The DAX Index has edged higher on Thursday. Currently, the DAX is trading at 12,186.75. In economic news, German Factory Orders rebounded in February with a gain of 3.5%, close to the forecast of 3.4%. The ECB will release the minutes from its March policy meeting and ECB President Mario Draghi will speak at a conference in Frankfurt. On Friday, Germany publishes Industrial Production and Trade Balance.

The eurozone has enjoyed a solid first quarter in 2017, and March PMI reports were positive. Manufacturing PMIs posted to expansion, and Services PMIs followed suit. German Services PMI climbed to a 15-month high, while Eurozone Services PMI jumped to a 71-month high, although it missed expectations. The euro shrugged off these strong numbers, as it continues to have an uneventful week. EUR/USD dropped 1.9 percent last week, marking its worst weekly decline since November 2016. The ECB will release the minutes of its March meeting, at which the central bank made no changes to interest rates or its asset purchase program. Although inflation levels have improved to their highest levels in years, they remain below the ECB target of 2.0%, so the central bank still has some breathing room and isn’t under immediate pressure to tighten monetary policy. The ECB’s asset purchase program of EUR 60 billion/mth is scheduled to expire in December. Any surprises from the minutes could have a strong impact on the movement of the euro.

There were no dramatic surprises from the Federal Reserve minutes for March, which were released on Wednesday. At that meeting, the Fed raised rates a quarter-point to 0.75%, but the dovish rate statement disappointed the markets, triggering broad losses for the US dollar. In the minutes, policymakers noted upside risk to the US economy, but remained divided on whether inflation will rise to the Fed target of 2.0%. Most policymakers were in favor of taking steps to trim the $4.5 trillion balance, which has ballooned since the Fed implemented its aggressive quantitative easing program back in 2008. So what’s next for the Fed? According to the CME’s Fed Watch, the odds of a rate hike at the May meeting are just 5 percent, while the likelihood of a rate hike in June stand at 63 percent.

Economic Calendar

Thursday (April 6)

- 2:00 German Factory Orders. Estimate 3.5%. Actual 3.4%

- 3:00 ECB President Mario Draghi Speech

- 4:10 Eurozone Retail PMI. Estimate 49.5

- 4:48 Spanish 10-y Bond Auction. Estimate 1.61%

- Tentative – French 10-y Bond Auction

- 5:40 German Buba President Jens Weidmann Speech

- 7:30 ECB Monetary Policy Meeting Accounts

Friday (April 7)

- 2:00 German Industrial Production. Estimate -0.1%

- 2:00 German Trade Balance. Estimate -0.1%

*All release times are EST

*Key events are in bold

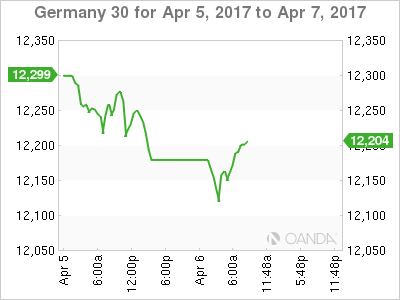

DAX, Wednesday, April 5 at 6:55 EST

Open: 12,140.75 High: 12,189.75 Low: 12,115.75 Close: 12,186.75