The U.S.-China phase-one trade deal which took nearly a year is set to be reviewed during this month. The trade negotiators from both sides will be joining this meeting and the progress of the deal will be reviewed since its inception. China pledged to increase its purchase of U.S. goods by $200 billion from its 2017 level. However, coronavirus has clearly made an impact on the purchase and China is running behind by nearly $77 billion in purchases. The import of agriculture goods, something that Donald Trump was most proud of and something that helped him to become more popular among farmers, is lagging the most.

The Dow Jones futures are likely to react adversely to any outcome that indicates that the U.S.-China trade deal could be in jeopardy. The U.S.-China relation is the biggest risk for the U.S. stock market.

Upcoming Economic Numbers

The Dow futures are likely to face higher volatility as we get two important economic readings. Firstly, it is the ADP Non-Farm Employment Change data, a data that usually sets the tone for the US NFP--which is due on Friday. A reading that is better than the forecast is likely to stimulate a stock rally and any disappointment may result in profit-taking. The forecast is 1.2 million while the previous reading was for 2.3 million.

The other important economic data is the ISM- Non-Manufacturing PMI number that is likely to shake the S&P 500 futures. The forecast is for 55 while the previous reading was at 57.1.

Global Stock Market Today

The global stock market had a bit of a mixed day. Stocks advanced in China, the stock rally pushed the Shanghai index higher by 0.15%. The HSI index also advanced 0.36% while the Japanese stock index declined by 0.21%. The Aussie stock index, the ASX index fell by 0.55%.

Gold Prices Made Another Record High

The yellow metal, gold recorded another record high today. The gold price climbed to $2031 per ounce and then retraced to 2,022 level at the time of writing this report. The path of the least resistance for gold is still skewed to the upside and there is enough momentum that can push the gold price toward the $2,500.

Dow Jones And S&P 500 Futures Today

The Dow Jones futures are higher by 60 points but caution is also the name of the game among stock traders.

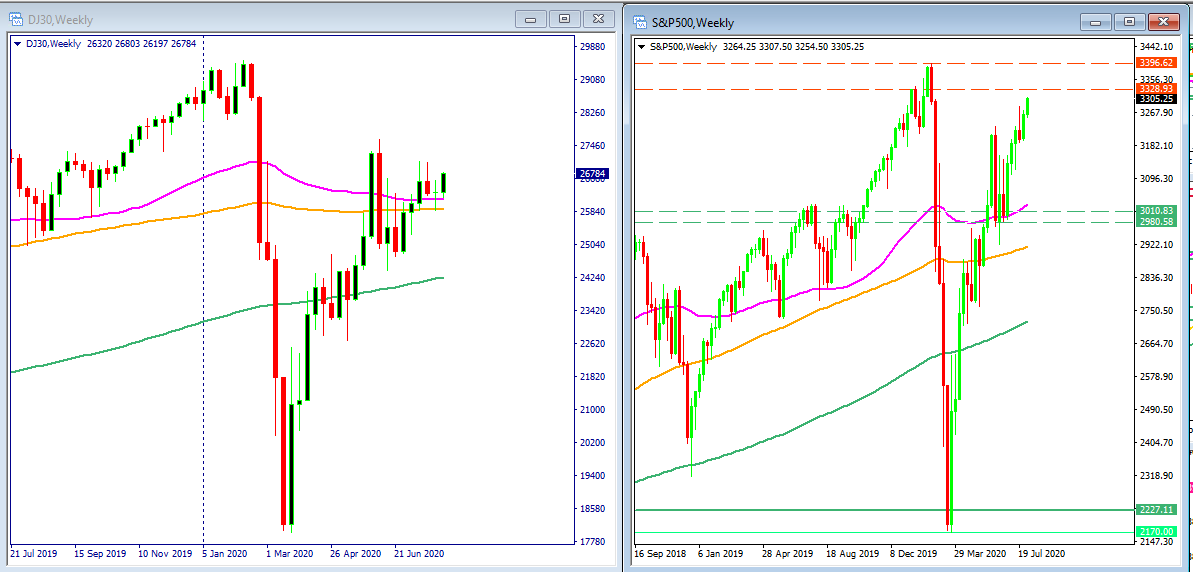

The Dow Jones industrial average futures is building its gains this week. It appears that the Dow stocks have support from the bulls as price is trading above the 50, 100 and 200--day SMA on a daily time frame. The fact that the Dow Jones’s 50-day SMA is above the 100-day SMA and the Dow’s price is also above these averages is a positive for the bull stock rally.

The DJIA index’s futures are trading above all the three important moving averages: 50, 100 and 200 SMA. The Dow Jones Industrial average stocks are pushing the Dow price away from its 50 and 100-week SMA, another positive sign for the coronavirus stock market rally.

The S&P 500 index, the U.S. stock which shows the overall picture of the U.S stock market is showing some serious signs of strength. The S&P 500 stocks have pushed the index beyond the last two week’s high and this confirms that the upward trend is largely intact. This is positive for the coronavirus stock market rally. The S&P 500 stock index is trading above the 50, 100 and 200-week SMA and this confirms bull are in control of the stock market rally.

Stock Market Rally

The stock rally that began in April has continued its run for the fourth consecutive month. Nasdaq index has outpaced the Dow Jones and S&P 500 index so far. The Dow Jones Index has been the weakest link.

The S&P 500 index closed on a positive note yesterday, the S&P 500 stock index soared 0.36%. The energy sector led the gains for the S&P 500 stocks yesterday and nine out of eleven sectors closed with gains. Mosaic stock contributed the most gains, up 13.5% and Evergy (NYSE:EVRG) stock was the biggest drag, dropped 11.6%. The S&P 500 stock index is 2.56% below its 53 weeks high.

The Dow Jones index soared 164 points yesterday and the Dow stocks pushed the index higher by 0.62%. 20 stocks of the Dow Jones Index soared, and 9 shares of the Dow index declined. McDonald stock advanced 2.55% and was the biggest for the Dow while Microsoft (NASDAQ:MSFT) stock declined 1.5%, the biggest drag for Dow Jones industrial average index.

The NASDAQ composite, a tech-savvy index, gained 41 points yesterday.