The DAX index has edged higher in the Tuesday session. Currently, the DAX is trading at 12,543.00, down 0.11% on the day. On the release front, German ZEW Economic Sentiment climbed to 17.0 points, crushing the forecast of 12.3 points. Eurozone ZEW Economic Sentiment improved to 31.7, but fell short of the estimate of 32.4 points.

Institutional investors and analysts gave a thumbs-up to the German economy on Tuesday, as the September ZEW Economic Sentiment jumped to 17.1 points, rebounding from a weak reading of 10.0 in August. The ZEW report noted that Germany’s growth in the second quarter remained strong, and both the public and private sectors were marked by increased investment. As well, global demand remained steady, and a stronger euro had not had a negative impact on the German economy. The Eurozone ZEW Economic Sentiment also improved in September, climbing to 31.7 points, up from 29.3 in the August release.

Germans head to the polls on Sunday, and Angela Merkel is widely expected to win her fourth term as prime minister. Merkel’s CDU conservative party is enjoying a 14 percent lead over the center-left SPD, its current coalition partner. Still, the CDU is not expected to win a majority, meaning that Merkel will have to hammer out a coalition agreement with either the SPD or the FDP. The pro-business FDP is against Germany transferring funds to other EU members and wants to take a tougher stance against laggards, such as Greece. The FDP has also taken a hard line on immigration, which Merkel may not be comfortable with.

The eurozone economy has rebounded in 2017, and much of the credit goes to Germany, the largest economy in the bloc. At the same time, inflation levels have been stubbornly low. This has complicated the ECB’s plans to reduce its quantitative easing scheme (QE), although ECB President Mario Draghi has said that the ECB will announce its plans to reduce QE at the October policy meeting.

QE is scheduled to end in December, and policymakers will have to balance opposing interests as to what happens next. Germany, with its robust economy, would like to remove stimulus entirely, while less affluent eurozone members want to retain an accommodative monetary policy. We’re likely to see some compromise, in which stimulus is extended into 2018, but will be tapered from its current level of EUR 60 billion/month.

Economic Calendar

Tuesday (September 19)

- 4:00 Eurozone Current Account. Estimate 22.3B. Actual 25.1B

- 5:00 German ZEW Economic Sentiment. Estimate 12.3. Actual 17.0

- 5:00 Eurozone ZEW Economic Sentiment. Estimate 32.4. Actual 31.7

Wednesday (September 20)

- 2:00 German Producer Price Index. Estimate 0.1%

*All release times are EDT

*Key events are in bold

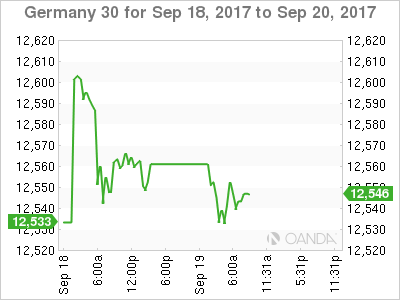

DAX, Tuesday, September 19 at 8:05 EDT

Open: 12,553.50 High: 12,560.25 Low: 12,527.00 Close: 12,546.50