EUR/AUD Daily Outlook

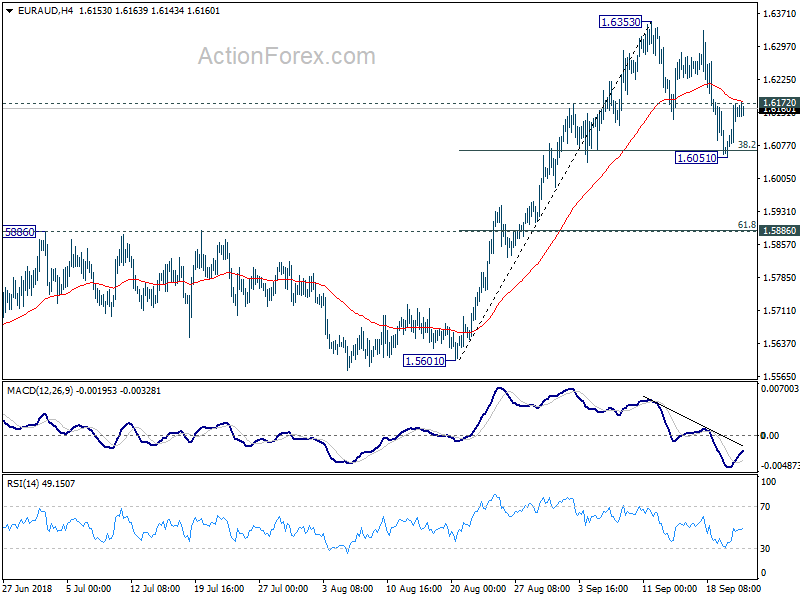

Daily Pivots: (S1) 1.6079; (P) 1.6126; (R1) 1.6198;

EUR/AUD drew support from 38.2% retracement of 1.5601 to 1.6353 at 1.6066 and formed a temporary low at 1.6051. Intraday bias is turned neutral first. On the upside, above 1.6172 minor resistance will indicate completion of the corrective fall from 1.6353. Intraday bias would be turned back to the upside for retesting this high. On the downside, below 1.6051 will extend the corrective decline. But downside should be contained well above 1.5886 cluster support (61.8% retracement at 1.5888) to bring rise resumption.

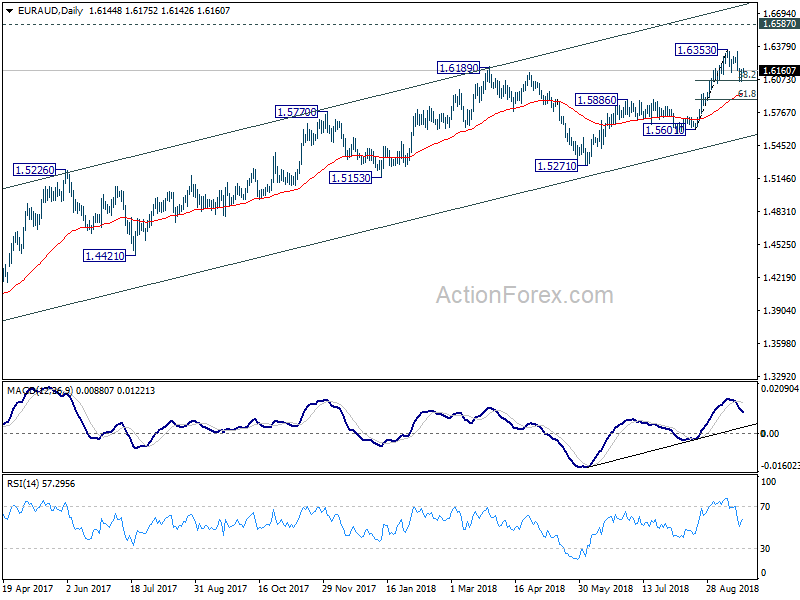

In the bigger picture, up trend from 1.3624 (2017 low) is still in progress. Further rise should be seen to retest 1.6587 (2015 high). Decisive break there will resume the long term rally and target 1.7488 fibonacci level. On the downside, break of 1.5601 support is need to be the first sign of medium term reversal. Otherwise, outlook will remain bullish in case of deep pull back.

EUR/GBP Daily Outlook

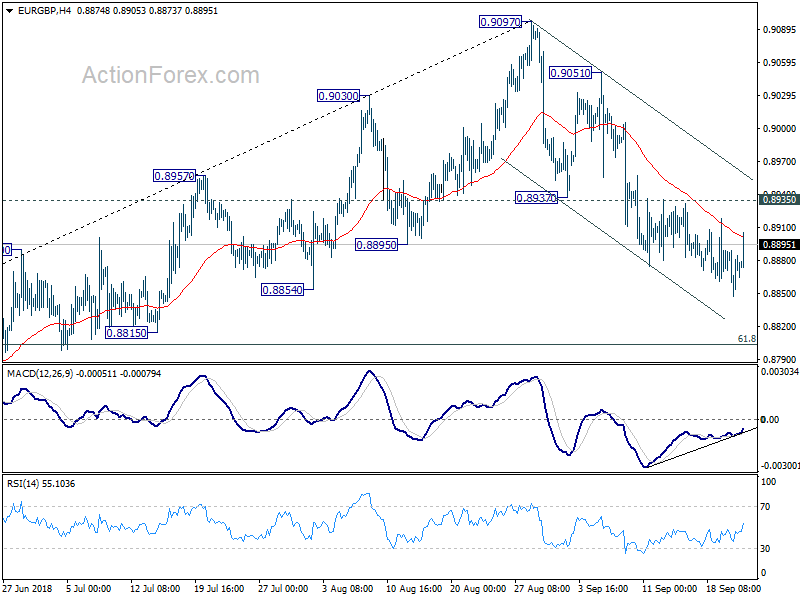

Daily Pivots: (S1) 0.8850; (P) 0.8871; (R1) 0.8897;

EUR/GBP continues to lose downside momentum as seen in 4 hour MACD. But with 0.8935 minor resistance intact, deeper decline is still expected. However, downside should be contained by 61.8% retracement of 0.8620 to 0.9097 at 0.8802 to form a short term bottom and bring rebound. On the upside, break of 0.8935 resistance will indicate short term bottoming and bring stronger rebound back towards 0.9051 resistance.

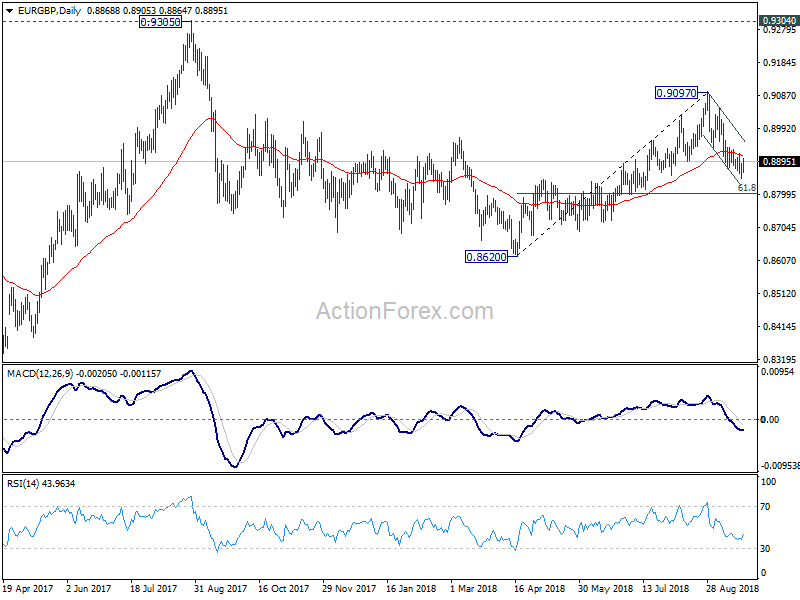

In the bigger picture, EUR/GBP is staying in long term range pattern from 0.9304 (2016 high). At this point, there is no clear sign of range break out yet. And more corrective trading would continue. On the upside, in case of another rise, we’d stay cautious on strong resistance from 0.9304/5 to limit upside in case of further rally. Meanwhile, if there is another medium term decline, strong support will likely be seen from 0.8303 to contain downside.