Here are the latest charts and statistics for the Commitment of Traders (COT) data published by the Commodities Futures Trading Commission (CFTC).

The latest COT data is updated through Tuesday, Mar. 1, and shows a quick view of how large traders (for-profit speculators and commercial entities) were positioned in the futures markets.

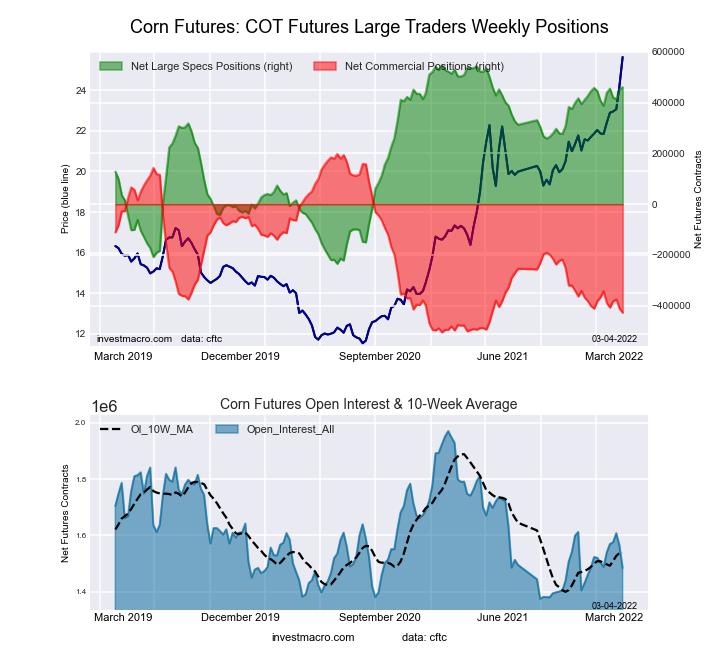

Highlighting the COT soft commodities data is the continued gains in the Corn Futures bets. The speculative net position in the Corn futures rose this week for a second consecutive week and for the fourth time in six weeks.

Corn speculator bets had risen by a total of +46,446 contracts over these past two weeks and pushed the current net speculator standing to the highest level in the last forty-two weeks, dating back to May 11 of, 2021 when the net position totaled +500,856 contracts. The Russian invasion of Ukraine has boosted already rising soft commodities markets with Corn, Soybeans Futures, and Wheat seeing especially sharp gains in the past two weeks.

The soft commodities that saw higher bets this week were Corn (9,196 contracts), Sugar (9,293 contracts), Soybean Oil Futures (1,859 contracts), Soybean Meal (1,083 contracts), Cotton Futures (1,526 contracts) and Wheat (10,345 contracts).

The soft commodities that saw lower bets this week were Cocoa (-16,484 contracts), Lean Hogs (-5,199 contracts), Coffee (-5,885 contracts), Soybeans (-7,557 contracts) and Live Cattle (-23,204 contracts).

CORN Futures

The CORN large speculator standing this week reached a net position of 460,938 contracts in the data reported through Tuesday. This was a weekly increase of 9,196 contracts from the previous week which had a total of 451,742 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish-Extreme with a score of 88.9 percent. The commercials are Bearish-Extreme with a score of 11.0 percent and the small traders (not shown in chart) are Bearish with a score of 23.9 percent.

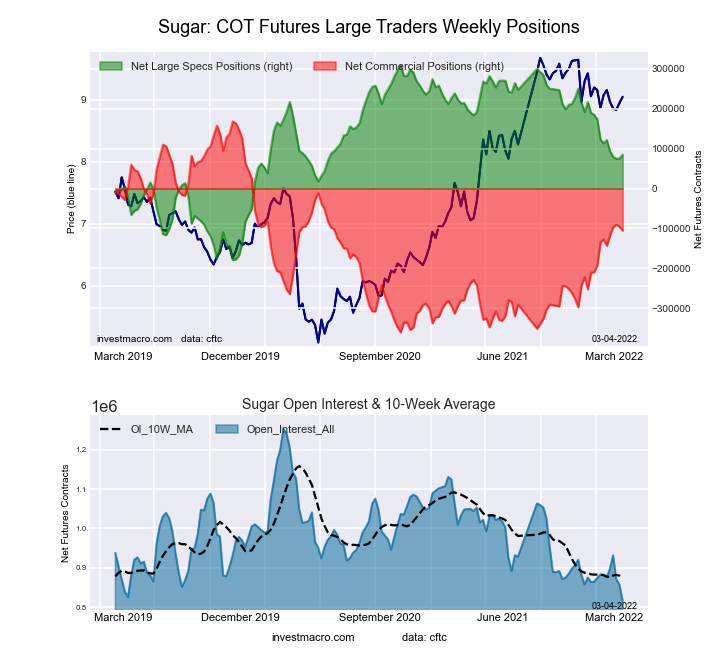

SUGAR Futures

The SUGAR large speculator standing this week reached a net position of 84,539 contracts in the data reported through Tuesday. This was a weekly lift of 9,293 contracts from the previous week which had a total of 75,246 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish with a score of 54.0 percent. The commercials are Bearish with a score of 48.2 percent and the small traders (not shown in chart) are Bearish with a score of 33.6 percent.

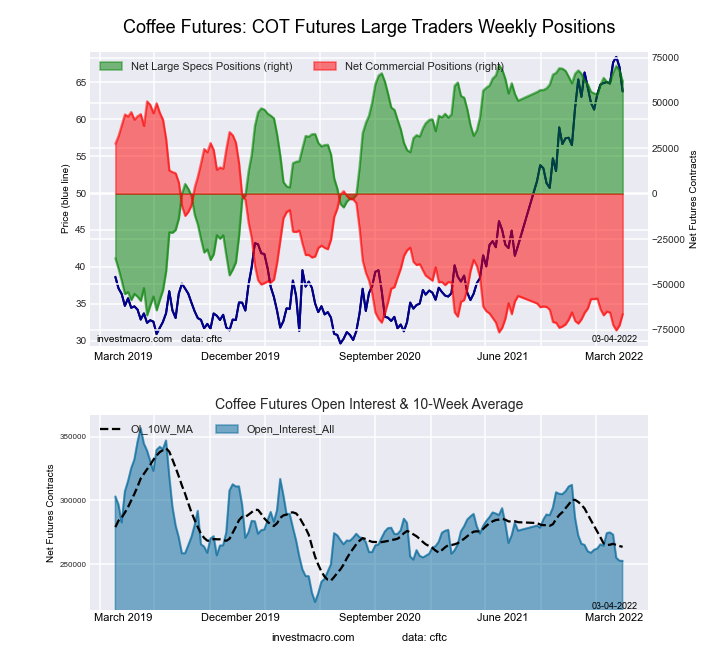

COFFEE Futures

The COFFEE large speculator standing this week reached a net position of 61,906 contracts in the data reported through Tuesday. This was a weekly reduction of -5,885 contracts from the previous week which had a total of 67,791 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish-Extreme with a score of 93.6 percent. The commercials are Bearish-Extreme with a score of 7.9 percent and the small traders (not shown in chart) are Bearish-Extreme with a score of 18.7 percent.

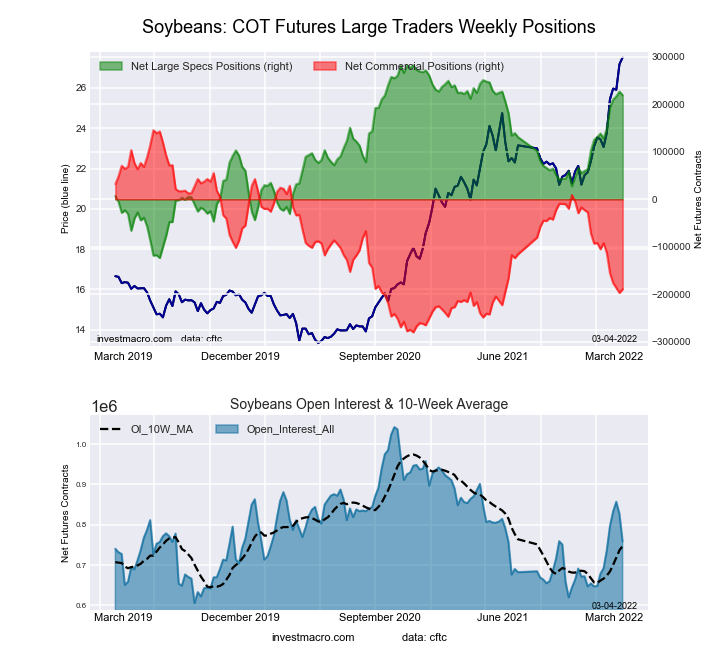

SOYBEANS Futures

The SOYBEANS large speculator standing this week reached a net position of 218,907 contracts in the data reported through Tuesday. This was a weekly lowering of -7,557 contracts from the previous week which had a total of 226,464 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish-Extreme with a score of 84.4 percent. The commercials are Bearish with a score of 21.3 percent and the small traders (not shown in chart) are Bearish with a score of 20.9 percent.

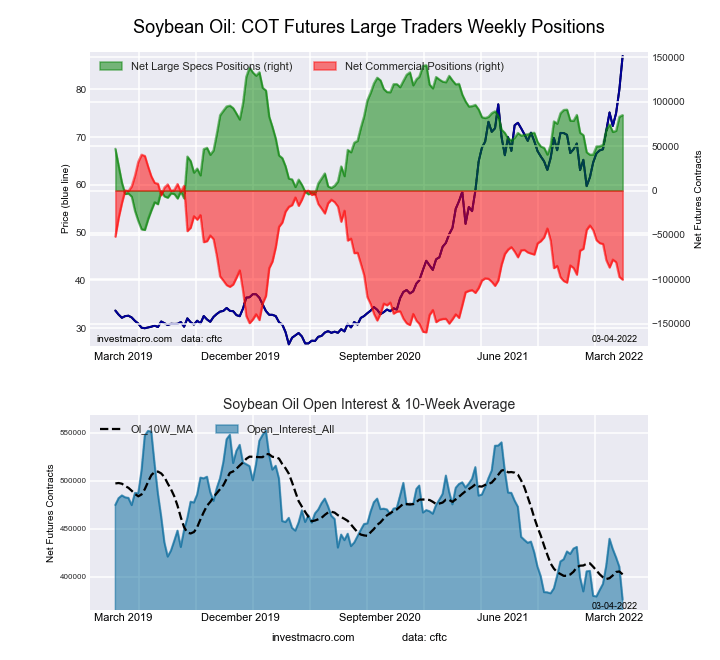

SOYBEAN OIL Futures

The SOYBEAN OIL large speculator standing this week reached a net position of 84,952 contracts in the data reported through Tuesday. This was a weekly increase of 1,859 contracts from the previous week which had a total of 83,093 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish with a score of 69.7 percent. The commercials are Bearish with a score of 29.7 percent and the small traders (not shown in chart) are Bullish with a score of 70.5 percent.

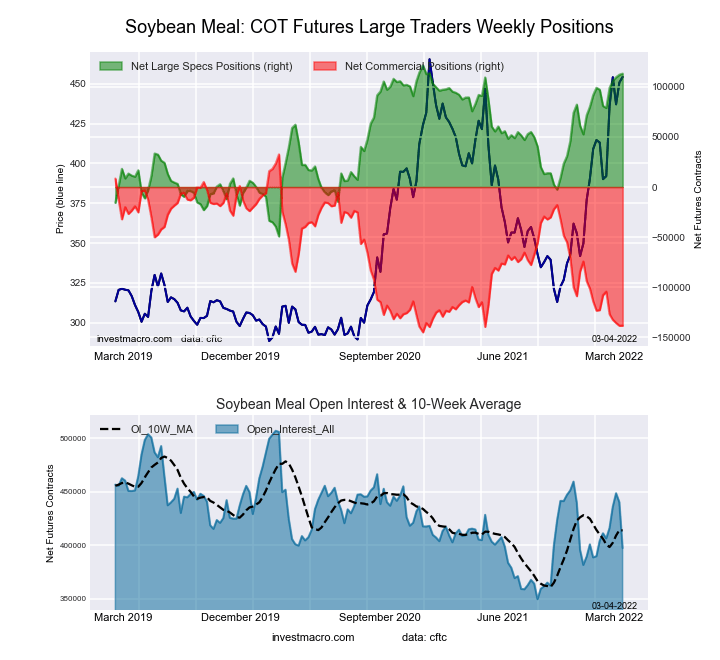

SOYBEAN MEAL Futures

The SOYBEAN MEAL large speculator standing this week reached a net position of 113,183 contracts in the data reported through Tuesday. This was a weekly rise of 1,083 contracts from the previous week which had a total of 112,100 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish-Extreme with a score of 95.1 percent. The commercials are Bearish-Extreme with a score of 3.7 percent and the small traders (not shown in chart) are Bullish with a score of 71.9 percent.

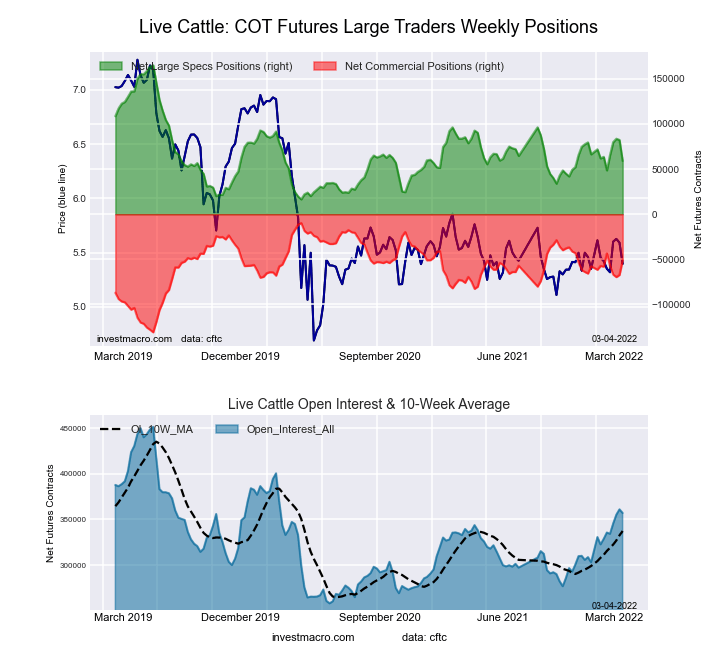

LIVE CATTLE Futures

The LIVE CATTLE large speculator standing this week reached a net position of 59,039 contracts in the data reported through Tuesday. This was a weekly reduction of -23,204 contracts from the previous week which had a total of 82,243 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish with a score of 28.6 percent. The commercials are Bullish with a score of 65.8 percent and the small traders (not shown in chart) are Bullish with a score of 67.9 percent.

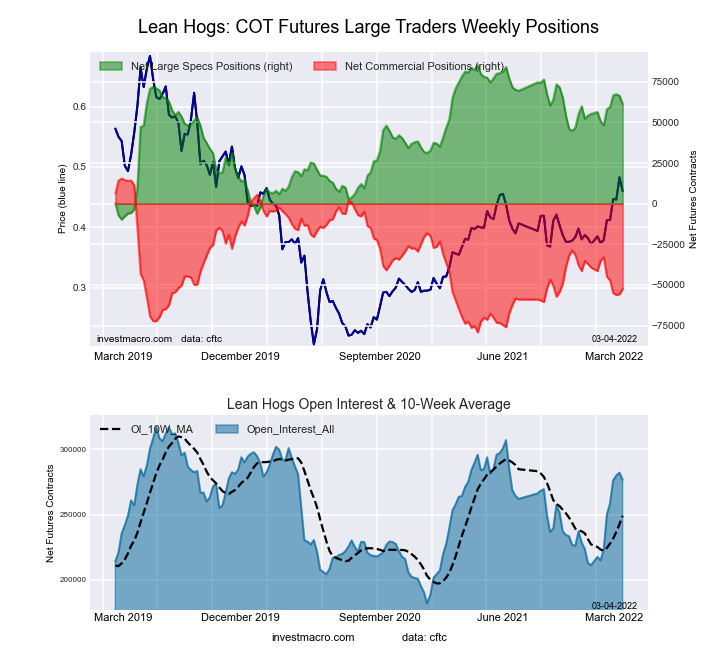

LEAN HOGS Futures

The LEAN HOGS large speculator standing this week reached a net position of 61,239 contracts in the data reported through Tuesday. This was a weekly decrease of -5,199 contracts from the previous week which had a total of 66,438 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish with a score of 73.5 percent. The commercials are Bearish with a score of 29.6 percent and the small traders (not shown in chart) are Bearish with a score of 41.8 percent.

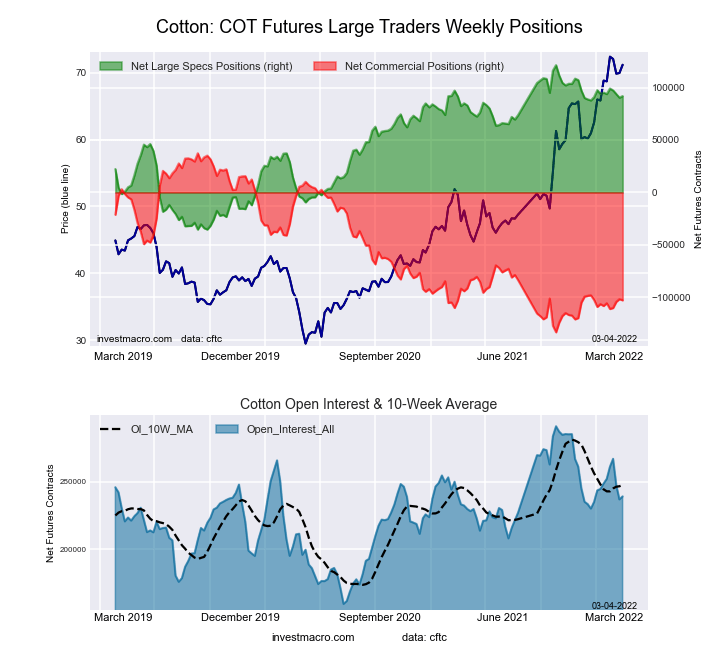

COTTON Futures

The COTTON large speculator standing this week reached a net position of 91,828 contracts in the data reported through Tuesday. This was a weekly rise of 1,526 contracts from the previous week which had a total of 90,302 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish-Extreme with a score of 81.2 percent. The commercials are Bearish-Extreme with a score of 17.8 percent and the small traders (not shown in chart) are Bullish-Extreme with a score of 82.3 percent.

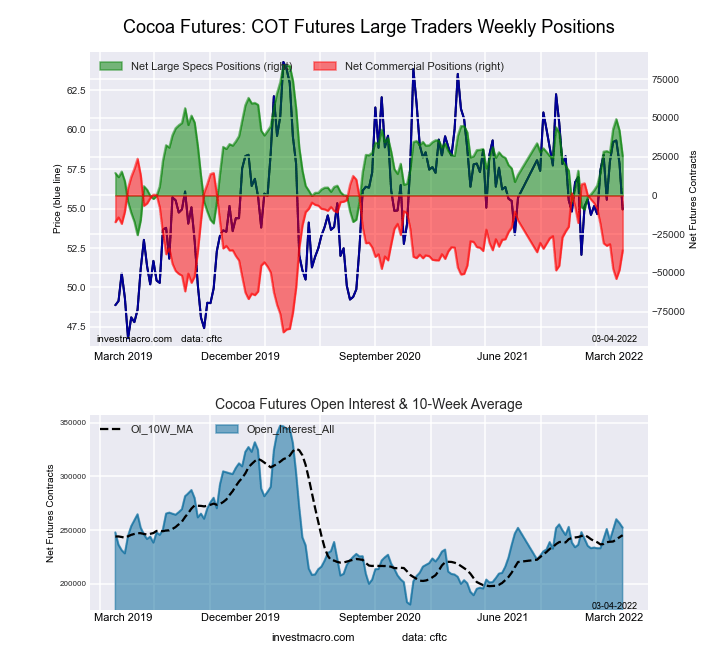

COCOA Futures

The COCOA large speculator standing this week reached a net position of 25,431 contracts in the data reported through Tuesday. This was a weekly fall of -16,484 contracts from the previous week which had a total of 41,915 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish with a score of 46.5 percent. The commercials are Bearish with a score of 47.2 percent and the small traders (not shown in chart) are Bullish-Extreme with a score of 100.0 percent.

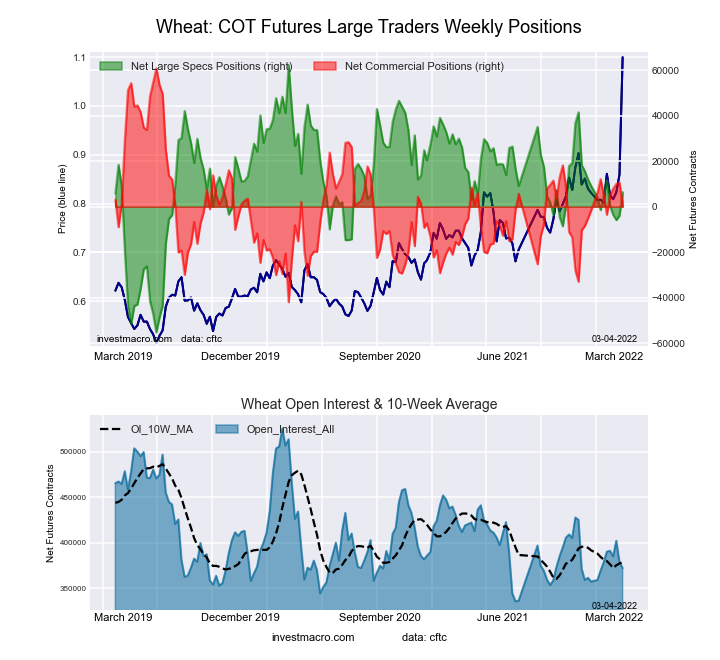

WHEAT Futures

The WHEAT large speculator standing this week reached a net position of 6,443 contracts in the data reported through Tuesday. This was a weekly advance of 10,345 contracts from the previous week which had a total of -3,902 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish with a score of 52.5 percent. The commercials are Bearish with a score of 41.1 percent and the small traders (not shown in chart) are Bullish with a score of 69.4 percent.