USD/CAD Daily Outlook

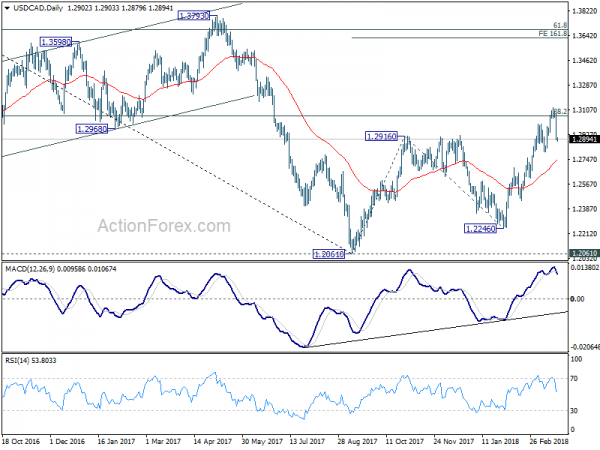

Daily Pivots: (S1) 1.2835; (P) 1.2955; (R1) 1.3022;

USD/CAD’s decline from 1.3124 accelerated to as low as 1.2879 so far and is pressing near term channel support. While further fall could still be seen, we’d anticipate strong support at 1.2802 cluster (38.2% retracement of 1.2246 to 1.3124 at 1.2789) to contain downside and bring rebound. On the upside, break of 1.3124 will extend recent rally to 161.8% projection of 1.2061 to 1.2916 from 1.2246 at 1.3629 next. However, firm break of 1.2789/2802 will raise the chance of rejection by 1.3065 medium term fibonacci level and bring deeper fall to 55 day EMA (now at 1.2704.

In the bigger picture, we’re favoring the medium term bullish case. That is larger down trend from 1.4689 has completed at 1.2061 as a correction, drawing support from 50% retracement of 0.9406 (2011 low) to 1.4689 (2015 high) at 1.2048. Sustained break of 38.2% retracement of 1.4689 to 1.2061 at 1.3065 will pave the way to 61.8% retracement at 1.3685. This will be the preferred case now as long as 1.2802 support holds. However, rejection by 1.3065 will argue that price action from 1.2061 is merely a three wave corrective pattern. And 1.2061 will be put back into focus with medium term bearishness revived.

EUR/USD Daily Outlook

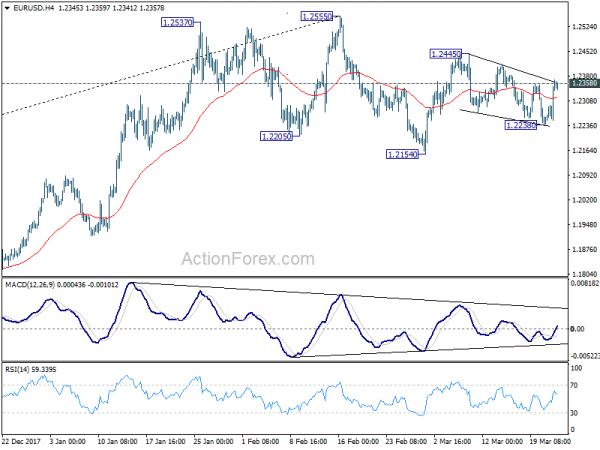

Daily Pivots: (S1) 1.2268; (P) 1.2309 (R1) 1.2378;

EUR/USD’s strong rebound and breach of 1.2358 minor resistance affirm our bullish view. That is, price actions from 1.2445 is a corrective pattern in form of falling wedge. And, it might be completed at 1.2238 already. Intraday bias is now on the upside for 1.2445 first. Break will resume whole rebound from 1.2154 and target 1.2555 high, which is close to 1.2516 key long term fibonacci level. On the downside, however, firm break of 1.1238 will turn bias back to the downside, to resume the fall from 1.2555 through 1.2154.

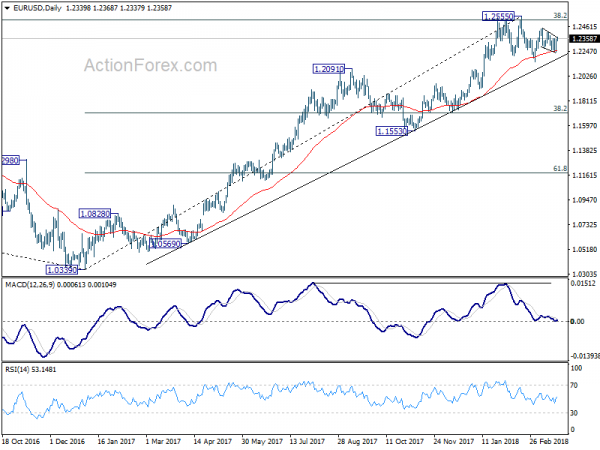

In the bigger picture, key fibonacci level at 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516 remains intact despite attempts to break. Hence, rise from 1.0339 medium term bottom is still seen as a corrective move for the moment. Rejection from 1.2516 will maintain long term bearish outlook and keep the case for retesting 1.0039 alive. Firm break of 1.1553 support will add more medium term bearishness. However, sustained break of 1.2516 will carry larger bullish implication and target 61.8% retracement of 1.6039 to 1.0339 at 1.3862.