The DAX has posted small gains in the Wednesday session. Currently, the index is at 12,923.00, up 0.16% on the day. On the release front, German Services PMI matched its estimate of 55.6, while the Eurozone Services PMI improved to 55.8, above the forecast of 55.6 points. Eurozone Retail Sales posted a second straight decline, coming in at -0.5%. This was well below the forecast of +0.3%. Later in the day, ECB head Mario Draghi will speak at an event in Frankfurt. On Thursday, the ECB releases the minutes of its September policy meeting.

It has been an impressive run for the DAX, which is trading at record levels and has its sights on the lofty 13,000 level. The index surged 6.0% in September, as the robust German economy continues to show post strong economic numbers. German Manufacturing PMI improved to 60.6 in September, its highest level since April 2011. German Services PMI has also been strong, pointing to expansion. However, inflation levels remain low in both Germany and the eurozone. On Tuesday, there was good news on the inflation front, as Eurozone PPI beat expectations with a gain of 0.3 percent. Is eurozone inflation on its way up? If upcoming inflation indicators follow suit and point upwards, the ECB will have to revisit tightening its ultra-loose monetary policy. With the eurozone showing sustained growth in 2017, the cautious ECB will be reluctant to tighten policy, unless inflation moves higher. However, the ECB will have to make some important decisions, as the bank’s current asset-purchase program is scheduled to terminate in December.

Despite the deepening crisis in Catalonia, European stock markets have been steady this week. The situation remains volatile, as the Spanish government and the Catalan regional government remain deadlocked over Sunday’s independent referendum. The violence between police and voters left close to 900 civilians injured, and tensions remains high. Catalan officials claim that 90 percent of the votes were if favor of independence, but the national government has declared the vote unconstitutional and illegal. On Wednesday, Catalonia declared a general strike and some 700,000 people demonstrated in Barcelona. Catalan Carles Puigdemont has not showed any intent to back down, warning that his government plans to act in a matter of days. The crisis is not expected to weigh on the euro or European stock markets, as the referendum is viewed as an issue local to Spain, and not to the eurozone in general. As well, the Spanish economy is in good shape, so a constitutional crisis is unlikely to affect the country’s economic growth.

Economic Calendar

Wednesday (October 4)

- 3:55 German Final Services PMI. Estimate 55.6

- 4:00 Eurozone Final Services PMI. Estimate 55.6

- 5:00 Eurozone Retail Sales. Estimate 0.3%. Actual -0.5%

- Tentative – German 10-year Bond Auction

- 13:15 ECB President Mario Draghi Speaks

Thursday (October 5)

- 7:30 ECB Monetary Policy Meeting Accounts

*All release times are EDT

*Key events are in bold

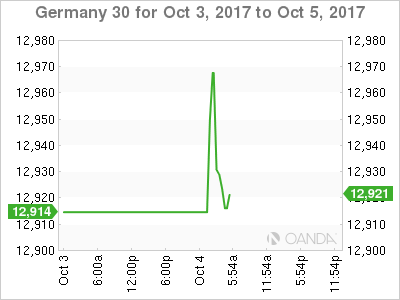

DAX, Wednesday, October 4 at 5:05 EDT

Open: 12,913.50 High: 12,974.50 Low: 12,913.50 Close: 12,923.00