The total cryptocurrency marketcap surged to $1.2T in 2023.

One day before Ethereum’s Shapella upgrade, Bitcoin broke the $30,000 psychological threshold. While the total crypto market cap is 84% down from its ATH set in November 2021, it has increased by 55% year-to-date.

Renewed Crypto Sentiment

Despite the mounting evidence of the government’s ‘Operation Chokepoint 2.0’ aimed at crypto, it appears this hasn’t dampened interest in digital assets. At least, not sufficiently to prevent a rally. Bitcoin breached the psychologically significant $30k barrier in early Tuesday, last seen in June 2022.

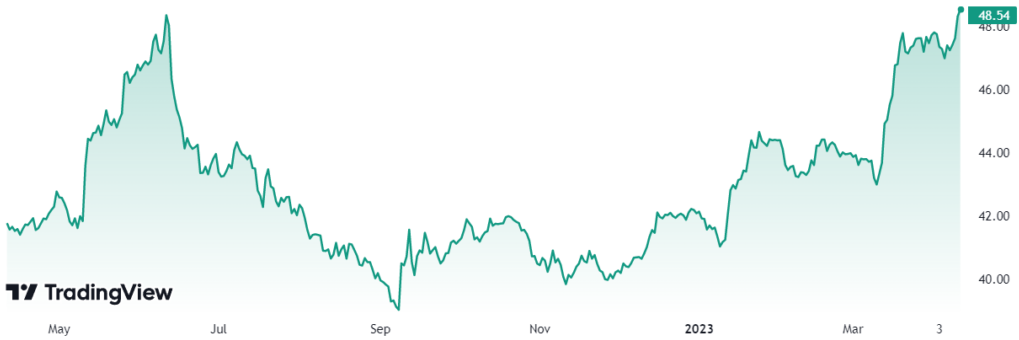

Interestingly, that period is the same when Bitcoin dominance was 48.36%, now slightly above 48.54%.

Following the cluster collapse of Terra, Celsius, 3AC, and others, the crypto market has experienced a historic erosion of confidence, with Bitcoin taking the brunt of the sentiment. Image credit: Trading View

Traditionally, this percentage of Bitcoin’s capitalization of the total crypto market cap signals a shift in market sentiment. For example, when Bitcoin dominance declines, it signals greater interest in altcoins. While lower market cap altcoins may pose greater risk-taking but offer greater potential returns.

However, with much uncertainty on securities vs. commodities and the US banking crisis, Bitcoin’s rising dominance appears to stem from investor perception. One that frames the originating coin as the benchmark for the broader crypto market, as it lacks even a hint of centralized governance that could be found in proof-of-stake chains like Ethereum.

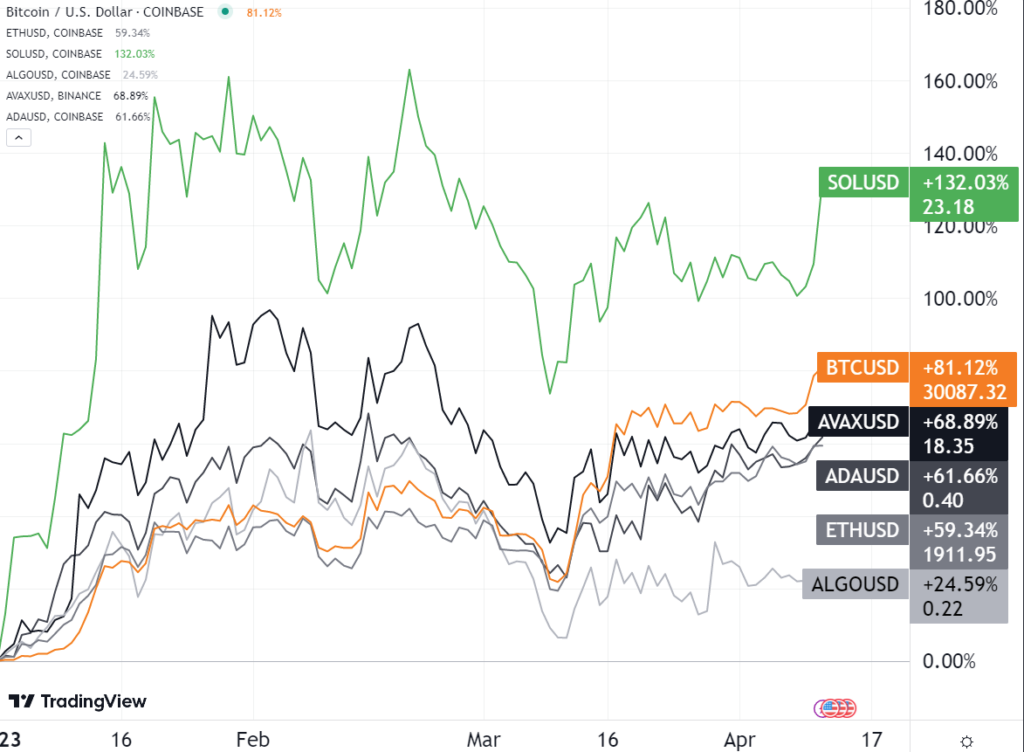

As Bitcoin’s gravity turns the crypto market sentiment positive of the significant PoS chains, Bitcoin outperformed all except Solana. This is somewhat predictable, as Solana has had a very deep bottom to recover from.

Year-to-date performance of Bitcoin vs. major proof-of-stake chains. Image credit: Trading View

Altogether, the total crypto market grew by 55% from the beginning of the year, from $795 billion to $1.2 trillion. Depending on the success of tomorrow’s Shapella upgrade for Ethereum, the altcoin scene may further pick up on Bitcoin’s $30k breach.

With that said, is the macro liquidity situation beneficial to a true crypto rally, or is this a blimp that will soon fizzle out?

What the Fed Got to Do With It?

When the crypto market reached its all-time high of $2.9 trillion in November 2021, one should look no further than to the Federal Reserve as the culprit. The central bank elevated the M2 money supply by 39%, a historical anomaly. Moreover, this happened in a near-zero interest environment, sparking a stock/crypto asset bubble.

Since then, the Fed has engaged in the fastest hiking cycle in 40 years to depress this bubble and put inflation under control. However, the market expects another reversal from QT to QE starting in November. In the meantime, only minor or zero interest rate hikes are expected.

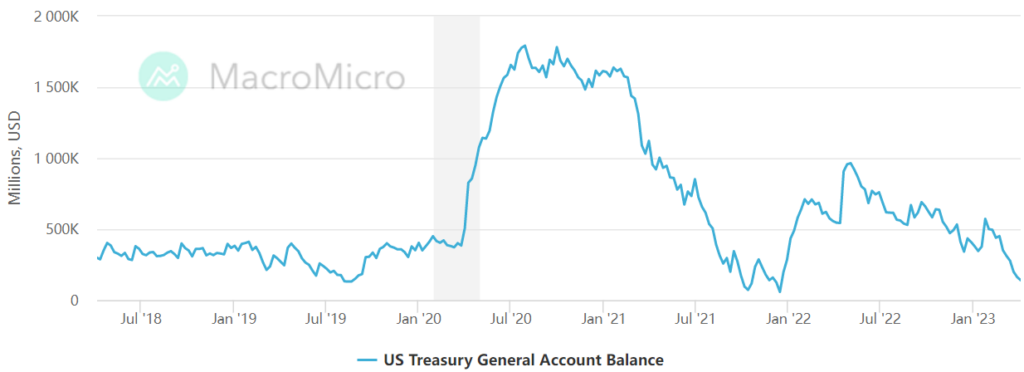

It also bears noticing that the Treasury General Account (TGA) is closing at its lowest point since the end of 2021, now at $140.6 billion. The US Treasury fills this checking account by issuing Treasury securities as government debt, which means another debt ceiling must be established.

The policies of the Federal Reserve and US Treasury are inextricably linked, as demonstrated by TGA’s balance during the height of Fed’s monetary injections. Image credit: MacroMicro

The non-partisan Congressional Budget Office (CBO) projects that the debt ceiling will likely be raised in Q4 2023. Otherwise, the federal government will not be able to pay its obligations. This is yet another reason why the market expects the closure of the Fed’s hiking cycle.

After all, when the Fed makes borrowing expensive during the hiking cycle, it also increases borrowing costs for the US Treasury to fund the TGA. On the other hand, rate cuts would make it easier to issue new Treasury securities to fund the TGA balance.

Bullrun or Bull Trap?

While long-term macro-conditions point to a positive direction for Bitcoin, is the current rally sustainable?

As noted previously, the Bitcoin rally has largely been driven by American investors. In turn, they have been driven by the US banking crisis, which now appears contained. However, for a simple reason, one should not expect to see a sustained bull run of previous years.

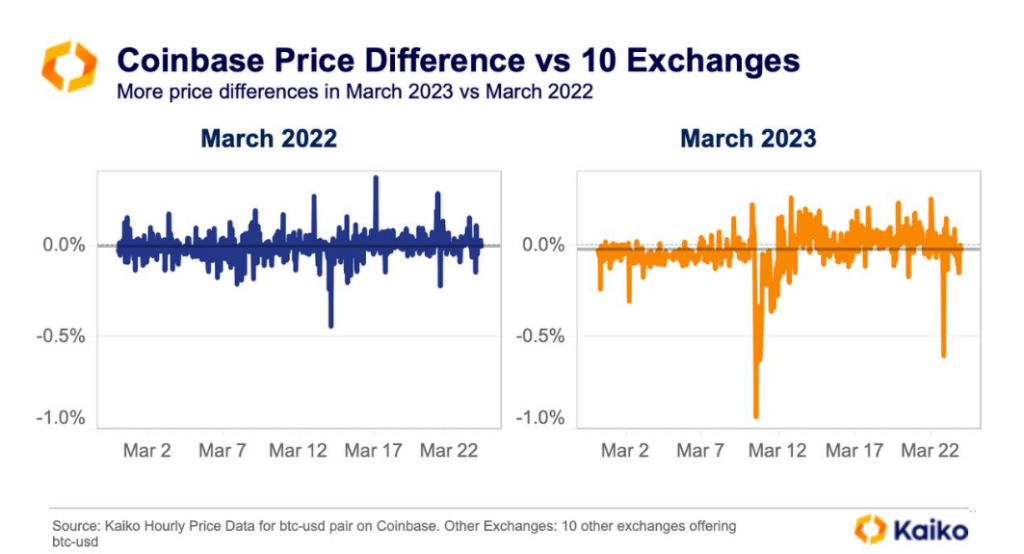

Bitcoin liquidity is much lower than during the same period last year, manifesting as more significant price differences across top exchanges.

Image credit: Kaiko

This was expected after the closures of crypto-facing banks such as Silvergate and Signature. In the short run, much is expected of tomorrow’s Consumer Price Index (CPI) report. If the new inflation numbers exceed expectations, the Fed will have to double down on “higher for longer.”

FactSet’s CPI estimate for March is 5.2%. However, for the Fed to consider rate hikes sooner, the CPI would have to be considerably lower than expected. Bitcoin’s rally should absorb even more investor energy in the latter scenario. Otherwise, back to below $30k is likely.

***

Neither the author, Tim Fries, nor this website, The Tokenist, provide financial advice. Please consult our website policy prior to making financial decisions.

Disclaimer: This article was originally published on The Tokenist. Check out The Tokenist’s free newsletter, Five Minute Finance, for weekly analysis of the biggest trends in finance and technology.