Copart, Inc. (NASDAQ:CPRT) reported adjusted earnings per share of 33 cents in first-quarter fiscal 2018 (ended Oct 31, 2017), beating the Zacks Consensus Estimate of 26 cents. The bottom line improved 17.9% from 28 cents recorded in the year-ago quarter.

Net income was $77.5 million, reflecting a plunge of 53.7% or $89.8 million from the first quarter of fiscal 2017.

Copart’s revenues rose 21.1% to $419.2 million from the year-ago quarter and surpassed the Zacks Consensus Estimate of $377.4 million. Service revenues went up 21.8% to $374.1 million, while revenues from vehicle sales gained 15.8% to $45.1 million.

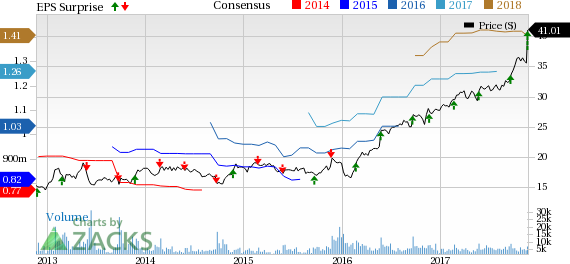

Copart, Inc. Price, Consensus and EPS Surprise

Gross margin improved 12.4% to $163.3 million in the reported quarter from $145.3 million a year ago. Operating expenses also increased to $295.2 million from $241.2 million, recorded in the prior-year period.

Operating income increased to $124 million from $104.8 million a year ago.

Financial Details

Copart had cash and cash equivalents of $224.2 million as of Oct 31, 2017 compared with $210 million as of Jul 31, 2017. Total debt, revolving loan facility and capital lease obligations were $550.7 million as of Oct 31, 2017, almost same in comparison to $550.8 million as of Jul 31, 2017.

In first-quarter fiscal 2018, Copart generated net cash flow of $93.4 million from operations compared with $74.3 million a year ago.

Price Performance

Shares of Copart have outperformed its industry year to date. The stock has soared 48% of its value compared with the industry’s 11.3% growth.

Zacks Rank & Other Key Picks

Copart carries a Zacks Rank #2 (Buy). Other top-ranked stocks in the auto space are Cummins Inc. (NYSE:CMI) , Toyota Motor Corporation (NYSE:TM) and BorgWarner Inc. (NYSE:BWA) , each sporting a Zacks Rank of 2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Cummins has a long-term growth rate of 12.1%. Year to date, shares of the company have been up 19.6%.

Toyota has a long-term growth rate of 6.2%. The stock has witnessed the Zacks Consensus Estimate for quarterly earnings per share being revised 4.3% upward to $2.9 over the last 30 days.

BorgWarner has a long-term growth rate of 9.1%. Its shares have been up 19.3% in the last three months.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

See Them Free>>

Toyota Motor Corp Ltd Ord (TM): Free Stock Analysis Report

BorgWarner Inc. (BWA): Free Stock Analysis Report

Cummins Inc. (CMI): Free Stock Analysis Report

Copart, Inc. (CPRT): Free Stock Analysis Report

Original post

Zacks Investment Research