GBP/JPY Daily Outlook

Daily Pivots: (S1) 140.51; (P) 141.28; (R1) 141.73;

GBP/JPY's decline resumed by taking out 141.24 and reaches as low as 140.60 so far. Intraday bias is back on the downside. Fall from 147.76 is still in progress and would extend through 138.65 support. Nonetheless, GBP/JPY is seen as staying in consolidation pattern from 148.42, we'd expect strong support from 135.58 to contain downside. Break of 143.18 resistance is needed to indicate short term bottoming. Otherwise, outlook stays bearish in case of recovery.

In the bigger picture, the sideway pattern from 148.42 is extending with another leg. But we'd expect strong support from 135.58 and 50% retracement of 122.36 to 148.42 at 135.39 to contain downside. Medium term rise from 122.36 is still expected to resume later. And break of 38.2% retracement of 196.85 to 122.36 at 150.43 will carry long term bullish implications. However, firm break of 135.58/39 will dampen the bullish view and turn focus back to 122.36 low.

EUR/JPY Daily Outlook

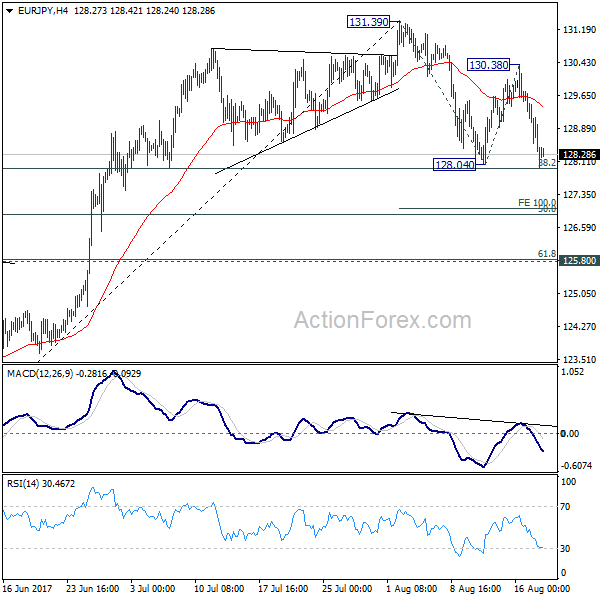

Daily Pivots: (S1) 127.96; (P) 128.83; (R1) 129.29;

EUR/JPY's fall from 130.38 accelerates further lower and breached 128.04. Based on current momentum, the corrective fall from 131.39 will dip deeper than originally expected. Intraday bias is now on the downside. Break of 38.2% retracement of 122.39 to 131.39 at 127.95 will target 100% projection of 131.39 to 128.04 from 130.38 at 127.03. We'll looking for bottoming above 125.80 cluster support (61.8% retracement at 125.82) . On the upside, break of 130.38 is needed to signal completion of the correction. Otherwise, deeper decline is now mildly in favor.

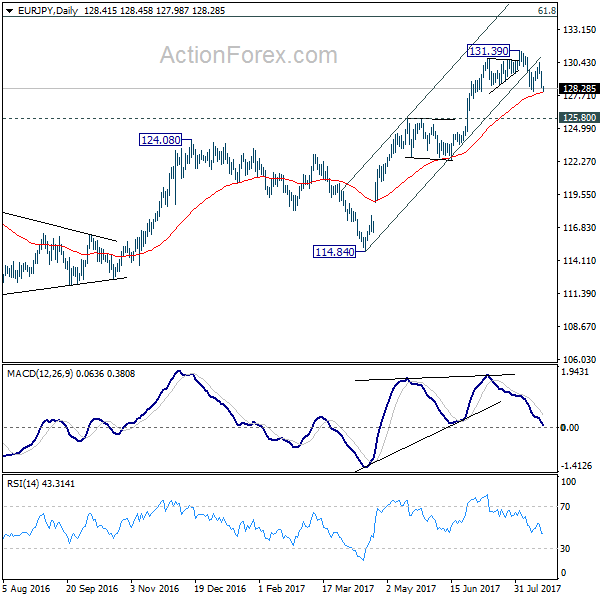

In the bigger picture, the down trend from 149.76 (2014 high) is completed at 109.03 (2016 low). Current rally from 109.03 should be at the same degree as the fall from 149.76 to 109.03. Further rise is expected to 61.8% retracement of 149.76 to 109.03 at 134.20. Sustained break there will pave the way to key long term resistance zone at 141.04/149.76. Medium term outlook will remain bullish as long as 124.08 resistance turned support holds.