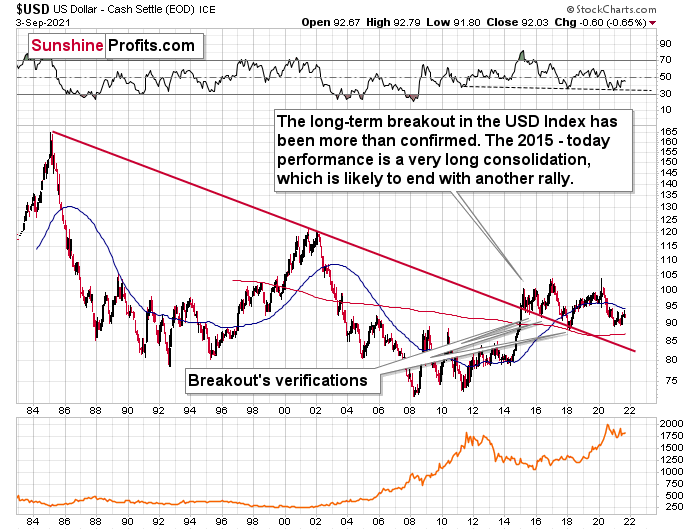

Continuing the theme, the eye in the sky doesn’t lie. And with the USDX’s long-term breakout clearly visible, the wind still remains at the greenback’s back.

Please see below:

The bottom line?

Once the momentum unfolds, ~94.5 is likely the USD Index’s first stop, ~98 is likely the next stop, and the USDX will likely exceed 100 at some point over the medium or long term. Keep in mind though: we’re not bullish on the greenback because of the U.S.’s absolute outperformance. It’s because the region is fundamentally outperforming the Euro zone, the EUR/USD accounts for nearly 58% of the movement of the USD Index, and the relative performance is what really matters.

In conclusion, the USD Index was a marked man over the last two weeks, and the dovish assassins had the dollar basket right in their crosshairs. And while the barrage of bullets fired at the greenback was bullish for gold, silver and mining stocks, the former’s ability to escape the infirmary highlights the shift in sentiment surrounding the USD Index. As a result, with technicals, fundamentals and sentiment supporting a stronger U.S. dollar over the medium term, the precious metals won the recent very short-term battle, but they’re still unlikely to win the medium-term war. Of course, I continue to think that gold is going to soar in the following years, but not before declining profoundly first. At the moment of writing these words, gold futures are already down more than $15 from their Friday’s close and about $20 below their last week’s high – it could be the case that the news-based rally is already over.