Gold

Gold prices have been slightly softer this week due mainly to a rebound in the US Dollar. Despite heavily delayed US news flow, due to the ongoing US government shutdown (now the longest in history), USD has managed to claim higher ground, benefiting from a weaker euro.

With Draghi reaffirming the need for monetary stimulus to remain in place in the eurozone, acknowledging the downside risks facing the economy, EUR bulls have been left deflated once again, pushing emphasis back onto the US Dollar.

Resurgent equity and oil prices, reflecting the improvement in risk sentiment recently, linked to optimism around the US/China trade talks, have also weighed on gold prices as investors seek better returns elsewhere.

The recovery in gold has now seen price making a move equal to that of the last move into the highs of 2018 before we saw the protracted sell-off last year. For now, the price is stalled at this level with price action flagging up reversal signs. However, while still above the rising trend line, the focus will be on a retest of the key 1366.80 – 1375.87 level which has been the high over the last four years. If the price falls from here, the 1235.30 level will be first support.

Silver

Silver prices were lower this week also, printing a larger loss than gold as recent profit-taking on long positions continues to halt upside momentum. The stronger US Dollar has weighed more heavily on silver despite the strong rally in equity prices which often keeps silver supported due to its common industrial usage.

Although bullish momentum has paused, for now, silver prices are still above the key 15.1800 – 15.5700 level resistance, confirming a bullish shift in momentum. The next key area to watch is the 16.2267 region where we have confluence between a raft of prior swing lows and the long-term bearish trend line from 2016 highs.

Copper

The red metal was sharply higher this week enjoying its largest positive week since late 2018, as optimism around the ongoing US/China trade talks has boosted sentiment. Investors hope that the two leading economies can forge a trade deal that will put an end to the tit for tat tariff war that marred 2018 and has recently once again fueled fears of a slowdown in China.

As the largest consumer of copper globally, a trade truce would be a strong catalyst for increased copper demand which is fuelling fresh long positions among speculators who are following the trade talk developments.

After piercing below the sloping neckline of the head and shoulders pattern, copper prices have since found support and are now turning higher again. There are two key levels in the local vicinity to watch out for with the 2.764 level and 2.852 levels just overhead.

Iron

Iron ore prices have benefitted from the trade talk optimism also, surging to fresh multi-month highs this week, despite the stronger US Dollar. Interestingly, the move was strongest among the lower grade iron ore markets, with moves in the medium to high-grade ores more subdued.

This is mostly explained by the lower profit margins seen recently in steel mills along with the less stringent than expected restrictions on the industrial output which has kept demand for the low-grade iron firm.

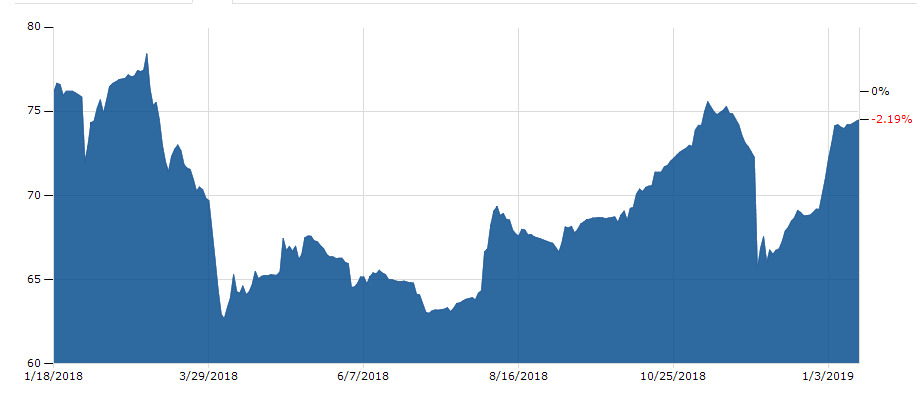

Iron ore is now sitting just below the late 2018 $76 level high, which given current momentum, looks likely to be broken soon. Above here and the 2018 high will come into focus just ahead of the key $80 psychological level.