Introduction

It is far too early for definitive statements on the impact of the virus. So in what follows key questions are raised with relevant data offered to provide some sense on the magnitude of the hit.

How Long Will It Last?

This will least in part depend on how well it is handled by individual countries. Consider China: so far, there have been more than 80,000 cases and 3,000 deaths in China. Given that China is a nation with 1.4 billion people, these are quite low infection rates and deaths.

After some delays, the first cases in China were “reported” in late December. So figure the first cases actually occurred in mid-December. It recorded more than 3,000 cases daily in February. By using near-draconian measures in Wuhan and other locales, it is now down to reporting fewer than 30 new cases daily. That means it has been four months to this point in China. It did badly at the beginning of the outbreak but has probably done better than most countries will be able to do using less forceful methods going forward.

Like China, things have started very badly in the US. The problem has not been “covering up” as happened in China. Instead the US problem is the lack of testing. Whereas in South Korea, 230,000 have been tested, estimates are that only 8,000 have been tested in the US. It appears the primary problem is the shortage of test kits. And on top of this, different groups are doing the testing so it is difficult to get an accurate overall total. And totals are needed to determine what should be done to control the virus.

Fauci: “Right now, the FDA, Secretary Azar, the CDC, all of us together have been now pushing with the task force, so that within — and I would say, you know, it’s dangerous to give times, but I would think within a week, we’re going to start seeing a real acceleration of testing.”

The first case in the US was discovered in January, but the volume did not pick up until the beginning of March. If the US is on the same four month trajectory as China, the numbers of new cases will not turn down until July. And between now and then, a huge number of new cases will be identified and deaths will occur.

The US is now reporting more than 600 new cases daily, and this is likely to spike as testing capabilities are increased in the coming days. As a point of reference, China at its peak reported about 4,000 new cases daily with one day jumping to about 14,000. China has a population of 1.3 billion compared to the US population of 327 million.

Vulnerable Industries

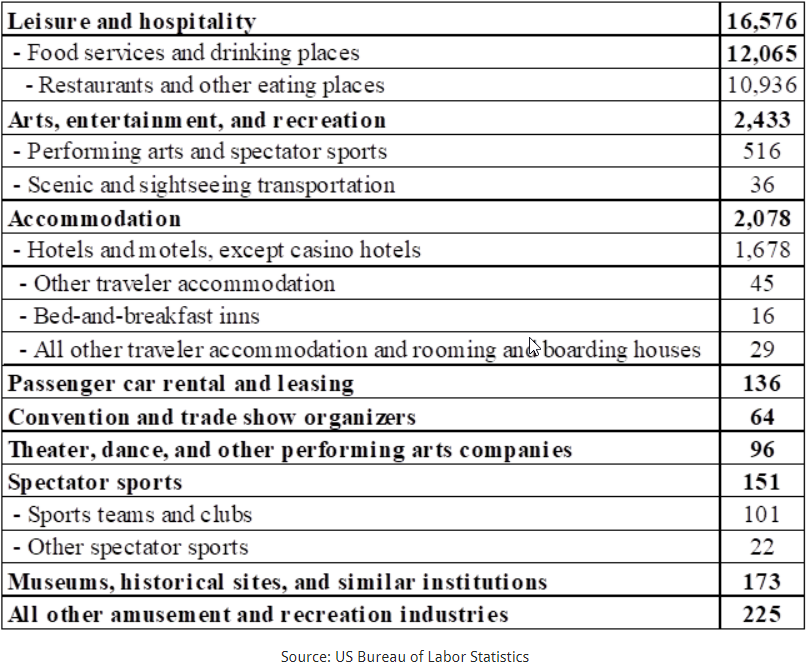

Numerous industries will be hard hit by the crisis. The following table lists the number of employees in industries likely to be hurt the most.

Most of these sectors will be mandated to shut down, and this will mean a tremendous number of businesses and workers will have no income. Lowering interest rates will not help. The government will have to spend large sums of money to partially compensate for these losses. And of course, the loss income in these sectors will lead to a reduction in consumption by those affected.

The Wealth Effect

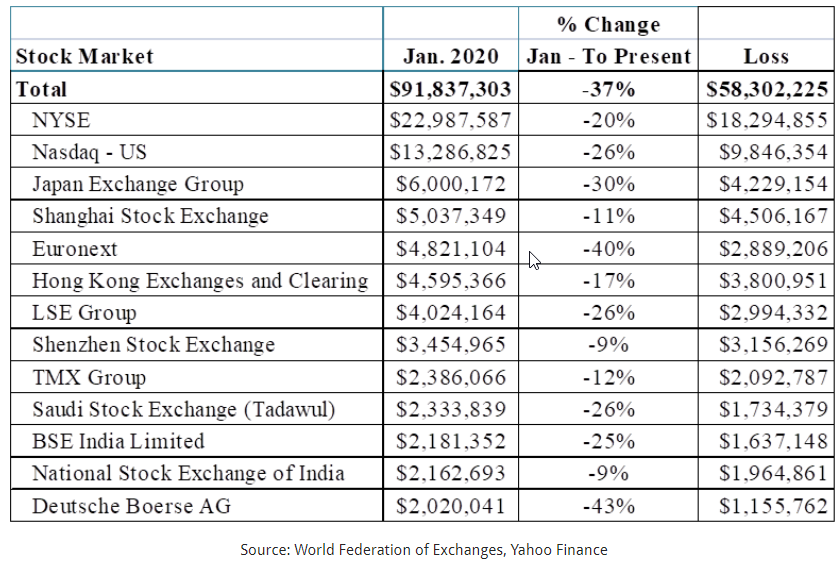

Economists use the “Wealth Effect” to indicate how changes in wealth affect consumption patterns. It is well documented that reductions in wealth cause consumption expenditures to fall. In the 2008 collapse, I reported that the global equity loss was $36 trillion. So far following the virus outbreak, the New York Stock Exchange has fallen $9.3 trillion with the NASDAQ down $2.7 trillion for a total of $12 trillion. With the US GDP of $22 trillion annually, it is reasonable to conclude that that the current wealth effect will cause consumption to fall by a significant amount.

Table 2 lists the world stock exchanges with capitalizations exceeding $2 trillion. Their losses now exceed $58 trillion. The other exchanges totaling $16 trillion have probably incurred losses of similar percentages. As a point of reference, world GDP is about $90 trillion.

The Limited Good News

a. The Digital Age

At times like these, being in the digital age has its advantages. For many, work no longer requires that people go to an office. And many students can study from online sources.

b. It Will Not Last Long

Many will be very sick and a large number will die. But evidence from China suggests that with “social distancing,” it can be controlled in a reasonably short period of time.

Conclusions

Because of testing lags, The US government got off to a very bad start. It was offered testing equipment from the World Health Organization but declined. Why?

And the resulting delay has lead to a spread that will be extremely disturbing to learn about once testing is finally ramped up.

The medical industry says an effective vaccine will take another year to develop.

For now and the indefinite future, social distancing and staying away from hospitals are probably our best defenses.