Swiss central bank went to great lengths to cut short a major contagion in the making.

Despite a string of multiple bad calls and scandals over the last five years, Credit Suisse (NYSE:CS) was among the top 30 banks to be considered ‘Global Systemically Important Bank'. In the previous eight days, the bank’s stock had lost 75% of its value and was eventually subject to a takeover bid by rival UBS (SIX:UBSG) in a deal supported by the Swiss government.

In this light, what does the Credit Suisse ‘bailout’ tell us about the current state of banking?

Credit Suisse to Become UBS

On Sunday, Credit Suisse issued a press release on the merger with UBS bank. According to the Financial Stability Board (FSB) that emerged from the ashes of the Great Financial Crisis of 2008, UBS is also designated as a global systemically important bank (G-SIB).

Both Credit Suisse and UBS are headquartered in Switzerland as multinational investment banks. The merger between Credit Suisse with UBS will leave UBS as the surviving entity once the deal is finalized by the end of 2023 under these conditions:

- Credit Suisse shareholders are to receive 1 UBS share for 22.48 Credit Suisse shares.

- Switzerland’s central bank, the Swiss National Bank, will provide extra liquidity access to Credit Suisse during the restructuring.

- Personnel from Credit Suisse will continue employment as UBS appoints new leadership and integrates the bank’s operations under UBS.

The merger took motion once UBS upped its offer to buy Credit Suisse for $3.25 billion, following the $1 billion offer rejection by the Credit Suisse board. On Friday, Credit Suisse’s closing price was CHF1.86 (CHF1 = $1.0732). Therefore, even with UBS upping its offer from 0.25 to 0.50 per share in its stock, the CS buyout was heavily discounted.

Accordingly, CS shareholders will take a significant loss as they receive CHF0.76 in UBS shares for CS stock worth CHF1.86 just a few days ago. Axel P. Lehmann, Chairman of the Board of Directors of Credit Suisse, framed the UBS-Credit Suisse merger as the best outcome:

“Given recent extraordinary and unprecedented circumstances, the announced merger represents the best available outcome.”

Indeed, Credit Suisse’s merger with UBS was underpinned by multiple unprecedented events. The ending of the 167-year-old bank was hastily arranged over the weekend, which does not bode well for consumer confidence.

Extraordinary Bailout of Credit Suisse

Also on Sunday, the Swiss National Bank issued a press release on its CHF100 billion ($108 billion) to facilitate UBS’ takeover of Credit Suisse. The central bank clarified that “both banks have unrestricted access to the SNB’s existing facilities.”

A federal default guarantee backs the CHF100 billion liquidity assistance loan. If the borrower fails to repay its obligations, the SNB commits to selling government bonds and other debt securities.

This is the first such intervention since the Great Financial Crisis of 2008.

Typically, such federal default guarantees are implicitly assumed to boost consumer confidence in the banking system. The problem is that the SNB reported an annual 2022 loss of CHF 132.5 billion ($143B). This is the deepest loss in the central bank’s 116-year history, almost all coming from foreign currency positions, at CHF131.5 billion.

Image credit: Trading View

As the Federal Reserve started hiking interest rates in 2022, the Dollar Strength Index (DXY) kept rising, while the CS stock kept plummeting.

Such loss is somewhat surprising given that the Bank for International Settlements (BIS) warns explicitly that “There are many activities of banks which involve risk-taking, but there are few in which a bank may so quickly incur large losses as in foreign exchange transactions.”

Compared to a year prior, in 2021, the SNB profited from foreign currency positions at CHF25.7 billion.

In addition to SNB’s shaky financial legs, while simultaneously providing up to CHF100 billion as a loan for the UBS-Credit Suisse merger, law-tweaking was also needed. Under normal circumstances, UBS shareholders had to vote on the merger, which had been circumvented before Monday.

“I have never seen such measures taken; it shows how bad the situation is.”

Vincent Kaufmann, CEO of Ethos Foundation, representing Swiss pension funds.

The abrupt law change by the Swiss government makes the UBS-Credit Suisse merger one of a kind.

The Credit Suisse Collapse Rife with Omens

Last November, Credit Suisse estimated a $1.6 billion loss in Q4 following a sustained $88.3 billion bank run. In 2022, the bank suffered a CHF160 billion ($173 billion) deposit exodus, with CHF111 billion just for Q4.

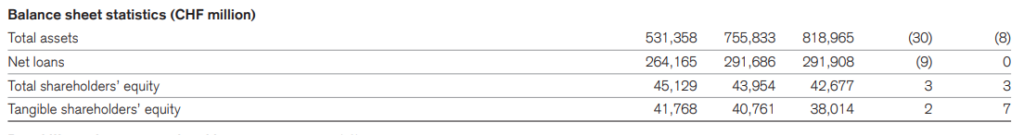

Starting at the end of 2022, from left to right, Credit Suisse shrunk its total asset size by -35% compared to 2020. Image credit: Credit Suisse

It was no coincidence that CS’s deposit withdrawals have ramped up since 2020. Early that year, CS CEO Tidjane Thiam had to resign after a spying scandal came into the public spotlight. After his departure to competitive UBS, the bank hired private investigators to spy on CS’s former wealth management head, Iqbal Khan.

The spy scandal resulted in the suicide of one of the private investigators.

After Thomas Gottstein took the CS reins in February 2020, he lasted until July 2022. The following month, CS was found guilty of money laundering assets belonging to the Bulgarian mafia from the decade prior. Although the fine was tiny, at $2.1 million, CS became the first major Swiss bank involved in such criminal proceedings.

However, the lack of due diligence by CS was far more damaging. In April 2021, the bank found itself in a $4.7 billion bind following the machinations of “Bill Hwang’s” Archegos Capital. Altogether, Credit Suisse managed to fashion public perception as the bank riddled with cultural rot.

This article was originally published on The Tokenist. Check out The Tokenist’s free newsletter, Five Minute Finance, for weekly analysis of the biggest trends in finance and technology.

***

Disclaimer: Neither the author, Tim Fries, nor this website, The Tokenist, provide financial advice. Please consult our website policy prior to making financial decisions.