In a rare breakdown of its lock-step move with gold, silver is down almost 4% over the past two weeks.

Gold, on the other hand, has barely moved since November began, with all eyes on the outcome of the Federal Reserve’s policy meeting today—and what that could mean for the yellow metal, stimulus-taper wise.

All charts courtesy of skcharting.com

So, is this disruption—temporary as many deem it to be—good for silver? Especially with the latest selloff making it a cheaper buy, hence boosting its attractiveness and potential to be a target for value-seekers?

Possibly, on the surface of it. But even without that, if one scratches deeper, there are compelling reasons to invest in silver right now.

Gold’s ‘Poorer Cousin’ Is A Rich Choice, Fundamentally

Silver has solid industrial-based fundamentals, but it has been playing second fiddle to gold in recent years, meaning a rally without the yellow metal seldom survives.

More than 50% of silver’s demand originates from industrial use. As a malleable metal, it is just as good as gold for jewelry making. It is also a good conductor of electricity, and used extensively in the manufacture of electronics components.

The transition to clean energy is expected to drive physical demand for silver in the coming years, particularly for connections in electric vehicles and for components within solar panels. The rollout of fifth generation (5G) telecom networks is also set to become a growing source of demand. But these demand factors are likely to play out in a big way for silver in the future, not right away.

For now, silver’s uses across a range of industrial applications have an effect on its price—when manufacturing activity rises, the price increases due to high demand, while a fall in activity, such as during a recession, pulls the price lower.

For that reason, monthly manufacturing PMI, or Purchasing Managers’ Indexes from around the world, is an important gauge of silver demand, as it provides an indication of industrial activity.

The global PMI compiled by JP Morgan and IHS Markit fell to a six-month low of 54.1 in August 2021 from 55.4 in July as output growth lost momentum in several major markets (a number above 50 indicates an expansion in manufacturing activity, while a figure below that points to a contraction). This significantly weighed on silver in recent months.

Adding to that bearish factor has been speculation since June on when the Federal Reserve will be ready to roll back the generous monthly stimulus of up to $120 billion that it has carried out since March 2020. That speculation weighed on gold previously and affected prices of silver as well.

Both these clouds have cleared now. JPM’s global PMI reading steadied at 54.1 in September.

The Fed, meanwhile, affirmed last month through the published minutes of its September policy meeting that the taper of its long-running stimulus would likely begin in November or December and conclude by the middle of next year.

With the central bank holding its October meeting today, expectations are rife that Chairman Jerome Powell will bring markets a step closer to the Fed’s plans on the taper.

The Fed has indicated a monthly roll back of $15 billion that would terminate in eight months the $120 billion it was spending each month to buy bonds and other assets to support the economy since COVID-19 turned into a pandemic.

The Fed has also stressed that it is not in any rush to hike interest rates held at between zero and 0.25% since the start of the pandemic. That has spared gold from a mauling, though it has been unable to recapture the $1,800 berth.

Silver futures traded on New York’s COMEX had their first positive month after four in the red in October, rising 8.63% for its best performance since December 2020, when it rose 16.8%.

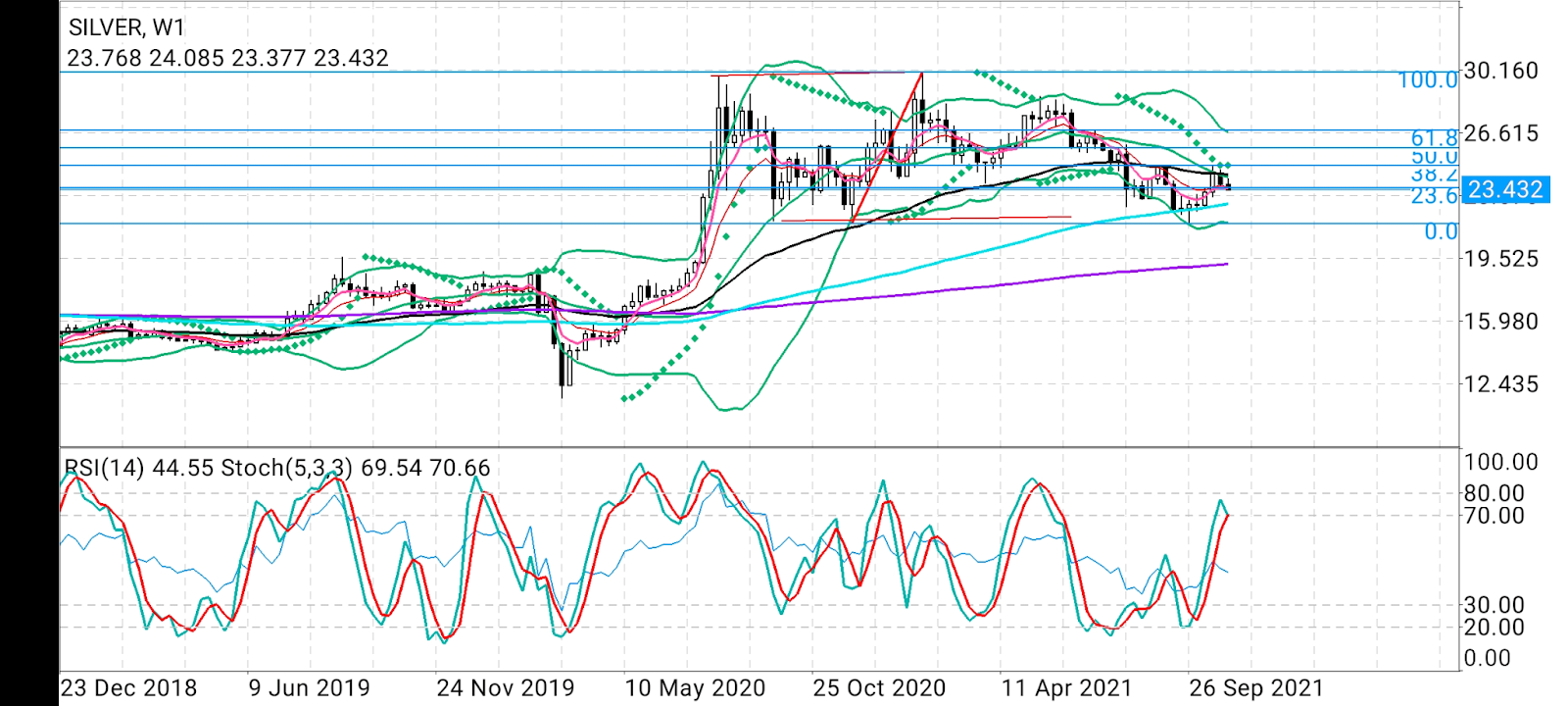

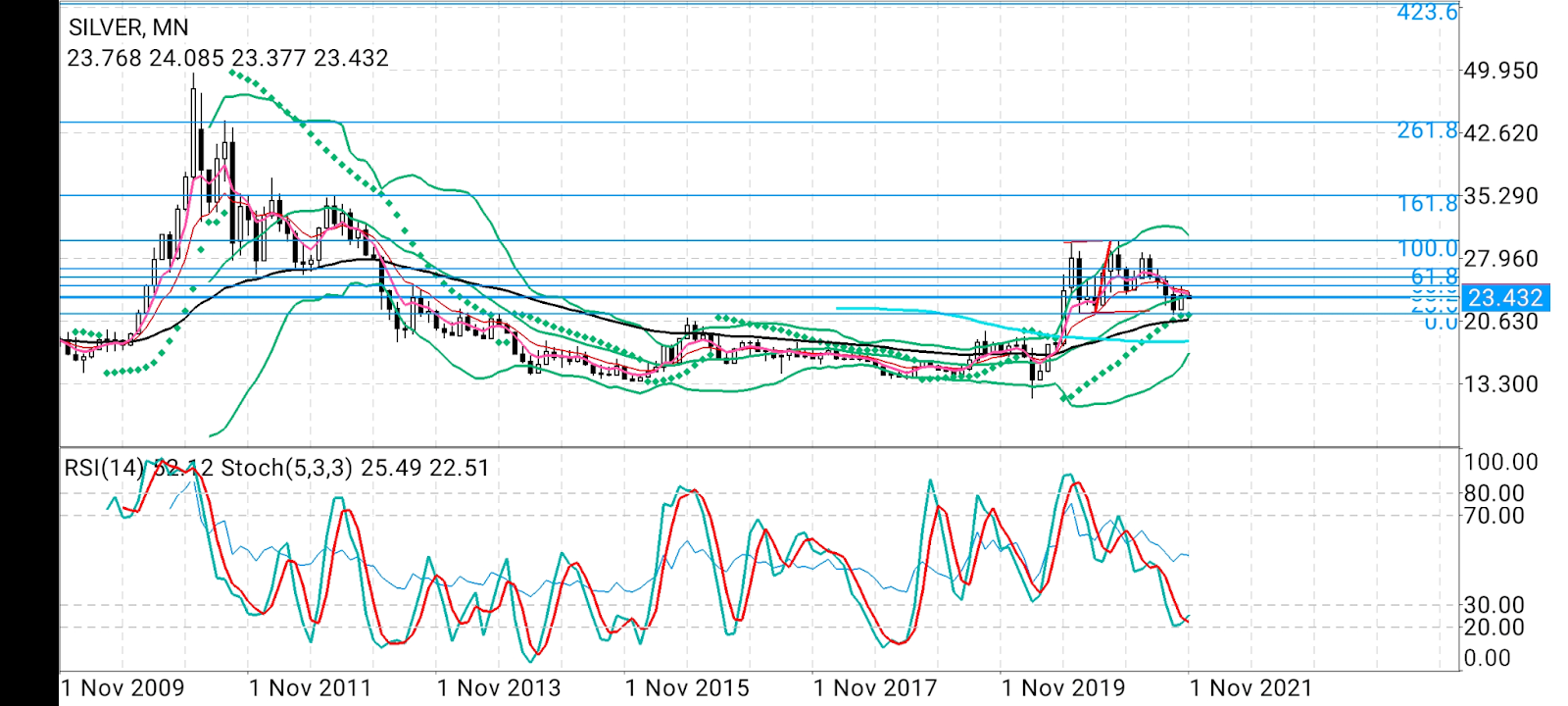

Technicals: Spot Silver Capable of $25.78 High And $21.57 Low

In Wednesday’s pre-New York session, the spot price of silver hovered at $23.45 an ounce. We'll use the spot price for our analysis given its relative stability

Sunil Kumar Dixit, chief technical strategist at skcharting.com, says silver’s recent sideways move can bring the spot price a little lower to the $22.63-$22.40 rung, before its next move. He adds:

“A retest of $22.63-$22.40 levels and bouncing back from the lows can help spot silver resume its bullish patterns and await to breach the $24.80 neckline for higher targets starting with $25.78, which is the 50% Fibonacci level of retracement measured from the $21.88 low (of Nov 2020 ) to $30.06 high (of Jan 2021).”

But failure to hold above the 100-week Simple Moving Average of $22.63 can invalidate the so-called inverted head and shoulder formation and expose silver to a major low of $21.57, Dixit cautioned.

In conclusion, he added:

“Silver’s bullish potential after its recent sideways move should be enough for some risk takers staking a bet that it will probably move higher rather than lower from here.

“Yet, given the prevailing price action, buyers should probably wait until silver reverses upwards and sustains above $23.53 for capturing the higher targets of $24.78 and $25.78. As long as the price sustains below $23.53, selling may continue for a retest of $22.63.”

Disclaimer: Barani Krishnan uses a range of views outside his own to bring diversity to his analysis of any market. For neutrality, he sometimes presents contrarian views and market variables. He does not hold a position in the commodities and securities he writes about.