Michael Smolyansky, a senior Fed economist, claims corporate profit growth will slow appreciably. His case rests on corporate tax rates and interest rates. Access to his white paper, The coming long-run slowdown in corporate profit growth and stock returns, can be found here.

As if his case was not strong enough, we provide other supporting evidence, including the newfound leverage of employees and labor unions, deglobalization, and long-term economic growth trends.

In the long run, stock prices and returns have a fundamental anchor in the cash flows that companies ultimately provide investors. If profits grow slower than expected, stock return projections must be recalibrated.

Summary of the Fed’s Article

Michael Smolyansky leads his article with the following paragraph:

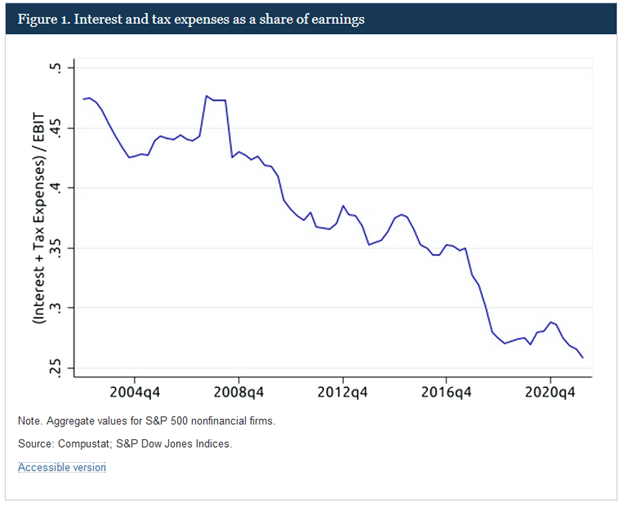

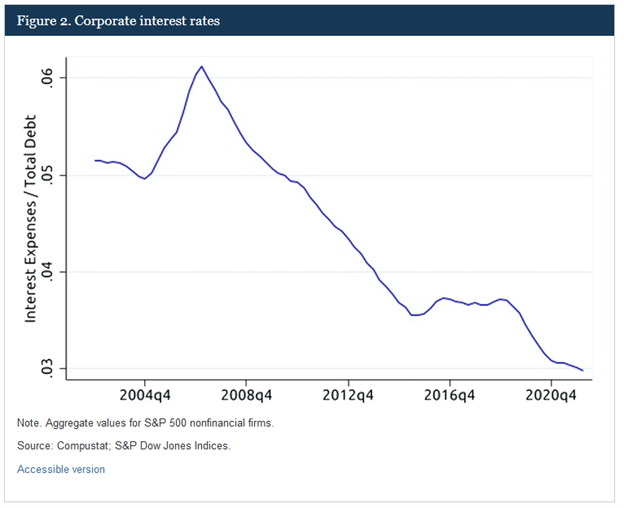

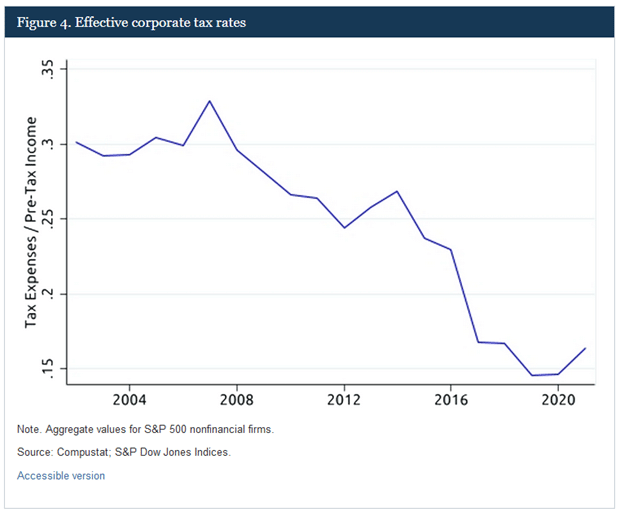

Over the past two decades, the corporate profits of stock market-listed firms have been substantially boosted by declining interest rate expenses and lower corporate tax rates. This note’s key finding is that the reduction in interest and tax expenses is responsible for a full one-third of all profit growth for S&P 500 nonfinancial firms over the prior two-decade period. I argue that the boost to corporate profits from lower interest and tax expenses is unlikely to continue, indicating notably lower profit growth, and thus stock returns, in the future.

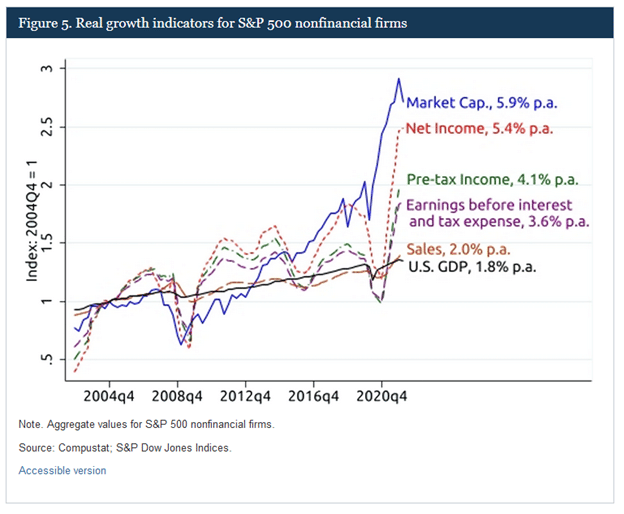

He presents the following graphs to support his case.

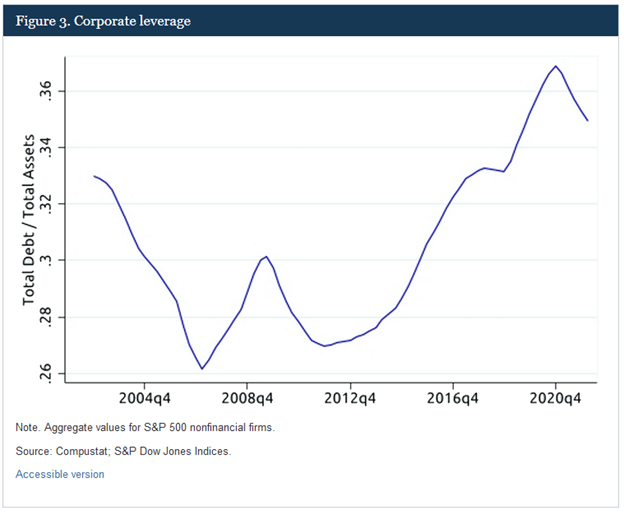

His theory is simple. Low-interest rates and corporate tax rate reductions significantly boosted corporate earnings growth. Further amplifying the above mentioned factors, financial leverage has risen over the past 15 years, as shown below.

In the following graph, he dissects earnings to show how lower taxes, interest rates, and more leverage boosted corporate profit growth. The critical takeaway is that GDP and sales, the sustainable driver of profits, have only been growing by about 2% annually over the last 15 years. Corporate profit growth would have been minimal without the three factors above driving double-digit growth.

Margin Growth

Michael argues that lower interest rates and tax rates boosted profit margins, resulting in earnings growth beyond what the economy dictates.

Can profit margins stay at current levels or expand?

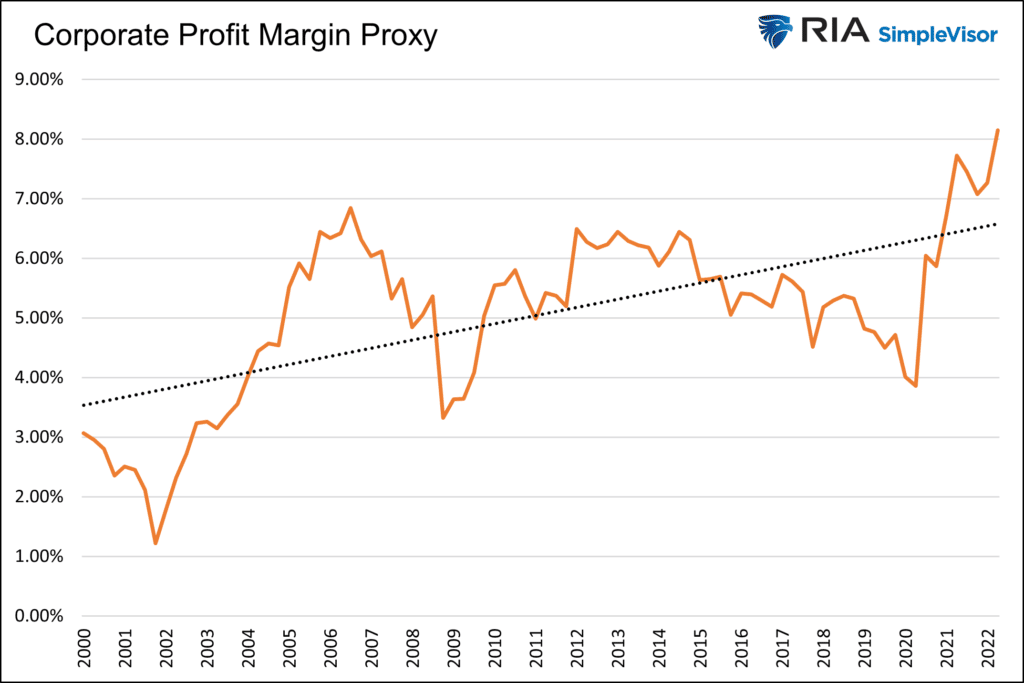

The graph below is a proxy for margins. It calculates an aggregate corporate profit margin based on nonfinancial corporate profits divided by nominal GDP.

Our margin proxy has risen by approximately 3% over the last 20 years.

In addition to corporate taxes and interest rates, corporate margins also benefitted from beneficial trends in labor costs and globalization. Both may work against margins in the future.

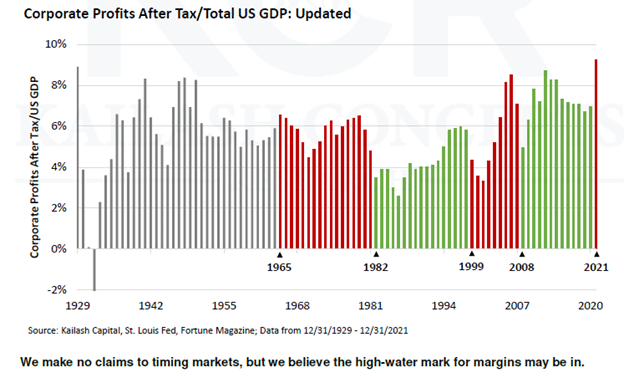

Below, Kailash Concepts provides longer-term perspectives on profit margins. The last time margins were as high as current levels were in 1929.

Per Kailash:

We have watched as corporate investors feasted on a record amount of the pie for nearly 10 straight years.

Over that horizon, we have seen social discord in this country unlike any time we can recall. The Financial Times recently reported that “More than a third of Republicans and Democrats today believe violence is justified to achieve their political ends.” Nobody can predict the future, but this hardly seems to be a backdrop to sustain profit margins last seen in 1929.

Labor costs

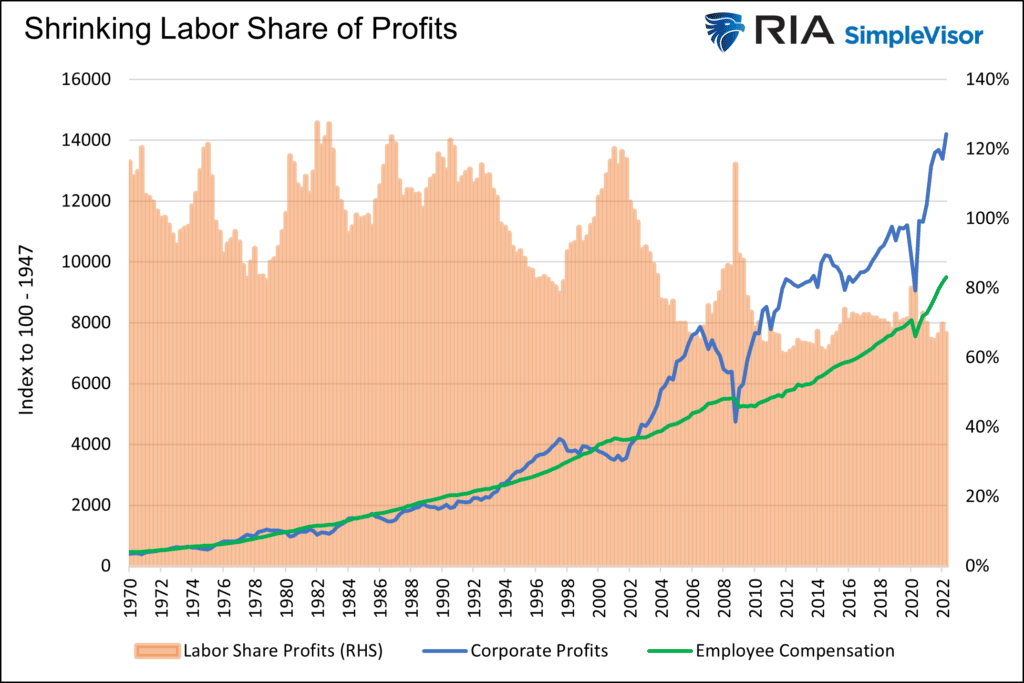

Outsourcing and friendly immigration policies allowed companies to reduce domestic labor costs by increasingly relying on foreign labor at much cheaper wages. The graph below shows that from 1970 to 2000, wages accounted for almost 100% of corporate profits. Over the last twenty years, they averaged 77%.

The recently averted rail workers’ strike and the employee-friendly settlement is just one of many recent events that suggest employees and their unions are gaining leverage over their employers.

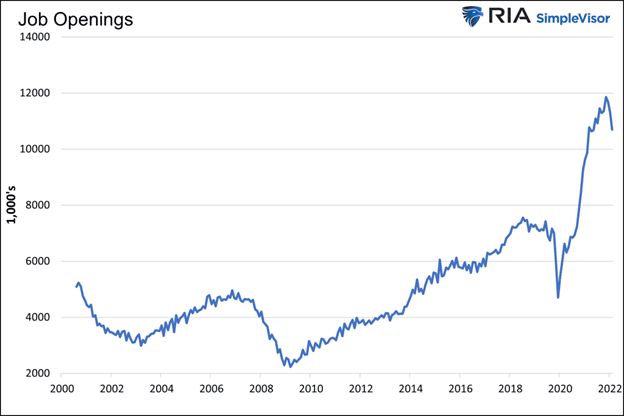

The friendly settlement is a result of extremely tight labor markets. For instance, the number of job openings is over 11 million, almost three times the average from 2000-20019. With an unemployment rate near 50-year lows, filling many of these jobs will be difficult.

The labor tightness will diminish as the economy continues to normalize from the pandemic shock. Further economic weakness will speed up the process.

However, even if the current labor market tightness vanishes, other longer-term macro trends will likely weigh on corporate profits.

Deglobalization and “insourcing” or “friend sourcing” of production will inevitably raise wage expenses. The days of outsourcing to the country with the cheapest labor costs may be over. Domestic labor costs are much higher than in the rest of the world. Sourcing labor to allies may be cheaper but still more expensive than it has been.

Further, stricter immigration policies make cheap labor from new immigrants less available.

Labor market tightness, deglobalization, and immigration trends lead us to believe that employees are finally gaining the upper hand after years of being expendable.

GDP Trends

Earlier, we wrote:

The critical takeaway is that GDP and sales, the sustainable driver of profits, have only been growing by about 2% annually over the last 15 years.

If interest rates and corporate tax rates remain steady or rise in the future, labor demands a bigger share of profits, and deglobalization weighs on profits, margins will shrink.

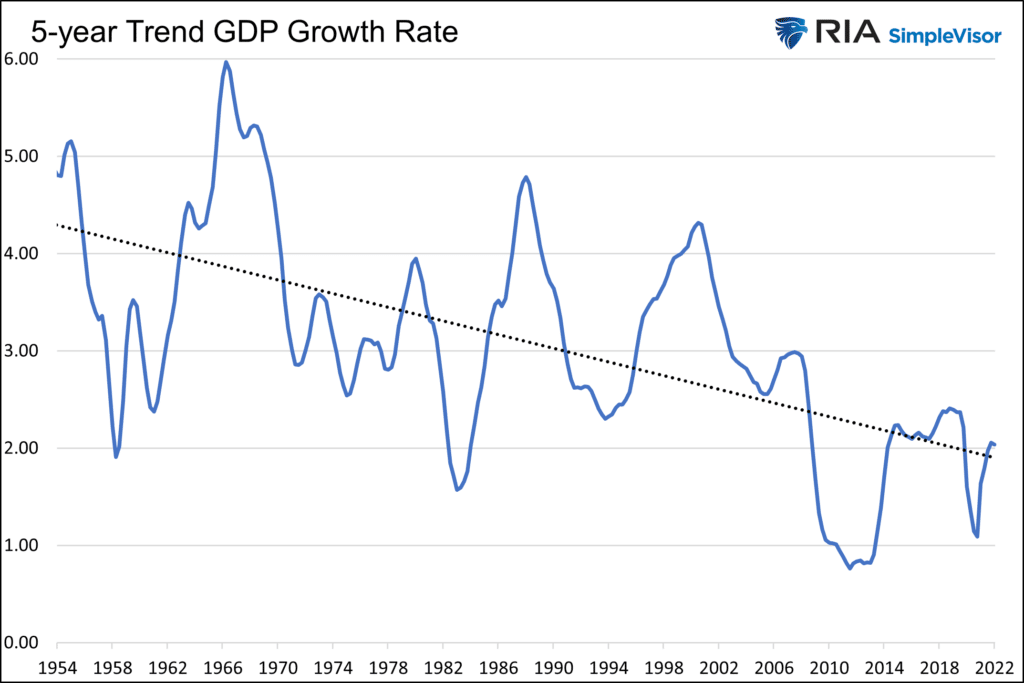

Sales are directly linked to the economy. Therefore, to estimate corporate profit growth, what can we expect from the economy? The graph below helps answer the question. It shows GDP has been trending lower for the last 70 years. The trend will likely continue, given increasing amounts of non-productive debt, slowing productivity growth, and weakening demographic trends.

Summary

Michael Smolyansky makes a great case that recent boosts to profit margins are likely to give way. We add to this theory with compelling arguments that higher labor costs, deglobalization, and weakening GDP growth will also limit corporate profit growth.

Since we piggyback on Michael’s theory, we let him have the final word.

The overall conclusion, then, is that—with the expected slowdown profit growth and the associated contraction in P/E multiples—real longer-run stock returns are likely to be notably lower than in the past.