Asia tried to start the week on a positive note, but we can’t pretend last week didn’t happen. As well, Bernanke dropped a bomb on Saturday that underlines the likelihood that he won’t seek renomination.

Markets were trying to get off to a positive start this week after an upbeat Asian session saw the JPY weaker and gold and equity markets higher. The theory is that the G20 has given the market the green light to continue to sell JPY. But early European trading has not been encouraging and we can’t pretend that last week didn’t happen (down over 4% in the DAX, etc…). We’ve got important European data up this week, as reviewed below and all eyes will be on the US corporate earnings results this week. EURJPY was up to new one-week+ highs at 130.70, but was already beaten back to the 130.00 level as of this writing. Bunds gapped lower and sold off, only to rally viciously back to Friday’s closing levels. In other words, there still appears to be plenty of residual weakness from last week’s nerves to go around. I suspect the market will remain nervy at best this week.

On Friday, Fitch downgraded UK’s debt from AAA to AA+– conveniently doing so just after I launched a short GBPUSD trade idea. These moves by rating agencies only tend to help a currency to go where it was going to go anyway, but it is a reminder of the frail state of the UK’s fiscal situation. Focus this week will be on the UK GDP data on Thursday and on the 1.5200 level in GBP/USD, which was also near the low overnight. The action Friday set up a nice bearish candlestick pattern on the daily candles, but we need that follow through for confirmation.

The other bomb that was dropped over the weekend was the news that Bernanke won’t be attending the Jackson Hole conference in late August due to a “scheduling conflict”. It will mark the first time the Fed chairman hasn’t attended the conference in 25 years. If this isn’t a further sign that the Fed chairman won’t be running for re-nomination, I’m not sure what is. One can’t help but believe Bernanke is privately troubled that Fed policy isn’t going to work and he would prefer to bow out rather than continue at the helm as the inevitable moment of realization arrives. The market and economic history may not be so kind, but let’s see. This is a very interesting development. The late August time frame of the Jackson Hole conference (not even shown on the KC Fed’s website, so I can’t find the exact date) is likely to coincide with the nomination hearings for whoever Obama nominates to become the next Fed chair.

Looking ahead

Look out for the HSBC flash manufacturing PMI out of China in Asian hours tonight, as the weak Chinese GDP data is being given a lot of credit for moves in asset markets and could certainly have a bearing on the Aussie in the near term.

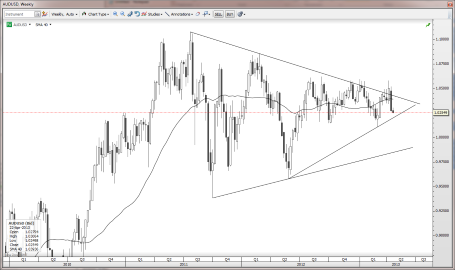

Chart: AUD/USD

A critical week for AUD/USD last week, as the market volatility shook the pair after it teased everyone with an attempt through that critical descending trendline, though it was still trading below the 1.0600 range resistance when the selling came in. From here, it is all about that 1.0133 low. I would expect at least a test through that level in the coming week or so -- and possibly even a test of parity. Note the ascending trendline that will eventually be working its way to parity in the weeks ahead -- that's the one I'm looking at for the "big break" when/if it arrives. AUD/USD" title="AUD/USD" width="455" height="270">

AUD/USD" title="AUD/USD" width="455" height="270">

The other data highlights this week include the preliminary PMI readings for Europe tomorrow morning and the German IFO on Wednesday, the combination of which should shake EUR/USD out of its 1.3000-1.3200 zone range by the end of the week if not sooner. The reversal Friday encourages a downside break-out, but we’ll likely need to see a follow-up of last week’s risk off move in asset markets to give the U.S. dollar the necessary boost for real follow-through. Watch for the German survey data in particular, as the services PMI was particularly ugly last month and the manufacturing survey dipped back below 50. This will all be the “set up data” for the ECB next week, which is likely to see a rate cut if the data this week is weak.

U.S. data this week is mostly second-tier stuff, with home sales data today (existing) and tomorrow (new) and Durable Goods Orders data on Wednesday and GDP on Friday. Overshadowing this data will be the heart of Q1 earnings season this week. There’s lots of attention on Caterpillar’s earnings outlook today, which could also have a further negative effect on Aussie if the outlook is weak.

Stay careful out there.

Upcoming Economic Calendar Highlights (all times GMT)

- UK BoE’s Baily to Speak (1010)

- US Fed’s Dudley to Speak (1230)

- Euro Zone ECB’s Rehn to Speak (1230)

- US Mar. Chicago Fed National Activity Index (1230)

- Euro Zone Apr. Consumer Confidence (1400)

- US Mar. Existing Home Sales (1400)

- Euro Zone ECB’s Noyer to Speak (1700)

- UK BoE’s Tucker to Speak (1830)

- China Apr. HSBC Flash Manufacturing PMI (0145)

- Japan Apr. Small Business Confidence (0500)