From a fundamental perspective, the rise in oil prices comes down to simply supply and demand.

Crude oil ticked down slightly to start this week’s trade, but the dominant trend over the last several quarters has been bullish.

From a fundamental perspective, the rise in oil prices comes down to simply supply and demand. With China starting to loosen its COVID lockdowns in major cities like Shanghai and Beijing, demand is coming back online in the world’s second-largest economy. Meanwhile, the US “driving season” is ramping up, with data showing that US consumers are not yet cutting back meaningfully on gasoline purchases despite high prices.

On the supply side, sanctions against Russia (which provided 14% of global oil supply last year) have pushed most of Western Europe to source oil from more far-flung locations, driving up freight costs. Though OPEC and its allies agreed last week to pump an extra 648K barrels per day, 200K more than anticipated, analysts are skeptical that the cartel will be able to meaningfully increase capacity after years of underinvestment in production; yesterday, Saudi Arabia announced that it was raising the price of its oil by $2.10 per barrel for Asian buyers, underscoring the tight nature of the market. Put simply, the oil market already featured higher demand than supply before the war between Russia and Ukraine cut supplies on the global market further.

Technical view: WTI Crude Oil (US OIL)

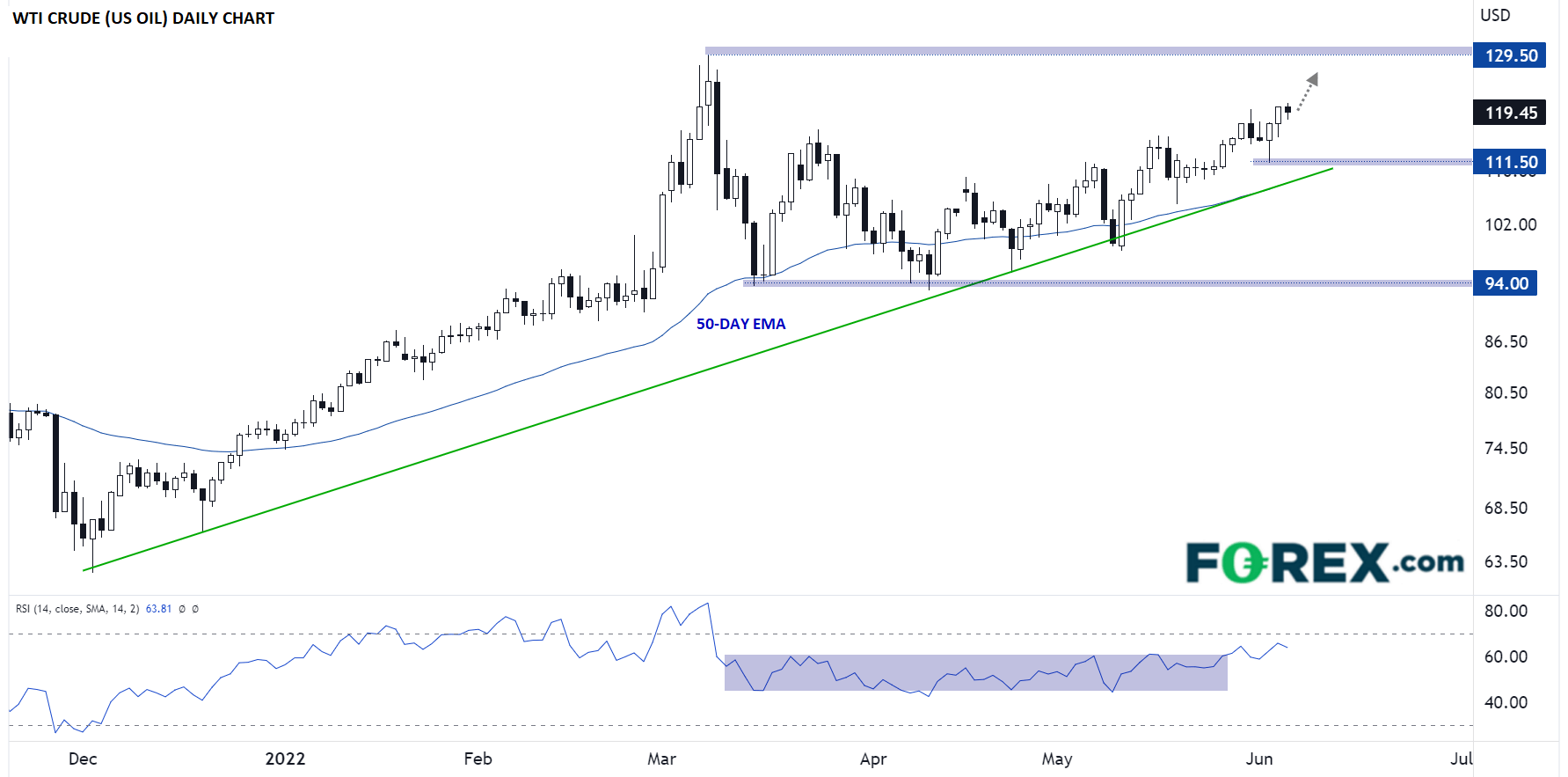

As we noted above, oil has been trending higher for months, culminating (so far) in the early-March spike to nearly $130. Now, after consolidating around the $100 level through April and early May, bulls are once again eyeing higher prices.

As the chart below shows, WTI crude oil has been bouncing off a bullish trend line since December, and Friday marked the second-highest daily close for the commodity in the last 14 years. As long as rising trend line support (currently around 108.50) holds, the bulls will remain in control of the market for a potential retest of the March highs near $130 in the coming weeks.

Source: StoneX, TradingView