The DAX has moved higher on Tuesday, after starting the week with sharp losses. Currently, the DAX is at 11,937, up 0.51%. In economic news, German ZEW Economic Sentiment declined by 2.1, missing the estimate of 5.1. The eurozone release followed the same trend, dropping by 1.6 points. This was well short of the estimate of 5.0 points. There was better news from German Final CPI jumped to 1.0%, matching the estimate. On Wednesday, Germany and the eurozone release GDP reports.

ZEW economic sentiments for Germany and the eurozone disappointed in May. The German release ended a long streak of declines in April, with a gain of 3.1. The indicator slipped to 2.1 in May, pointing to pessimism. Eurozone ZEW economic sentiment posted a decline of 1.6 in May, after a score of 4.5 in April. The economic outlooks for the eurozone and Germany are not promising, as the trade war between China and the U.S. has escalated with another round of tariffs between the sides.

The volatility continues on the stock markets, as trade tensions between the U.S. and China have soared in the past few days. On Friday, the U.S. raised tariffs on some $200 billion in Chinese goods, from 10% to 25%. A response followed quickly, as China announced tariffs on $60 billion in U.S. goods. As well, China has allowed the yuan to fall to its lowest level in four months. A lower yuan makes Chinese exports more competitive and will cushion the effect of the new U.S. tariffs, which makes Chinese goods more expensive for U.S. consumers. Despite the rise in tensions between China and the U.S., the new tariffs do not take effect immediately. The U.S. tariffs do not apply to Chinese goods that are in transit, and the shipping of goods across the Pacific can take up to three weeks. The Chinese tariffs do not kick in until June. This hiatus gives negotiators some breathing room before the tariffs take effect.

Despite the rise in tensions between China and the U.S., the new tariffs do not take effect immediately. The U.S. tariffs do not apply to Chinese goods that are in transit, and the shipping of goods across the Pacific can take up to three weeks. The Chinese tariffs do not kick in until June. This hiatus gives negotiators some breathing room before the tariffs take effect.

Economic Calendar

- 2:00 German Final CPI. Estimate 1.0%. Actual 1.0%

- 2:00 German WPI. Estimate 0.4%. Actual 0.6%

- 3:15 US FOMC Member Williams (NYSE:WMB) Speaks

- 5:00 German ZEW Economic Sentiment. Estimate 5.1

- 5:00 Eurozone ZEW Economic Sentiment. Estimate 5.0

- 5:00 Eurozone Industrial Production. Estimate -0.3%

Wednesday (May 15)

- 2:00 German Preliminary GDP. Estimate 0.4%

*All release times are DST

*Key events are in bold

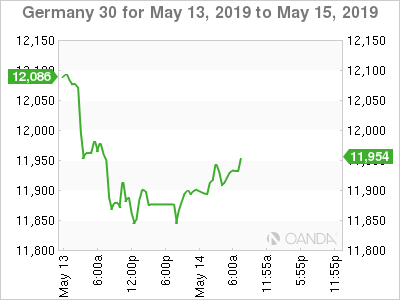

DAX, Tuesday, May 14 at 6:40 DST

Previous Close: 11,876 Open: 11,916 Low: 11,899 High: 11,954 Close: 11,937