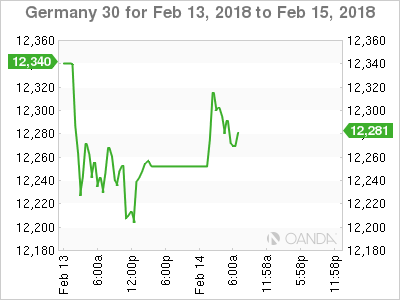

The DAX index has posted losses in the Tuesday session. Currently, the index is trading at 12,277.50, up 0.67% since the Monday close. In Germany, Preliminary GDP slowed in the fourth quarter to 0.6%, but still matched the estimate. Final CPI declined 0.7%, also matching the forecast. Eurozone Flash GDP for Q4 remained steady at 0.6% for a third straight quarter, matching the estimate. In the US, the markets are expecting mixed inflation numbers. Core CPI is expected to expected to edge lower to 0.2%, while CPI is forecast to improve to 0.1%.

European markets have given a thumbs-up to German and Eurozone GDP reports. Both indicators showed respectable gains of 0.6% in the fourth quarter. On an annual basis, Eurozone GDP was up by 2.7%, underscoring the strong rebound in the eurozone economy in 2017. The DAX is marginally higher last week, after sliding 7.6% last week. In the banking sector, stocks are in green territory on Wednesday. Commerzbank (DE:CBKG) has posted strong gains of 1.24%, and Deutsche Bank (DE:DBKGn) has gained 0.24%.

Investors across the globe, who endured a massive sell-off last week, will be keeping a close eye on US inflation indicators. Concern over higher inflation and additional rate hikes was a catalyst to the volatility in the stock markets, and any whiff of higher consumer inflation could again spook investors and send the markets into a tailspin. The new head of the Federal Reserve, Jerome Powell, sought to send a reassuring message on Tuesday, saying that the Fed is on alert to any risks to financial stability. However, it is clear that the Fed’s hand is limited when it comes to stock markets moves, and the volatility which we saw last week could resume at any time.

Economic Calendar

Wednesday (February 14)

- 2:00 German Preliminary GDP. Estimate 0.6%. Actual 0.6%

- 2:00 German Final CPI. Estimate -0.7%. Actual -0.7%

- 3:00 German Buba President Weidmann Speaks

- 5:00 Eurozone Flash GDP. Estimate 0.6%. Actual 0.6%

- Tentative – German 30-year Bond Auction

Thursday (February 15)

- 5:00 Eurozone Trade Balance. Estimate 22.4B

*All release times are EST

*Key events are in bold

DAX, Wednesday, February 14 at 6:35 EDT

Open: 12,315.50 High: 12,318.46 Low: 12,263.50 Close: 12,277.50