Cryptocurrencies went on a deep dive today. Some blame new futures, others cite technical factors.

Bitcoin sank slowly all day then cascaded over a steep waterfall at about 1:30PM.

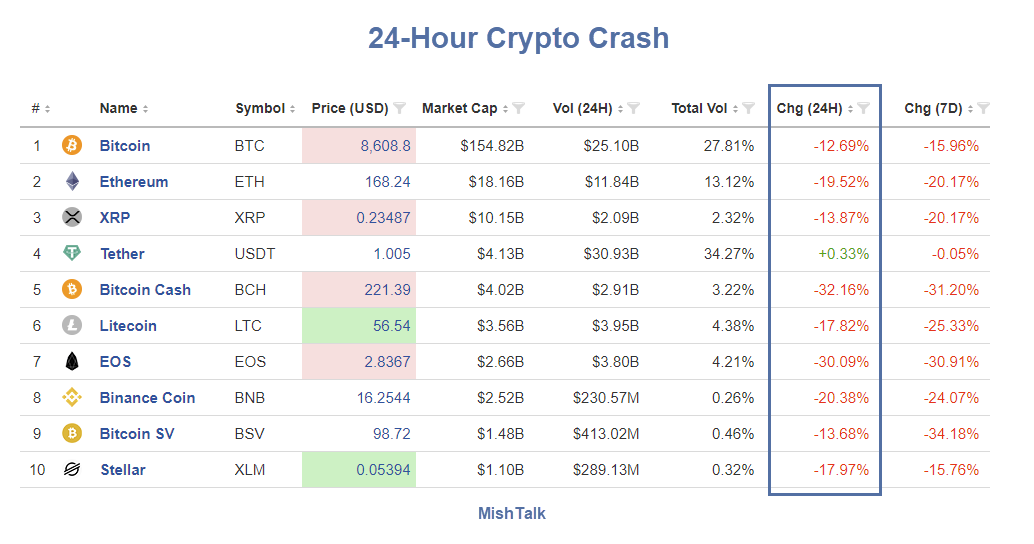

24-Hour Crypto Crash

Altcoins Lead Cryptocurrencies Lower

Bloomberg reports Altcoins Lead Cryptocurrencies Lower After Bitcoin Futures Start Slow

Bitcoin tumbled as much as 17% to $8,087, the most on an intraday basis since January 2018. So-called alternative coins such as Ether and Litecoin slumped even more, declining as much as 25% and 21%, respectively.

As often is the case with digital assets, multiple reasons are being cited by traders for the decline, from the lackluster introduction of one-day Bitcoin deliverable futures Monday to a general risk-off atmosphere with U.S. equity markets taking a downturn Tuesday afternoon.

“Price action is being driven by short-term technical analysis right now, as every low price that Bitcoin has bounced off of, and every high price that has been reached has proven to be resistance,” Jeff Dorman, chief investment officer at Arca, a Los Angeles-based asset manager that invests in cryptocurrencies, said in an email. “Because crypto is still dominated by short-term focused traders, these telegraphed narratives often become self fulfilling prophecies.”

Surprised Not

Take your pick of reasons but I am certainly not surprised.

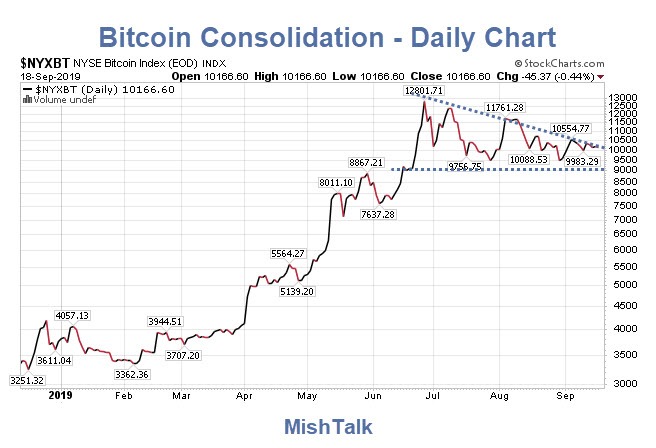

Six days ago I commented Technically Speaking, Bitcoin Ripe for Major Move: Which Way?

Here is the chart I posted.

I posted a weekly chart as well that also suggested a major move. But his might not even be it. and If it is, it's likely just the start of a big move.

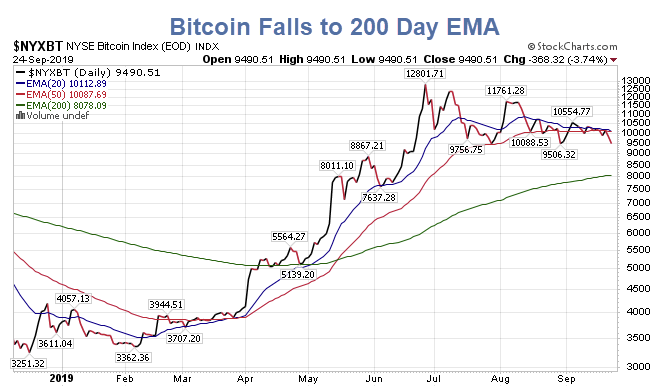

Stockcharts does not have today's action yet, but here's another set of charts to consider.

Bitcoin Falls to 200 Day EMA

Bitcoin fell to its 200 EMA Exponential Moving Average today. Had I posted those overlays a week ago I would have suggested the $8,000 level.

Looking ahead, the next chart is more interesting.

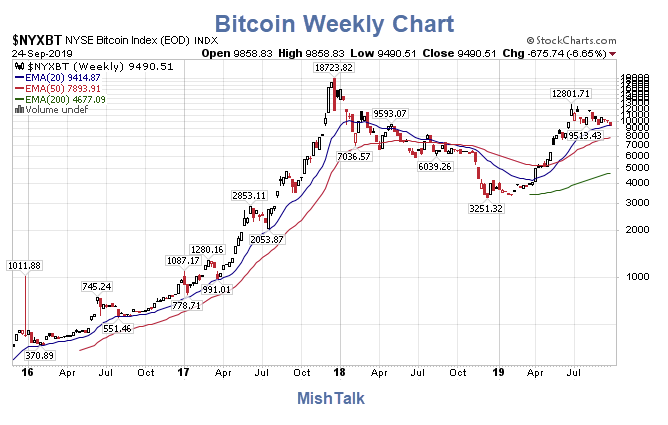

Bitcoin Weekly Chart

On a weekly basis note that Bitcoin nearly fee to the 50 EMA, which is $7893. It's no wonder traders came in near that level today.

Will it hold? No one knows, certainly not me.

But assuming the waterfall move today is not a headfake, then a test of 4,500 level or so seems likely.

How Am I Playing This?

I am not.

I have no position and I do not intend to have a position but I do not rule out a tiny position at some point.

This is why.

"Bitcoin Thursday" Coming

Note: I posted a discussion of "Bitcoin Thursday" previously. But new material follows. I received comments from readers to that discussion and I address them below.

Skip to "Reader Comments" for new material.

Bitcoin is a free market construct so I do not root against it no matter how obnoxious many of the Bitcoin promoters are.

However, the moment Bitcoin threatens central banks it will be squashed in seconds just as the Hunt Brothers were squashed on "Silver Thursday" for cornering the silver market in 1980.

Nelson Bunker Hunt, Lamar Hunt, and William Herbert Hunt, the sons of Texas oil billionaire Haroldson Lafayette Hunt, Jr., had for some time been attempting to corner the market in silver. In 1979, the price for silver (based on the London Fix) jumped from $6.08 per troy ounce ($0.195/g) on January 1, 1979 to a record high of $49.45 per troy ounce ($1.590/g) on January 18, 1980, which represents an increase of 713%. The brothers were estimated to hold one third of the entire world supply of silver (other than that held by governments). The situation for other prospective purchasers of silver was so dire that on March 26, 1980 the jeweller Tiffany's took out a full page ad in The New York Times, condemning the Hunt Brothers and stating "We think it is unconscionable for anyone to hoard several billion, yes billion, dollars' worth of silver and thus drive the price up so high that others must pay artificially high prices for articles made of silver".

But on January 7, 1980, in response to the Hunts' accumulation, the exchange rules regarding leverage were changed, when COMEX adopted "Silver Rule 7" placing heavy restrictions on the purchase of commodities on margin. The Hunt brothers had borrowed heavily to finance their purchases, and, as the price began to fall again, dropping over 50% in just four days, they were unable to meet their obligations, causing panic in the markets.

The Hunt brothers had invested heavily in futures contracts through several brokers, including the brokerage firm Bache Halsey Stuart Shields, later Prudential-Bache Securities and Prudential (LON:PRU) Securities. When the price of silver dropped below their minimum margin requirement, they were issued a margin call for $100 million. The Hunts were unable to meet the margin call, and, with the brothers facing a potential $1.7 billion loss, the ensuing panic was felt in the financial markets in general, as well as commodities and futures. Many government officials feared that if the Hunts were unable to meet their debts, some large Wall Street brokerage firms and banks might collapse.

To save the situation, a consortium of US banks provided a $1.1 billion line of credit to the brothers which allowed them to pay Bache which, in turn, survived the ordeal. The U.S. Securities and Exchange Commission (SEC) later launched an investigation into the Hunt brothers, who had failed to disclose that they in fact held a 6.5% stake in Bache.

Corner Bitcoin?

I do not propose anyone will "corner" Bitcoin, but theoretically it could happen.

Instead, I do propose central banks will suddenly, without warning, change investment rules on Bitcoin if the price gets high enough for central bankers to be threatened.

That is what happened with silver.

What is that price?

I don't know, nor does anyone else. It will only be observable after the fact.

If you think Bitcoin is immune to central bank actions, you are only nuts.

Best Thing for Bitcoin

The best thing for Bitcoin would be if it consolidates in a reasonable range of say $4,000 to $12,000 for decades.

Only after a long, non-threatening period of stability will bitcoin be viable as a transaction mechanism as opposed to a speculation mechanism.

I do not expect Bitcoin to play out that way. I admit it could.

Too the Moon

To the Moon, Alice?

You better hope you cash out in time.

Reader Comments

I wrote about "Bitcoin Thursday" before. Here are a couple of reader comments and my replies to them.

Ballistic Bunny: While governments can do things like "ban Bitcoin" or screw with exchange rules on, e.g., KYC/AML, Bitcoin itself doesn't rely on bank-issued contracts on which the rules can be changed arbitrarily. Anyone can (and everyone should) take "physical" possession of what they purchase on exchanges by moving it to keys they personally control. This has been standard practice for years, and the phrase "not your keys, not your Bitcoin" is parroted constantly in the community.

JayTe: Mish, you do know that one of the properties of bitcoin is that you can exchange them irrespective of the authorities. And there are plenty of ways of anonymity the transaction.

Mish Reply: OK you have your keys. I am even willing to assume governments cannot get them. But can you? If you cannot spend the Bitcoins or buy anything with them, they are in fact worthless. All governments have to do is declare Bitcoin transactions illegal.

Let's assume that BB and JT are both correct and people can actually get money into Bitcoin, illegally. Let's further assume that Bitcoin holders can trade bitcoin anonymously among themselves.

I find that preposterous but let's assume that is really the case.

My key point remains, Bitcoin holders will not be buying anything at a major retail outlet or for that matter anywhere else legitimate.

Instead Bitcoin holders will be restricted to bartering bitcoins with those willing to defy the law. The implied assumption (and a false one) is other Bitcoin holders have something each other wants and can get it to them.

I suspect a shutdown would start in China. If the US ever went along it would be lights out immediately.

I do not believe we are at that point, or close to it yet but if central banks ever feel threatened we will get to that point in a flash, without warning.