The DAX index is steady in the Thursday session. Currently, the DAX is trading at 12,576 points, down 0.11% on the day. On the release front, the eurozone current account surplus dropped to EUR 35.1 billion, but beat the estimate of EUR 32.3 billion. On Friday, Germany releases PPI and the Eurozone publishes consumer confidence.

Eurozone inflation improved in March, but still remain short of the ECB target of 2.0%. Final CPI came in at 1.3%, up from 1.1% a month earlier. Still, the reading fell short of the estimate of 1.4%. As long as inflation remains low, there will be little pressure on the ECB to tighten its accommodative monetary policy. The ECB’s stimulus program is scheduled to wind up in September, but an increase in interest rates is unlikely before 2019.

After a lull in the trade battle between the US and China, another shot was fired this week. This time it came from China, which tariff announced a tariff of some 179% on US sorghum crops, which is a livestock feed. China imports about $1 billion of sorghum annually, and if the tariff remains in place, will essentially halt US exports of sorghum to China. The Chinese government has threatened to impose tariffs on US soybean exports, valued at some $12 billion each year. If the US administration decides to retaliate, the specter of an ugly trade war between the US and China could spook investors and send global markets into a tailspin.

Economic Fundamentals

Thursday (April 19)

- 4:00 Eurozone Current Account. Estimate 32.3B. Actual 35.1B

Friday (April 20)

- 2:00 German PPI. Estimate 0.2%

- 7:30 German Buba President Weidmann Speaks

- 10:00 Eurozone Consumer Confidence. Estimate 0

*All release times are DST

*Key events are in bold

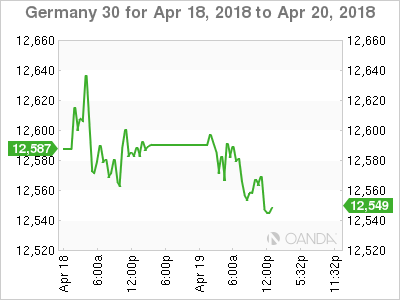

DAX, Thursday, April 19 at 7:45 EDT

Prev. Close: 12,590 Open: 12,592 Low: 12,558 High: 12,596 Close: 12,577