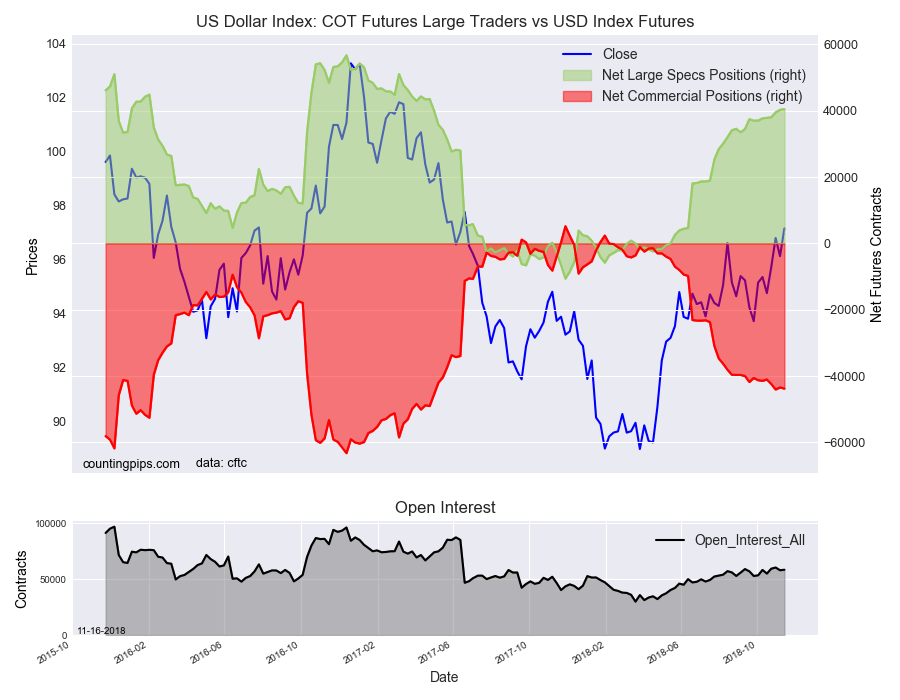

US Dollar Index Speculator Positions edged higher

Large currency speculators continued to increase their bullish net positions in the US Dollar Index futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of US Dollar Index futures, traded by large speculators and hedge funds, totaled a net position of 40,513 contracts in the data reported through Tuesday November 13th. This was a weekly boost of 231 contracts from the previous week which had a total of 40,282 net contracts.

This week’s net position was the result of the gross bullish position ascending by 153 contracts to a weekly total of 48,448 contracts in addition to the gross bearish position lowering by -78 contracts for the week to a total of 7,935 contracts.

The speculative US Dollar Index position once again continued its steady rise for a seventh consecutive week and has now gained for the twenty-eighth time out of the past thirty weeks. The current bullish standing is at the highest position since April 25th of 2017 and is above the +40,000 net contract level for a second straight week.

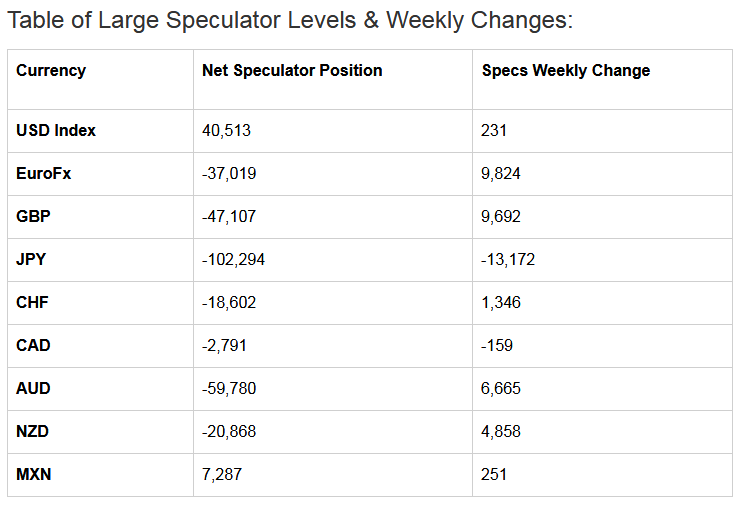

Individual Currencies Data this week: Yen bets go more bearish

In the other major currency contracts data, we saw just one substantial change (+ or – 10,000 contracts) in the speculators category this week.

Japanese yen contracts dropped sharply by over -13,000 contracts this week. The fall in yen contracts pushes the net position back over the -100,000 contract level for the first time since October 16th. The rise in bearish bets this week followed the previous four straight weeks of declining bearish bets.

Overall, the major currencies that saw improving speculator positions this week were the US dollar index (231 weekly change in contracts), euro (9,824 contracts), British pound sterling (9,692 contracts), Swiss franc (1,346 contracts), Australian dollar (6,665 contracts), New Zealand dollar (4,858 contracts) and the Mexican peso (251 contracts).

The currencies whose speculative bets declined this week were the Japanese yen (-13,172 weekly change in contracts) and the Canadian dollar (-159 contracts).

Other Notable Trends for the week:

Some of the so called ‘risk’ currencies saw their bets improve earlier this week with gains for the euro, British pound sterling, Australian dollar and the New Zealand dollar. All four of these currencies continue to have bearish net positions but are mostly off of their most bearish levels of the past few months.

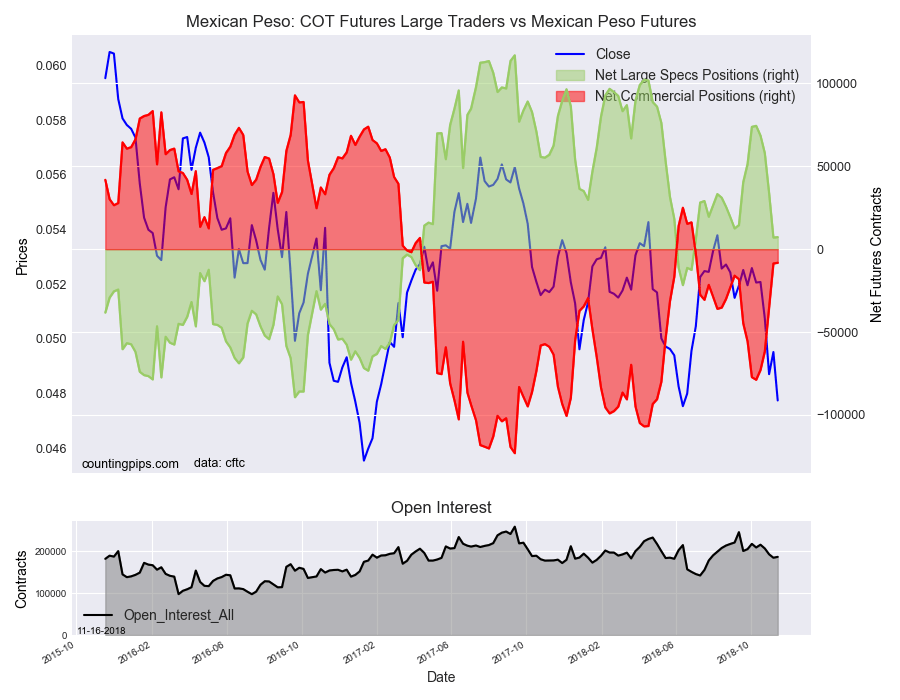

The Mexican peso remains the one currency outside the Dollar Index that maintains a bullish position. This week the bullish peso position edged a bit higher to 7,287 net contracts.

See the table and individual currency charts below.

Weekly Charts: Large Trader Weekly Positions vs Price

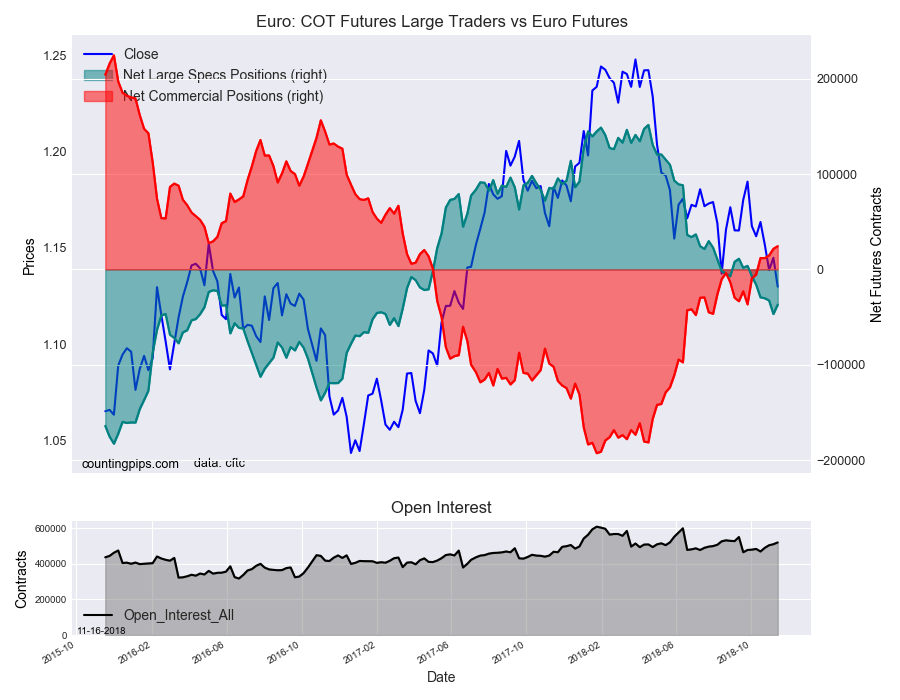

EuroFX:

The Euro large speculator standing this week came in at a net position of -37,019 contracts in the data reported through Tuesday. This was a weekly rise of 9,824 contracts from the previous week which had a total of -46,843 net contracts.

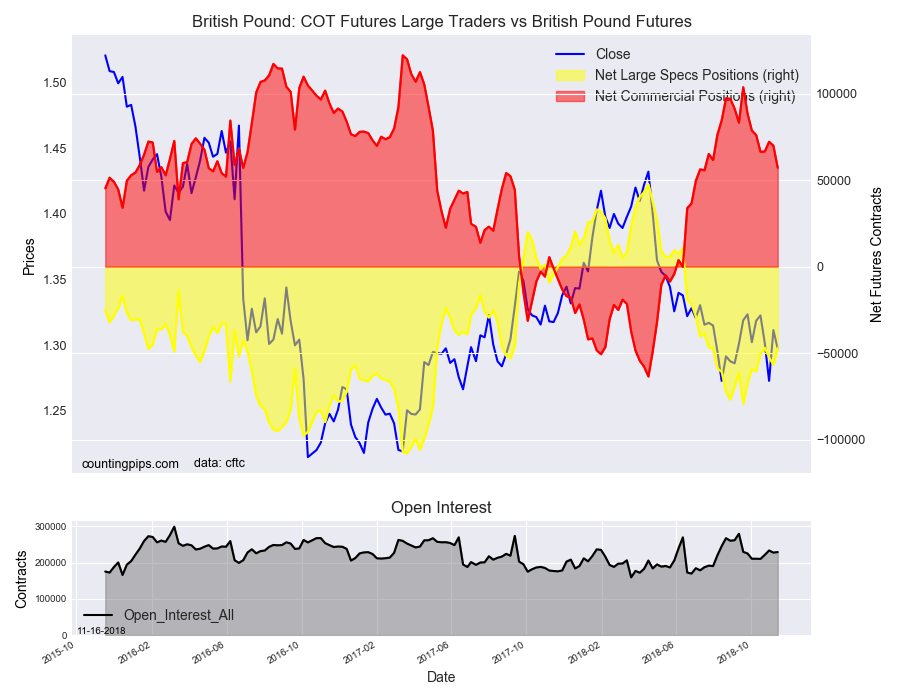

British Pound Sterling:

The large British pound sterling speculator level equaled a net position of -47,107 contracts in the data reported this week. This was a weekly advance of 9,692 contracts from the previous week which had a total of -56,799 net contracts.

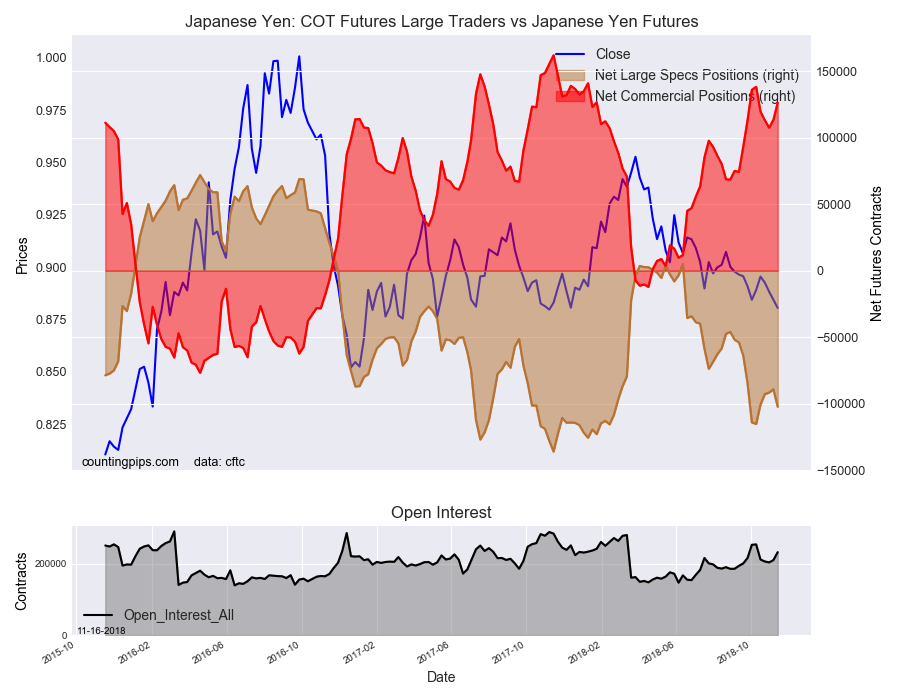

Japanese Yen:

Large Japanese yen speculators totaled a net position of -102,294 contracts in this week’s data. This was a weekly change of -13,172 contracts from the previous week which had a total of -89,122 net contracts.

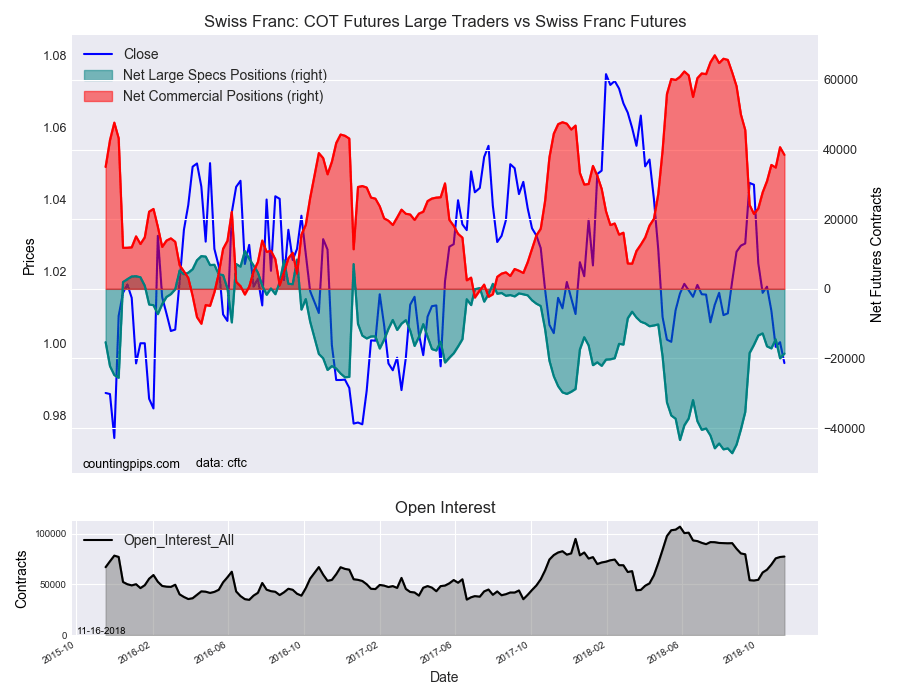

Swiss Franc:

The Swiss franc speculator standing this week reached a net position of -18,602 contracts in the data through Tuesday. This was a weekly rise of 1,346 contracts from the previous week which had a total of -19,948 net contracts.

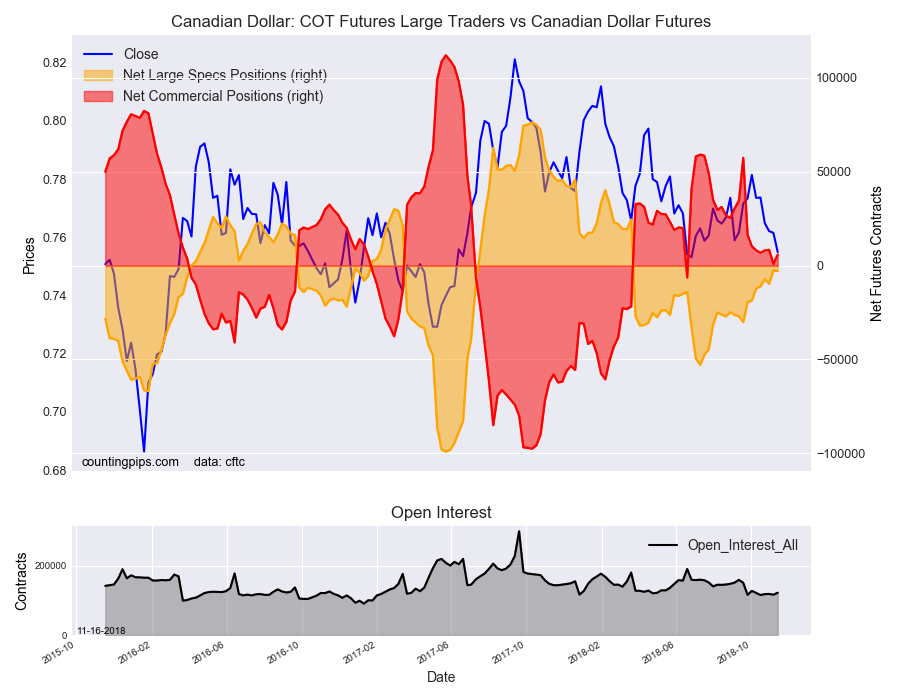

Canadian Dollar:

Canadian dollar speculators resulted in a net position of -2,791 contracts this week. This was a change of -159 contracts from the previous week which had a total of -2,632 net contracts.

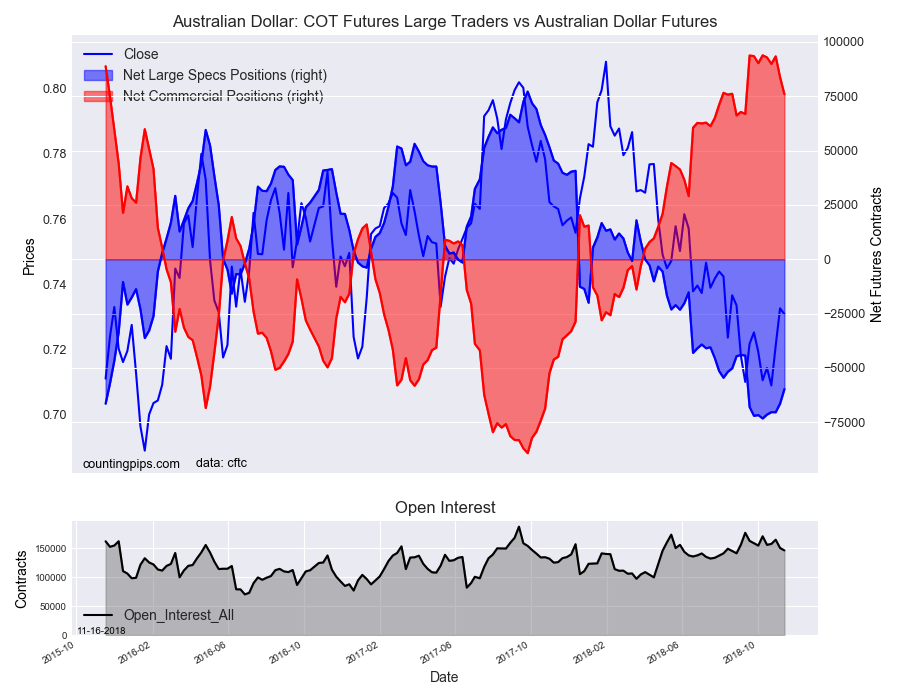

Australian Dollar:

The large speculator positions in Australian dollar futures reached a net position of -59,780 contracts this week in the data ending Tuesday. This was a weekly gain of 6,665 contracts from the previous week which had a total of -66,445 net contracts.

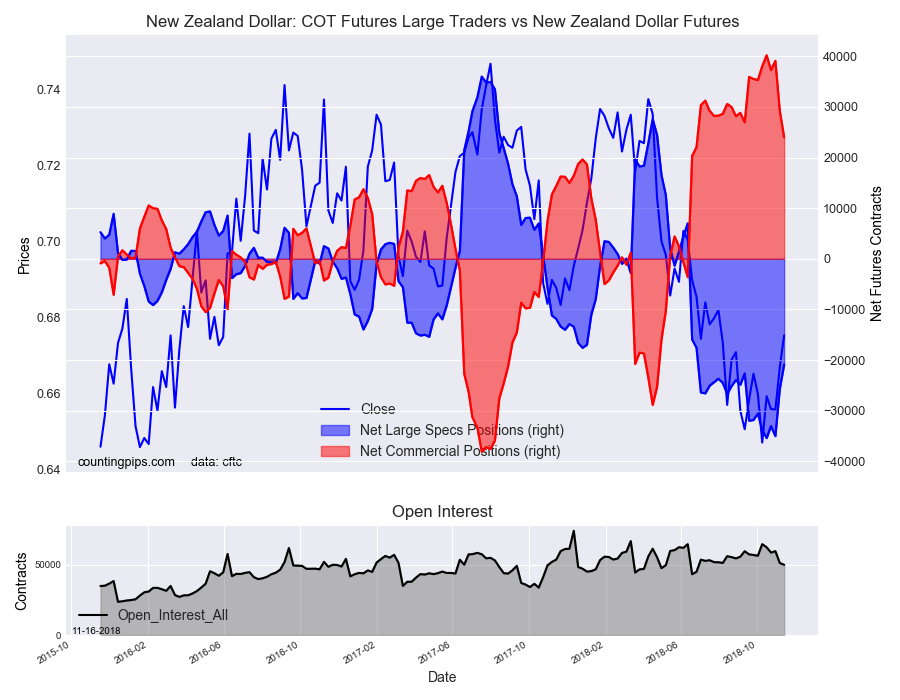

New Zealand Dollar:

The New Zealand dollar speculative standing resulted in a net position of -20,868 contracts this week in the latest COT data. This was a weekly lift by 4,858 contracts from the previous week which had a total of -25,726 net contracts.

Mexican Peso:

Mexican peso speculators came in at a net position of 7,287 contracts this week. This was a weekly advance of 251 contracts from the previous week which had a total of 7,036 net contracts.

*COT Report: The COT data, released weekly to the public each Friday, is updated through the most recent Tuesday (data is 3 days old) and shows a quick view of how large speculators or non-commercials (for-profit traders) were positioned in the futures markets.

The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators). Find CFTC criteria here: (http://www.cftc.gov/MarketReports/CommitmentsofTraders/ExplanatoryNotes/index.htm).