GBP/USD Daily Outlook

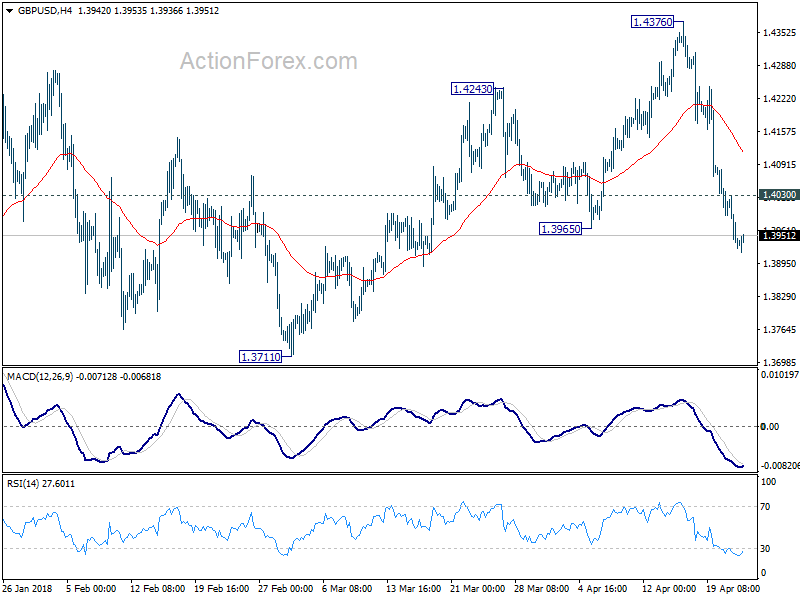

Daily Pivots: (S1) 1.3899; (P) 1.3965; (R1) 1.4004;

Intraday bias in GBP/USD remains on the downside as fall from 1.4376 is in progress. Deeper decline would be seen to 1.3711 key support level. On the upside, above 1.4030 minor resistance will turn intraday bias neutral and bring consolidations. But for now, near term risk will stay on the downside as long as 4 hour 55 EMA (now at 1.4114 holds).

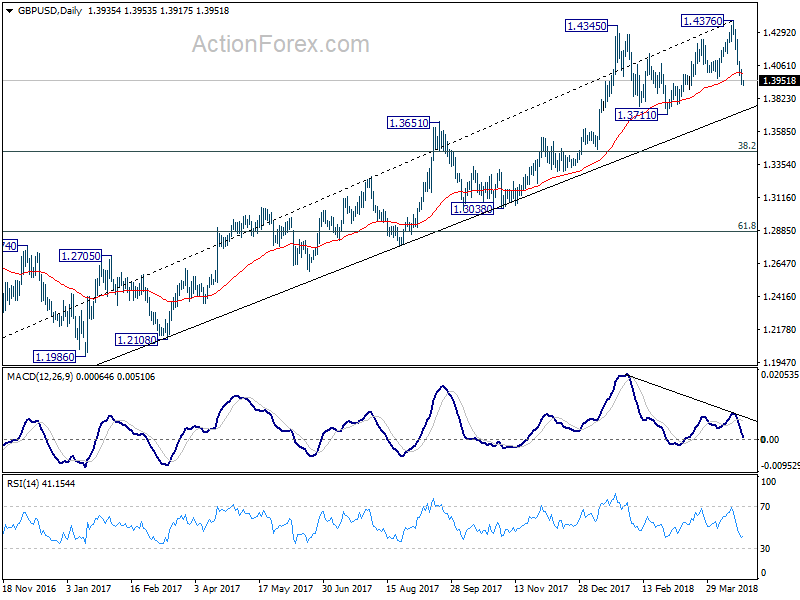

In the bigger picture, bearish divergence condition in daily MACD is raising the chance of medium term reversal. Also, note that GBP/USD has just failed to sustain above 55 month EMA (now at 1.4257). Focus is back on 1.3711 support. Firm break there will confirm medium term reversal and target 38.2% retracement of 1.1936 (2016 low) to 1.4376 at 1.3448 first. Break will target 61.8% retracement at 1.2874 and below. For now, sustained break of 55 month EMA is needed to confirm medium term upside momentum. Otherwise, we won’t turn bullish even in case of strong rebound.

USD/CHF Daily Outlook

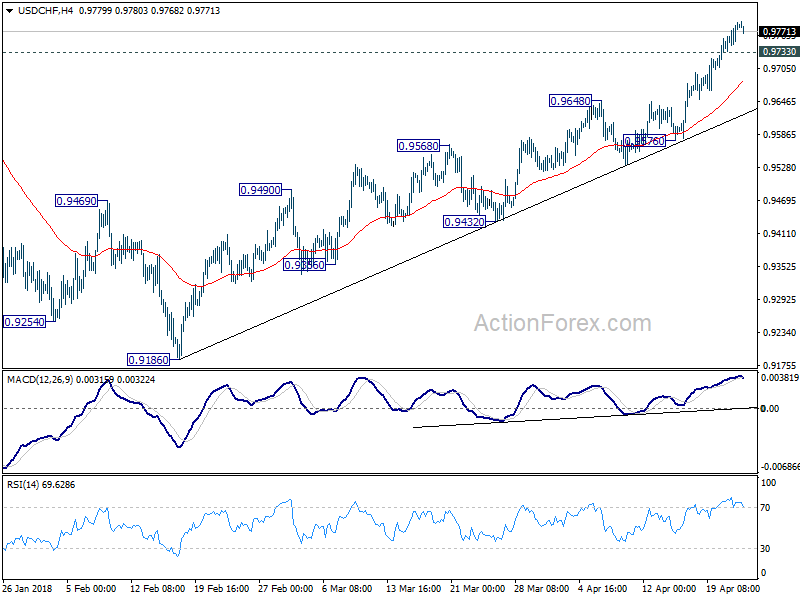

Daily Pivots: (S1) 0.9749; (P) 0.9768; (R1) 0.9801;

Intraday bias in USD/CHF remains on the upside at this point. Current rally from 0.9186 should extend to 0.9900 fibonacci level next. On the downside, below 0.9733 minor support will turn bias neutral and bring consolidations. But outlook will stay bullish as long as 0.9576 support holds.

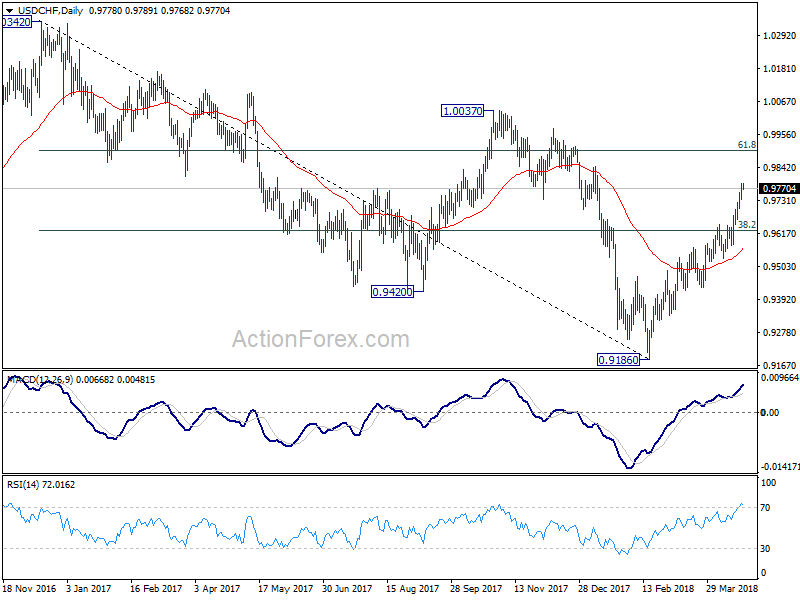

In the bigger picture, fall from 1.0342 is seen as a medium term down trend. The break of 38.2% retracement of 1.0342 (2016 high) to 0.9186 (2018 low) at 0.9626 suggests that it’s likely completed at 0.9186 already. Further rally would be seen back to 61.8% retracement at 0.9900 and above. Sustained break there would pave the way to retest 1.0342 key resistance next. This will now be the preferred case as long as 0.9576 support holds.