GBP/JPY Daily Outlook

ActionForex.com Nov 21 04:22 GMT

Share This

AddThis Sharing ButtonsShare to Google (NASDAQ:GOOGL) TranslateShare to Facebook (NASDAQ:FB)Share to TwitterShare to Google+Share to LinkedIn (NYSE:LNKD)Share to PinterestShare to SkypeShare to Print

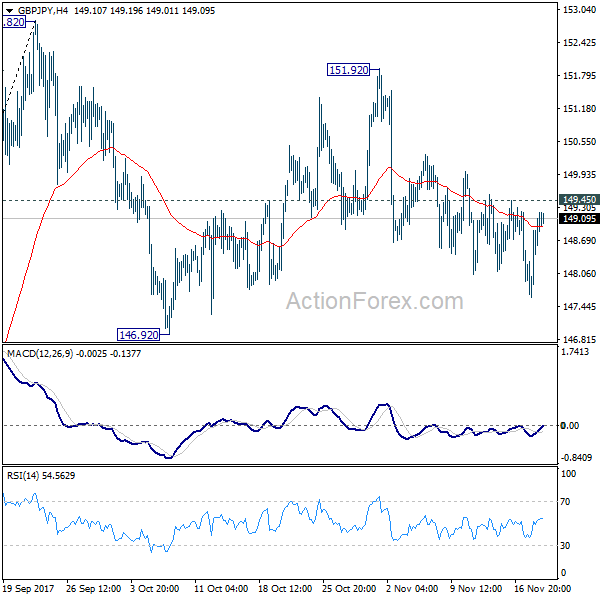

Daily Pivots: (S1) 148.02; (P) 148.62; (R1) 149.62

No change in GBP/JPY's outlook. Price actions from 152.82 are viewed as a corrective pattern, with fall from 151.92 as the third leg. Deeper decline could be seen through 146.92 support. But we'd expect strong support from 61.8% retracement of 139.29 to 152.82 at 144.45 to contain downside and bring rebound. On the upside, break of 149.45 minor resistance will turn bias back to the upside for 151.92/152.82 resistance zone.

In the bigger picture, medium term rebound from 122.36 is still expected to resume after corrective pull back from 152.82 completes. Firm break of 38.2% retracement of 196.85 to 122.36 at 150.43 will carry long term bullish implications. In that case, GBP/JPY could target 61.8% retracement at 167.78. However, break of 139.29 will indicate rejection from 150.43 key fibonacci level. And the three wave corrective structure of rebound from 122.36 will argue that larger down trend is resuming for a new low below 122.26.

EUR/JPY Daily Outlook

ActionForex.com Nov 21 04:19 GMT

Share This

AddThis Sharing ButtonsShare to Google TranslateShare to FacebookShare to TwitterShare to Google+Share to LinkedInShare to PinterestShare to SkypeShare to Print

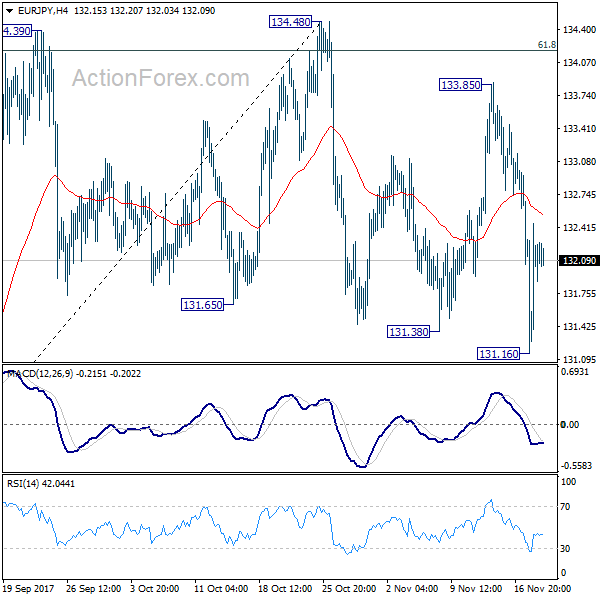

Daily Pivots: (S1) 131.36; (P) 131.91; (R1) 132.66

Despite breaking 131.38 to 131.15, EUR/JPY quickly recovered. Intraday bias is turned neutral first. A short term top is at least in place at 134.48 after hitting 134.20 long term fibonacci level. For now, deeper fall will be in favor towards 38.2% retracement of 114.84 to 134.48 at 126.97, which is close to 127.55 support. We'll look for support from there to bring rebound on first attempt. In any case, firm break of 134.48 is needed to confirm up trend resumption. Otherwise, near term risks remain on the downside.

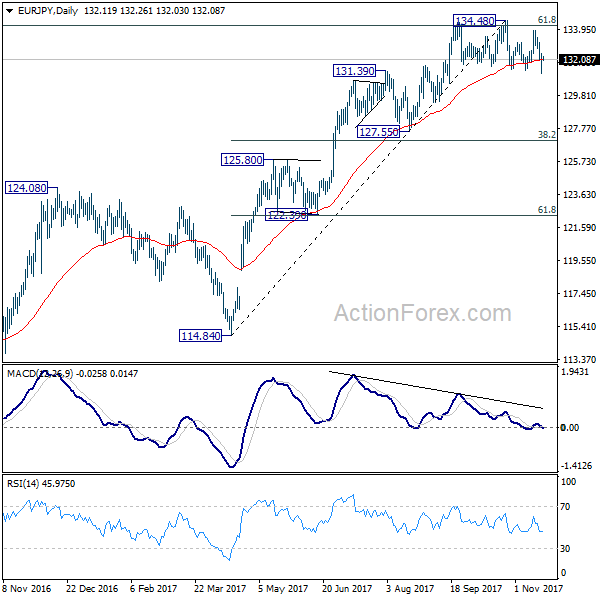

In the bigger picture, medium term rise from 109.03 (2016 low) is seen as at the same degree as the down trend from 149.76 (2014 high) to 109.03 (2016 low). 61.8% retracement of 149.76 to 109.03 at 134.20 is already met. Sustained break there will pave the way to key long term resistance zone at 141.04/149.76. However, break of 127.55 support will argue that the medium term trend has reversed and will turn outlook bearish for deeper fall back to 114.84/124.08 support zone at least.