As an investor, it seems that the last thing you want to look at is price, especially lately.

A savvy investor in an emerging industry will want to get a good picture of the overall landscape and one of the best ways to see this is in the job sector.

Job growth and average salaries are often seen as a leading economic indicator, which is why the NFP jobs report in the United States is one of the most scrutinized pieces of data that moves the markets every month.

So, if you want to get a good idea of how the crypto industry has grown throughout 2018, look no further than jobs data. At least according to this data point, we can see that jobs in blockchain development are in high demand.

Today's Highlights

China Slowdown

Shutdown: Day 24

Bitcoin Support and Network

Please note: All data, figures & graphs are valid as of January 14th. All trading carries risk. Only risk capital you can afford to lose.

Traditional Markets

The week has started off on the wrong foot for global stock markets. Some sour trade data from China has investors worried that the narrative of a China slowdown or "hard landing" is starting to seem real.

Export growth from the number one producer of goods in the world has seen its sharpest drop in two years.

The market is already cringing with anticipation for the upcoming GDP figure announcement on January 21st.

Where's the Safe Play?

A new political upheaval in Greece has barely grazed investors conscious this morning. With the US Government shutdown entering day 24 and the data out of China there scant little time for that.

The bright light at the end of the tunnel is coming in the form of earnings season, which kicks off this week. Let us pray they don't disappoint.

One thing that is clear is that there is an overwhelming demand for safe havens. We can see it in the price of gold, which is still giving an extensive test to the $1,300 level.

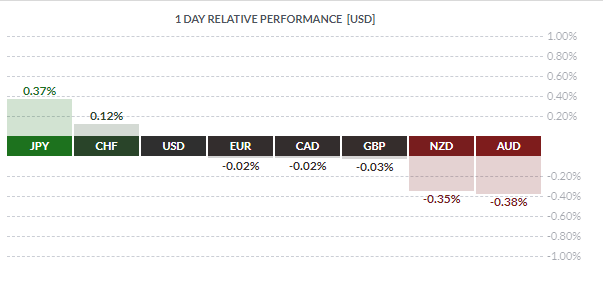

The next clue comes from the currency markets, where the Japanese Yen and the Swiss Franc are leading today.

The final nail in the coffin is the bond markets, where we can see the yields dropping as investors turn to this traditional market for safekeeping of their assets. To think the 10-year US treasury bond was threatening a wide move higher in November and now it's sliding into oblivion.

Crypto Safety

In line with what we're seeing above, the risk assets are on the ropes and bitcoin is no exception. Just as the stock markets have reached a point of inflection the crypto markets are now giving a heavy test of their support levels.

Those that have recently called the bottom may not be wrong though. The critical support level for bitcoin is at $3,000, so we're still about $500 above that at the moment.

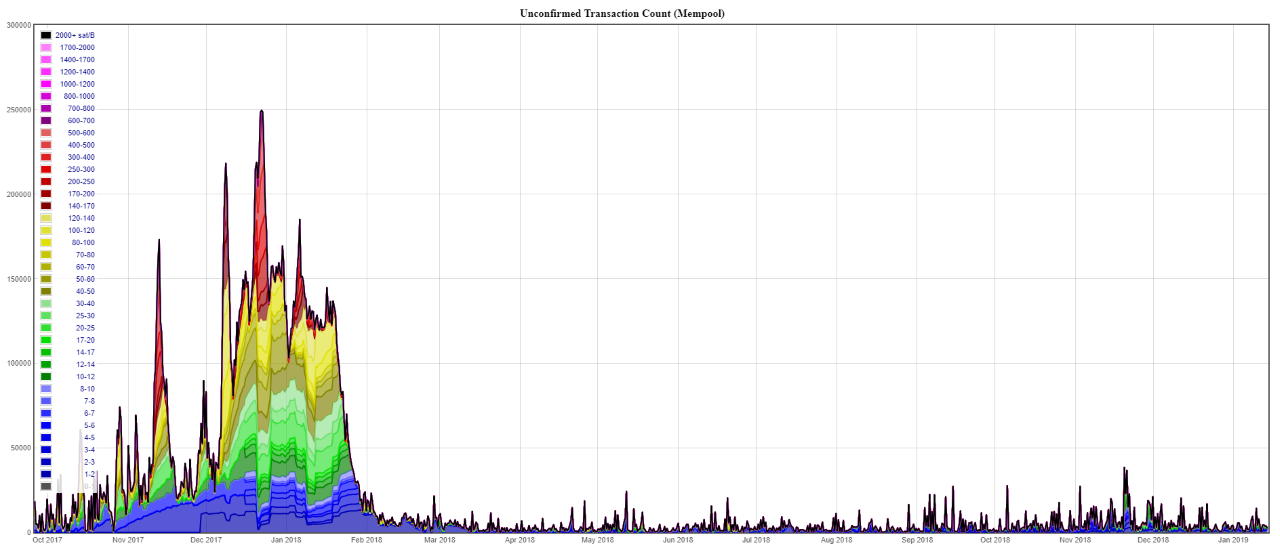

Moving beyond the price, we can see that activity on Bitcoin's blockchain is heating up rapidly. Here we can see the transaction rate hitting its highest level in almost a year.

Of course, more transactions on the blockchain is neither bullish nor bearish. The comforting thing is that last time the transaction rate was this high, we saw a distinct clog in the network.

Last January, the Bitcoin blockchain was so congested that transaction times were significantly slower and the cost to send bitcoin was through the roof.

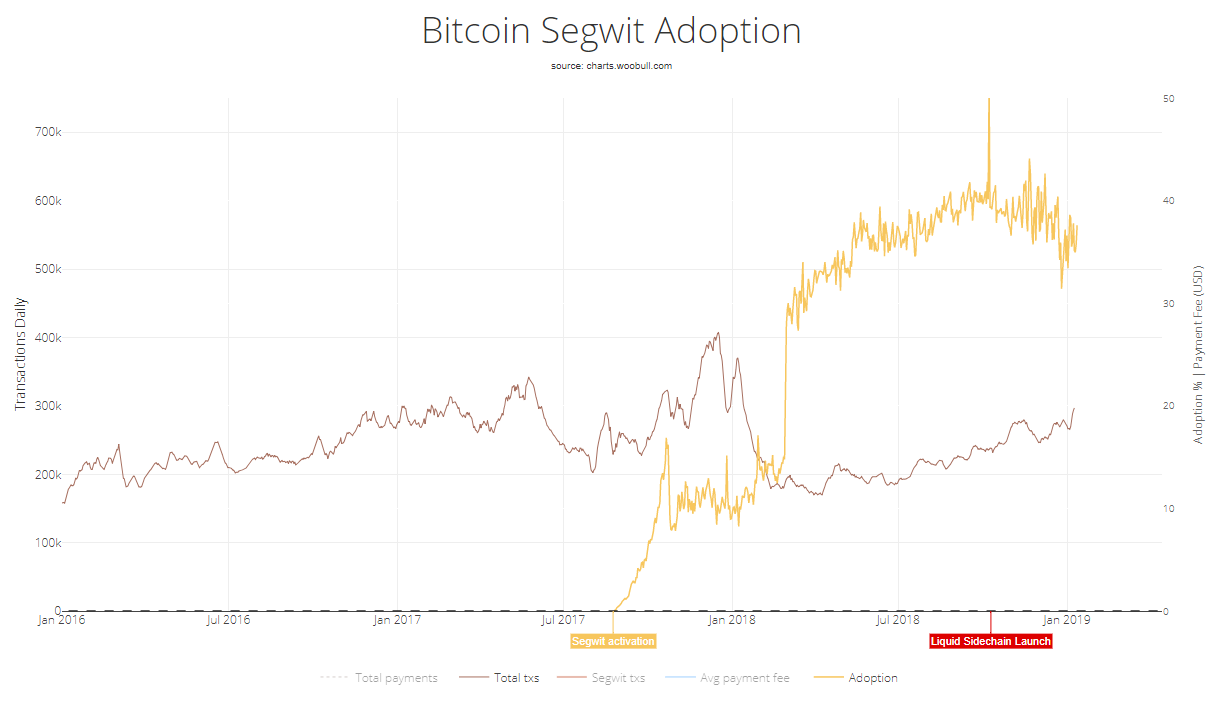

During the bear market, however, developers have had more time to upgrade their systems. Specifically, we now see the adoption of SegWit, which reduces the size of transactions on the blockchain, is now about 40%.

In short, I don't know when the next bull run will happen but I am fairly confident that the network is fully set up to handle the load.

eToro, Senior Market Analyst

Disclosure: This content is for information and educational purposes only and should not be considered investment advice or an investment recommendation. Past performance is not an indication of future results. All trading carries risk. Only risk capital you're prepared to lose.