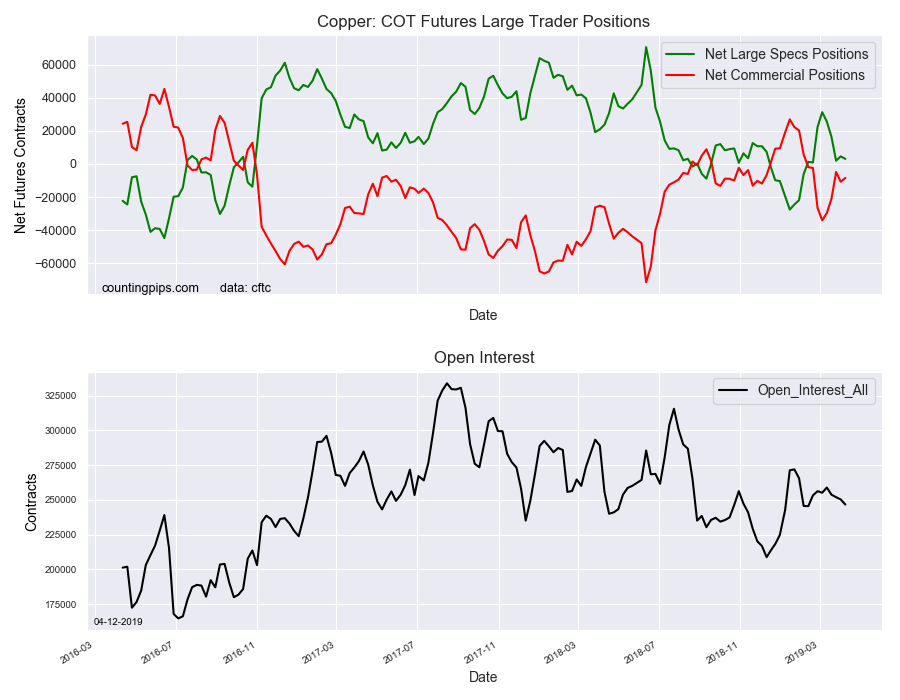

Copper Non-Commercial Speculator Positions:

Large precious metals speculators lowered their bullish net positions in the Copper futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of Copper futures, traded by large speculators and hedge funds, totaled a net position of 3,014 contracts in the data reported through Tuesday, April 9th. This was a weekly lowering of -1,542 net contracts from the previous week which had a total of 4,556 net contracts.

The week’s net position was the result of the gross bullish position (longs) sliding by -442 contracts to a weekly total of 81,503 contracts and combined with the gross bearish position (shorts) which saw a boost by 1,100 contracts for the week to a total of 78,489 contracts.

The net speculative position has fallen for four out of the past five weeks and has settled at close to a virtual neutral level with a total position of 3,014 contracts. Copper bets have mostly been dancing around the neutral level (zero contracts) since last July.

Bets have stalled out on both the bullish and bearish side around + or -30,000 contracts level. The highest level since July was hit on March 5th at +31,256 contracts. On the opposite side, -27,592 contracts (January 15th) marks the lowest level since July.

Copper Commercial Positions:

The commercial traders' position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -8,443 contracts on the week. This was a weekly uptick of 2,338 contracts from the total net of -10,781 contracts reported the previous week.

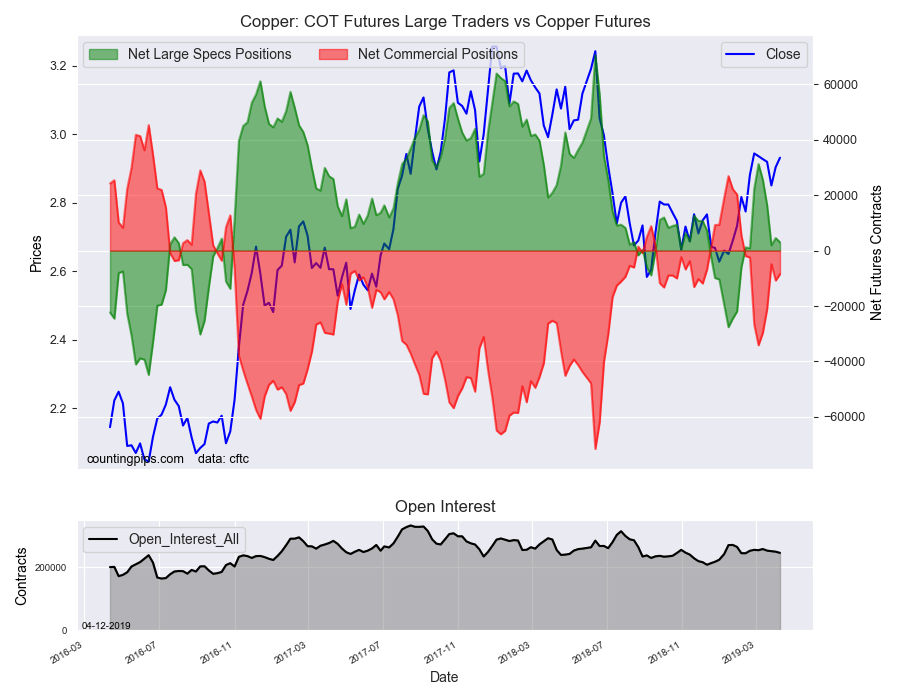

Copper Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the Copper Futures (Front Month) closed at approximately $2.93 which was an advance of $0.03 from the previous close of $2.90, according to unofficial market data.