It seems clear by now to many of us that the next leap in the evolution of technology will be that of decentralization.

The innovation of distributed ledger technology "blockchain" has shown us that centralized money, power, and data are inherently weak and that by spreading out these things over an entire network we can strengthen all of them and make them more effective.

Why then do the entire industry and the cutting edge cryptotraders, all rely on the same stupid centralized website to get our information and pricing?

I'm as guilty as everyone else on this and find myself logging into coinmarketcap.com several times a day to check pricing. I've seen them cited over and over again in articles as if they're some kind of authority and it's gotten out of hand.

CMC caused the market to crash on Monday. Whether this was intentional or not remains to be discovered. For myself and all of you reading, I propose that we boycott this website effective immediately.

I'm sick and tired of their banner adds that intentionally promote scammy ICOs and sick and tired of them having total authority over a market that should be free, especially where there are so many other great websites that can give us the information we need just as quickly and just as efficiently.

Today's Highlights

Action in The Bonds

Japan Exiting?

Ethereum is the Safer

Please note: All data, figures & graphs are valid as of January 10th. All trading carries risk. Only risk capital you can afford to lose.

Traditional Markets

Usually, the bond markets are the most boring market to be involved in. As an incredibly low risk asset, the volatility is often times non-existent.

Yesterday however, there was some sudden sell off in US treasury bonds. Here we can see the iShares 20+ Year Treasury Bond (NASDAQ:TLT) bond, which is trading on eToro.

What bond traders like to watch are the yields, which trade inversely to the price. Seeing the Yield on the US 10 Year spiking above 2.5%, for the first time since March, was enough to raise a few eyebrows on Wall Street.

Nevertheless, with eyebrows raised investors kept plowing into buy positions on the stock market. The S&P 500 has closed with a record high every day this year making it one of the strongest starts for stocks ever.

What caused the bonds to sell-off?

Many analysts are pointing to "monetary tightening." The central banks of the world are in the slow process of raising interest rates and gradually trying to reverse the "loose money" policy that has been in place since 2009.

The Bank of Japan, who until now has been the most aggressive champion of quantitative easing, showed a tiny sign that they might be reducing their monthly bond buying practices.

In their monthly purchases yesterday they bought a total of ¥190 Billion, instead of the ¥200 Billion that they bought last month.

That's it. A tiny difference, less than $90 million difference from one month to the next has the entire bond market in a tizzy.

Though the Stocks don't seem to be affected much, the currency markets certainly have been.

The USD/JPY fell quite quickly below the current range (dotted blue line) and below the psychological level of 112 Yens to the Dollar.

Finally some action!!!

Let's Talk about Crypto

The crypto market is also seeing somewhat of a selloff. The overwhelming gains we saw in Ripple's XRP token's over the few weeks are being rapidly clawed back. It looks like XRP has found some sort of floor at $1.50 but we'll see how that develops.

It should be noted, that even if XRP retraces all the way to $1.10, it will still be worth 5 times what it was a month ago.

For those of you who got in early and are still hodling, awesome!! For those of you who got in late and are now hurting, I feel you and I've been there before. Next time please try to be more diverse in your investments and try to take a more long term approach to the markets.

The pullback isn't just in XRP though. In fact, the only cryptocurrency that seems to be in green today is Ethereum. As we've noted several times in past updates, Ethereum is acting as the safe haven in this market.

Bitcoin Mining

It seems we have an update on the status of bitcoin mining in China. Official documents from the Chinese authorities obtained by the Financial Times indicate that China will in fact be cracking down on Bitcoin miners.

This is particularly concerning because most mining is still done in China. Though many other countries have plans to ramp up their operations, these things take time and none are fully operational just yet.

This news comes at a particularly bad time for the world's first cryptocurrency as the backlog of unconfirmed transactions known as the mempool just does not want to clear. Even though the number of transactions processed by the bitcoin blockchain is coming down, there are still about 170,000 unconfirmed transactions at any given time.

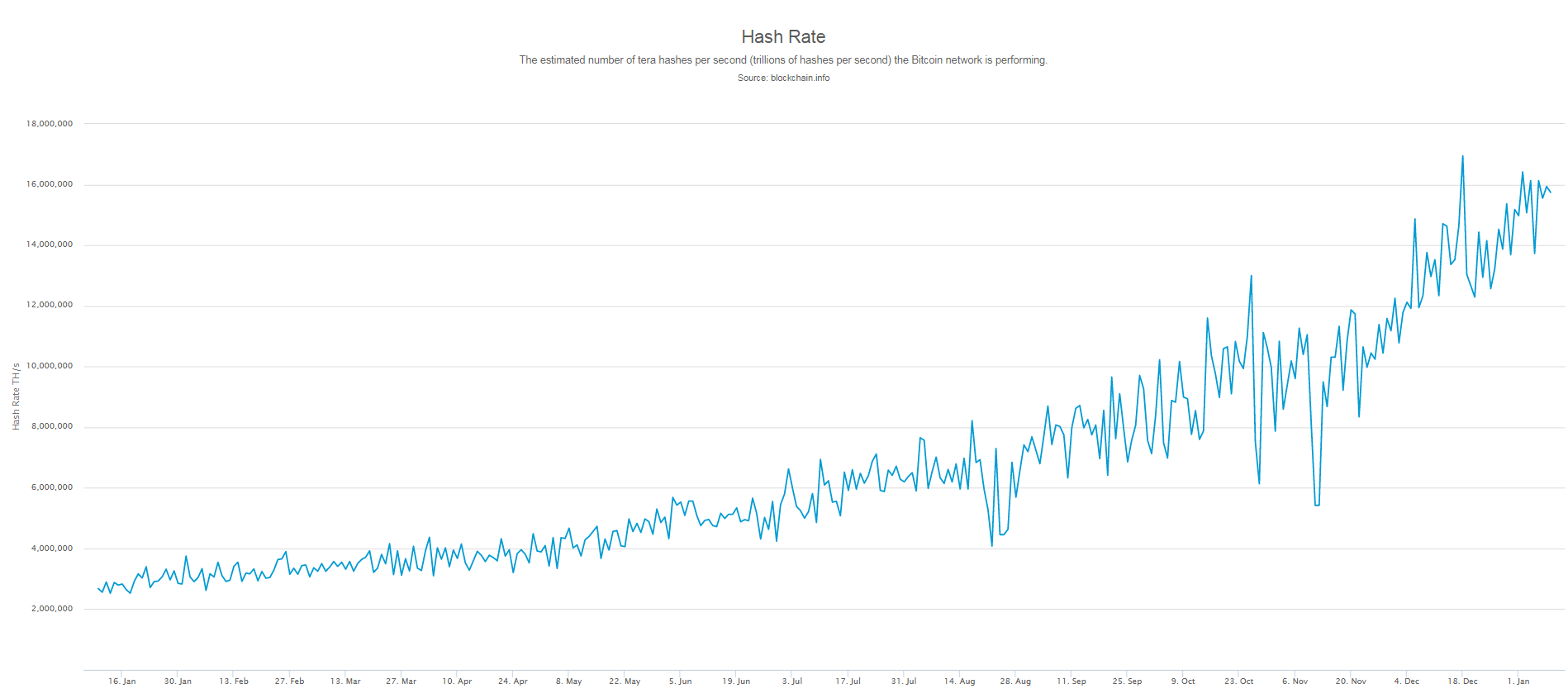

The thing to watch is the hashrate. To bitcoin's benefit, the computing power of the network has grown drastically over the last few months. If it starts to falter now it will be a very bad sign for bitcoin indeed.

The SegWit solution could still save bitcoin but the possibilities of this happening seem increasingly slim. Alas, only 10% of miners have gotten onboard so far.

Even though I love bitcoin, the amount of energy it currently uses to facilitate the blockchain is quite excessive. If the protocol cannot be updated to make it more efficient, perhaps it's best that the way be cleared for other more efficient cryptos.

eToro, Senior Market Analyst

Disclosure: This content is for information and educational purposes only and should not be considered investment advice or an investment recommendation. Past performance is not an indication of future results. All trading carries risk. Only risk capital you're prepared to lose.